15Usc1692C Letter Template

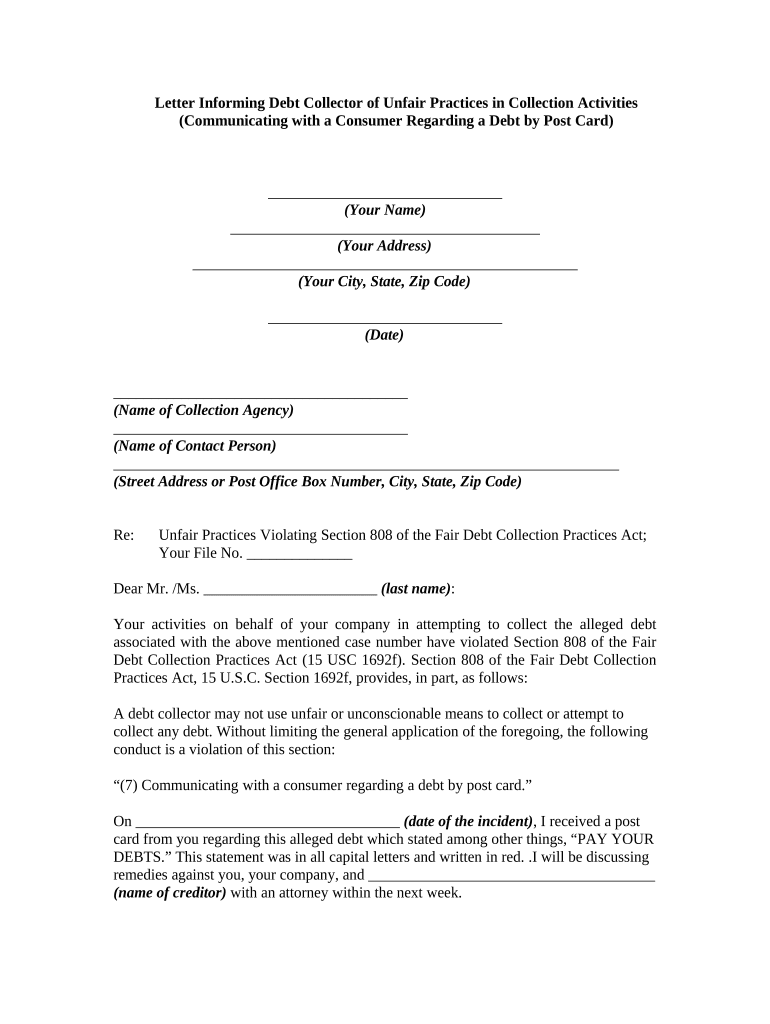

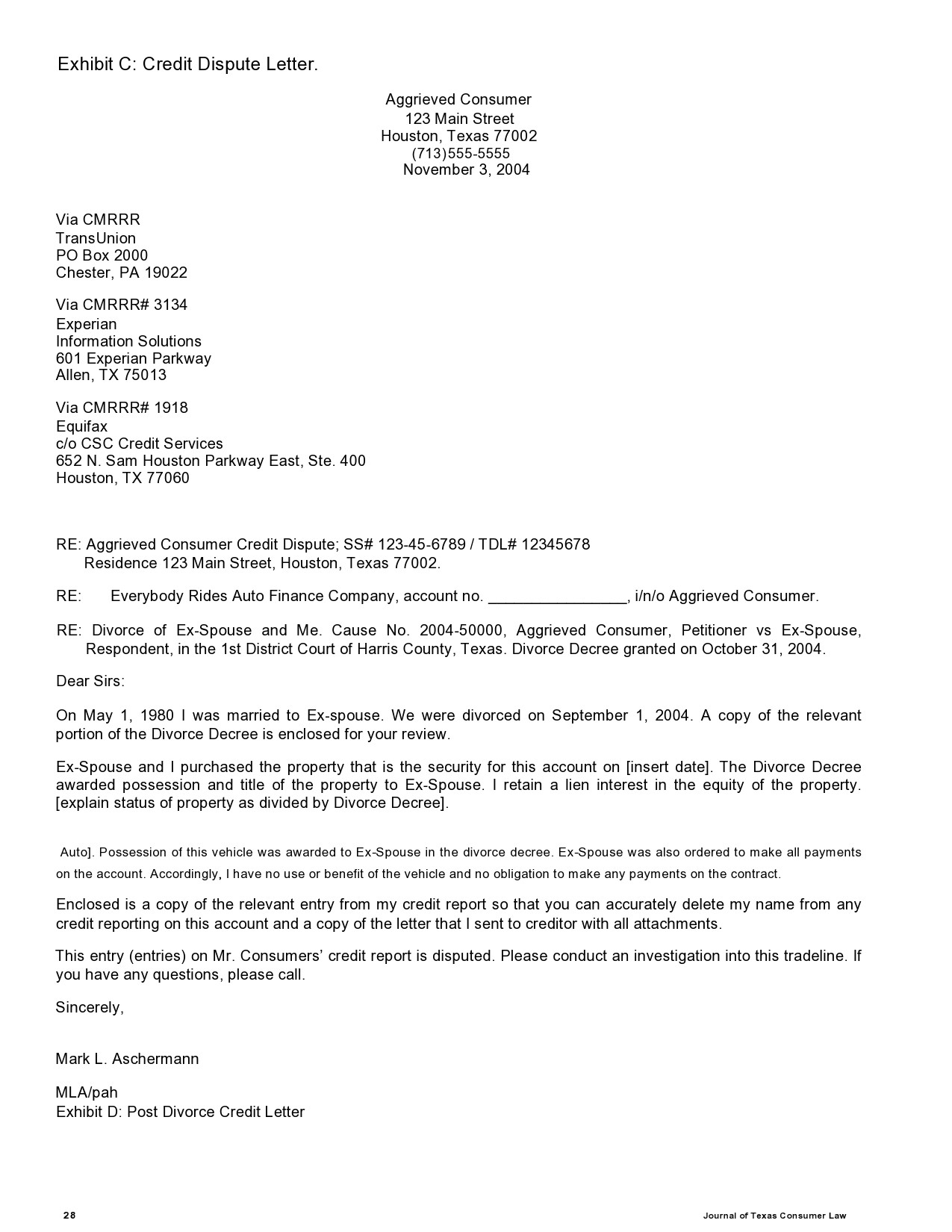

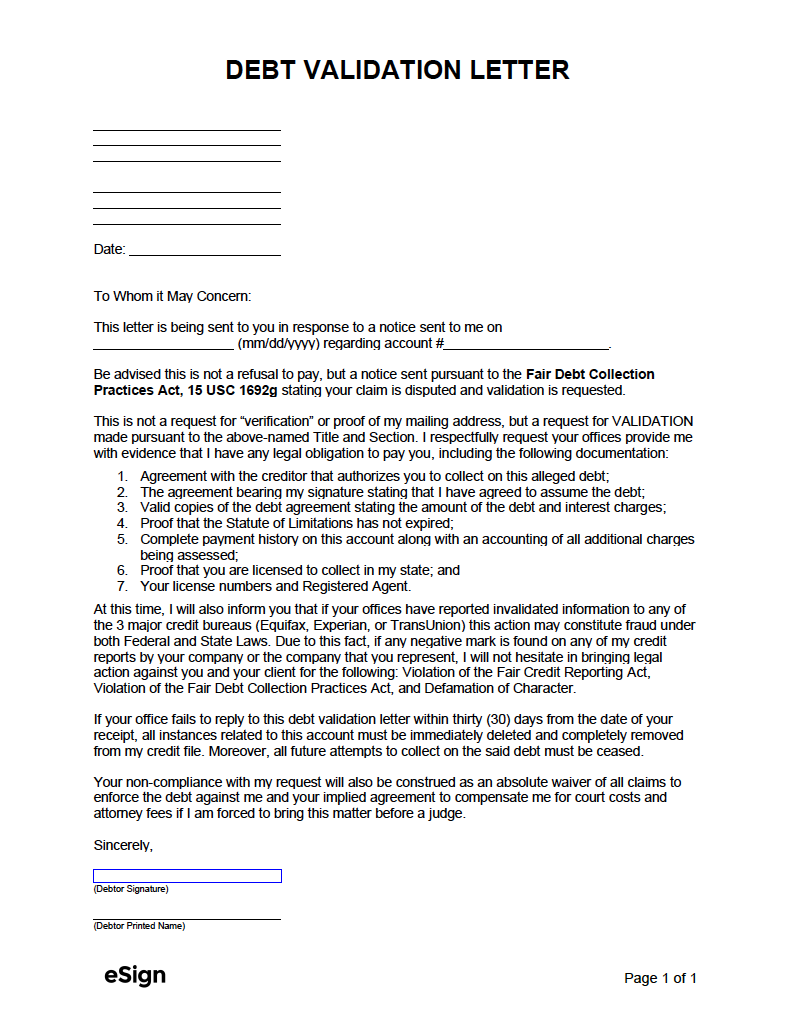

15Usc1692C Letter Template - I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection. I also request verification, validation, and the name and address of the original. Sending this letter does not cancel your debt. See below for the full template. Here is a sample form: Use this letter to dispute a debt and to tell a collector to stop contacting you. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. I am writing in response to your constant phone calls! Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. I also request verification, validation, and the name and address of the original. Code § 1692c, this is my formal declaration to terminate and cease all communication from you in. A cease and desist letter can stop a debt collector in their tracks. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. I am writing pursuant to the fair debt collection practices act, 15 usc 1692c (c), to request to request that you cease all communication to me about my account# [number] with [creditor]. In the absence of knowledge of circumstances to the contrary, a debt collector shall assume that the convenient time for communicating with a consumer is after 8 o’clock antemeridian and. Use this letter to tell a debt collector to stop contacting you. (2) to notify the consumer that the debt collector or creditor may invoke specified remedies which are. See below for the full template. Be sure to keep a copy of your letter and. I am writing in response to your constant phone calls! (2) to notify the consumer that the debt collector or creditor may invoke specified remedies which are. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc. If you get sued for a debt use solosuit to respond in 15 minutes and win your. See below for the full template. Here is a sample form: The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. The. I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection. According to the fair debt collection practices act, specifically 15 u.s. If you get sued for a debt use solosuit to respond in 15 minutes and win your. I also request verification, validation, and the. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. If you get sued for a debt use solosuit to respond in 15 minutes and win your. If you send this letter within 30 days from the. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection. The following. I am writing pursuant to the fair debt collection practices act, 15 usc 1692c (c), to request to request that you cease all communication to me about my account# [number] with [creditor]. A cease and desist letter can stop a debt collector in their tracks. I am writing in response to your constant phone calls! If you send this letter. I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. Please complete. The best case for sending a cease communications letter is when the sol has expired, and the credit report exclusion period has also expired, or is about to. Use this letter to tell a debt collector to stop contacting you. (1) to advise the consumer that the debt collector's further efforts are being terminated; Please consider this letter a formal. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Sending this letter does not cancel your debt. Be sure to keep a copy of your letter and. According to the fair debt collection practices act, [15 usc 1692c] section 805(c): You can send this letter at any time. See below for the full template. I also request verification, validation, and the name and address of the original. (2) to notify the consumer that the debt collector or creditor may invoke specified remedies which are. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Letter to creditors or collection agencies to. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. Use this letter to tell a debt collector to stop contacting you. See below for the full template. (2) to notify the consumer that the debt collector or creditor may invoke specified remedies which are. You can send this letter at any time. (1) to advise the consumer that the debt collector's further efforts are being terminated; Below is an electronic form of the cease letter, which you may fill out and print. Here is a sample form: Letter to creditors or collection agencies to stop contact instructions under the pennsylvania fair credit extension uniformity act, 73 p.s.§2270.4, and the federal. If you get sued for a debt use solosuit to respond in 15 minutes and win your. I also request verification, validation, and the name and address of the original. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Please complete the letter according to the above instructions. A cease and desist letter can stop a debt collector in their tracks. The best case for sending a cease communications letter is when the sol has expired, and the credit report exclusion period has also expired, or is about to. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must.15usc1692c letter template Fill out & sign online DocHub

15 usc 1692c Fill out & sign online DocHub

Letter Of Credit Sample Format

15 USC 1607 PART 2 YouTube

CMAP Cease & Desist Letter PDF Foreclosure Practice Of Law

Part One FDCPA (Fair Debt Collection Practices Act) Text 15 USC

Cease And Desist Letter Template Free

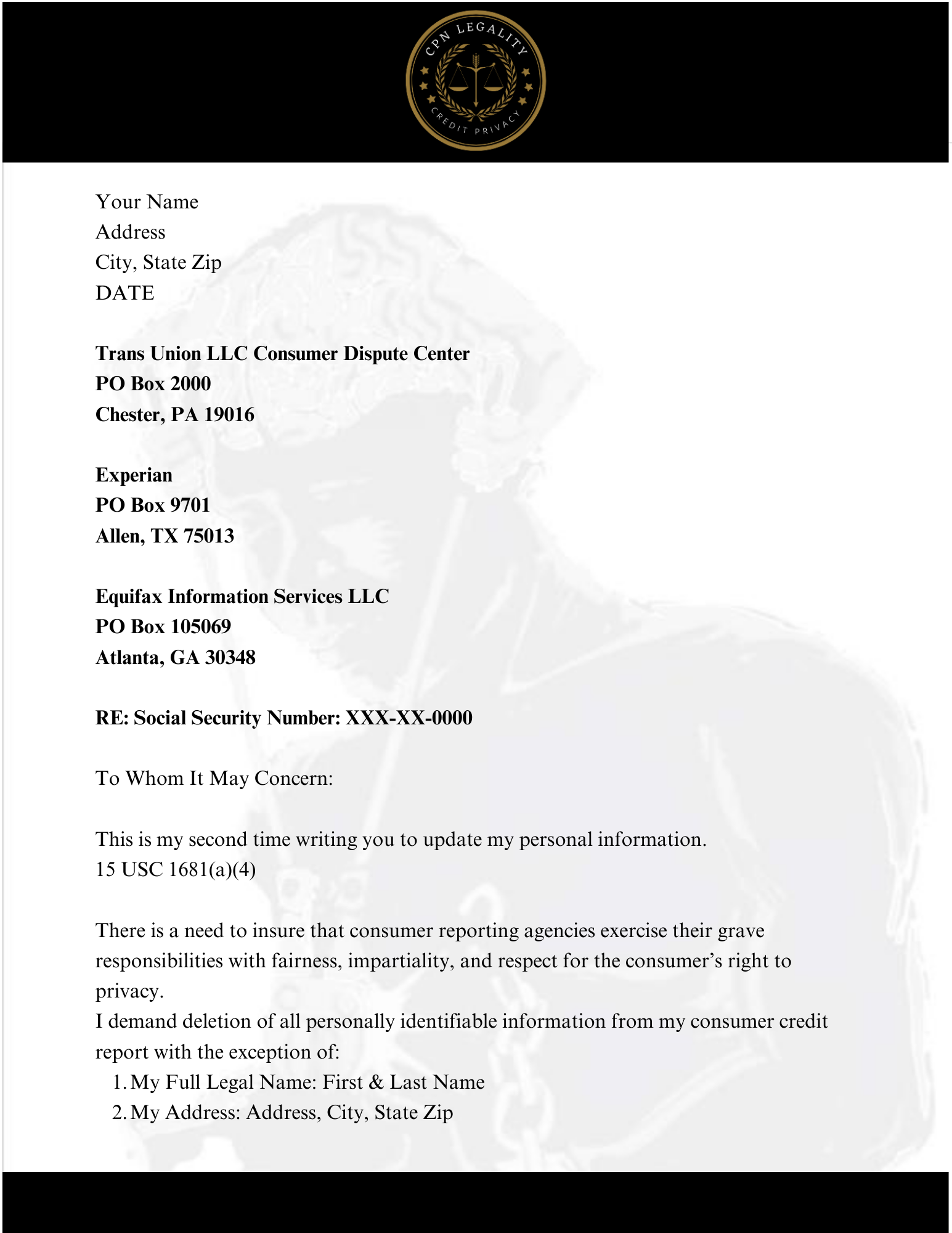

Shop page cpnlegality

CLARO Buffalo Debt Validation Letter Fill and Sign Printable Template

Debt Validation Sample Letter

Please Consider This Letter A Formal Dispute Of The Alleged Debt Pursuant To The Fdcpa, 15 U.s.c.

I Am Writing To Request That You Stop Contacting Me About My Account Number _____ With [Creditor’s Name] As Required By The Fair Debt Collection.

According To The Fair Debt Collection Practices Act, Specifically 15 U.s.

Be Sure To Keep A Copy Of Your Letter And.

Related Post: