Charge Dispute Letter Template

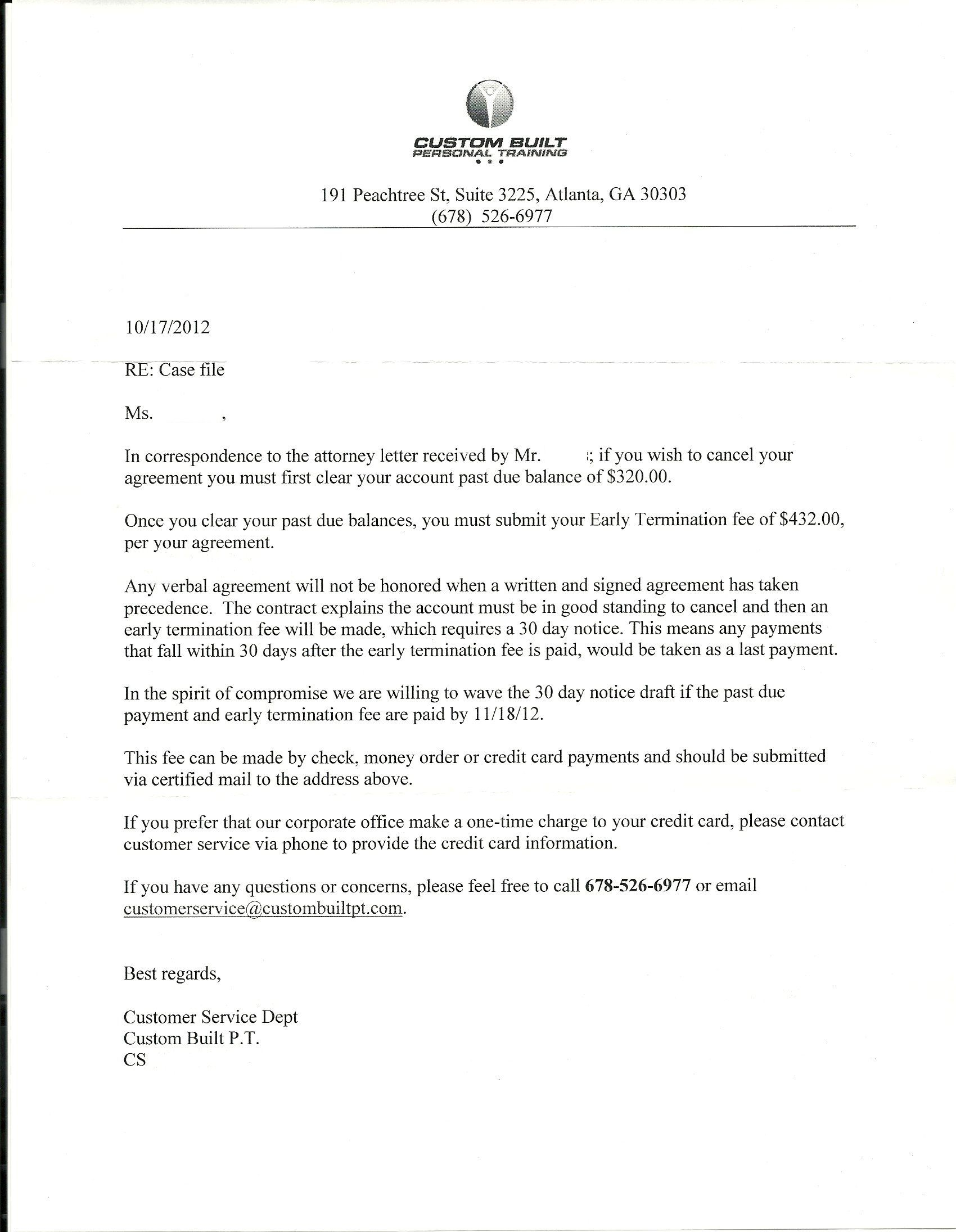

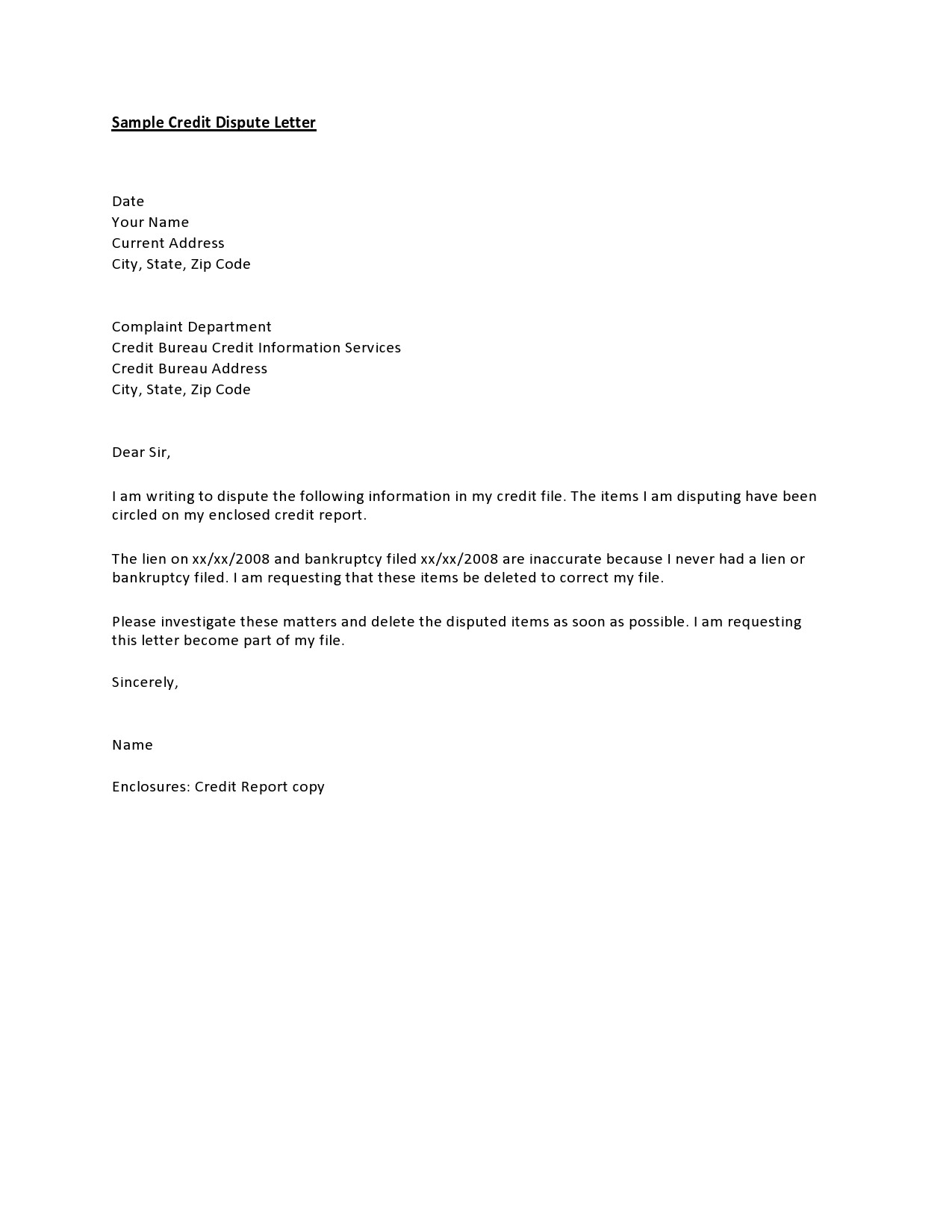

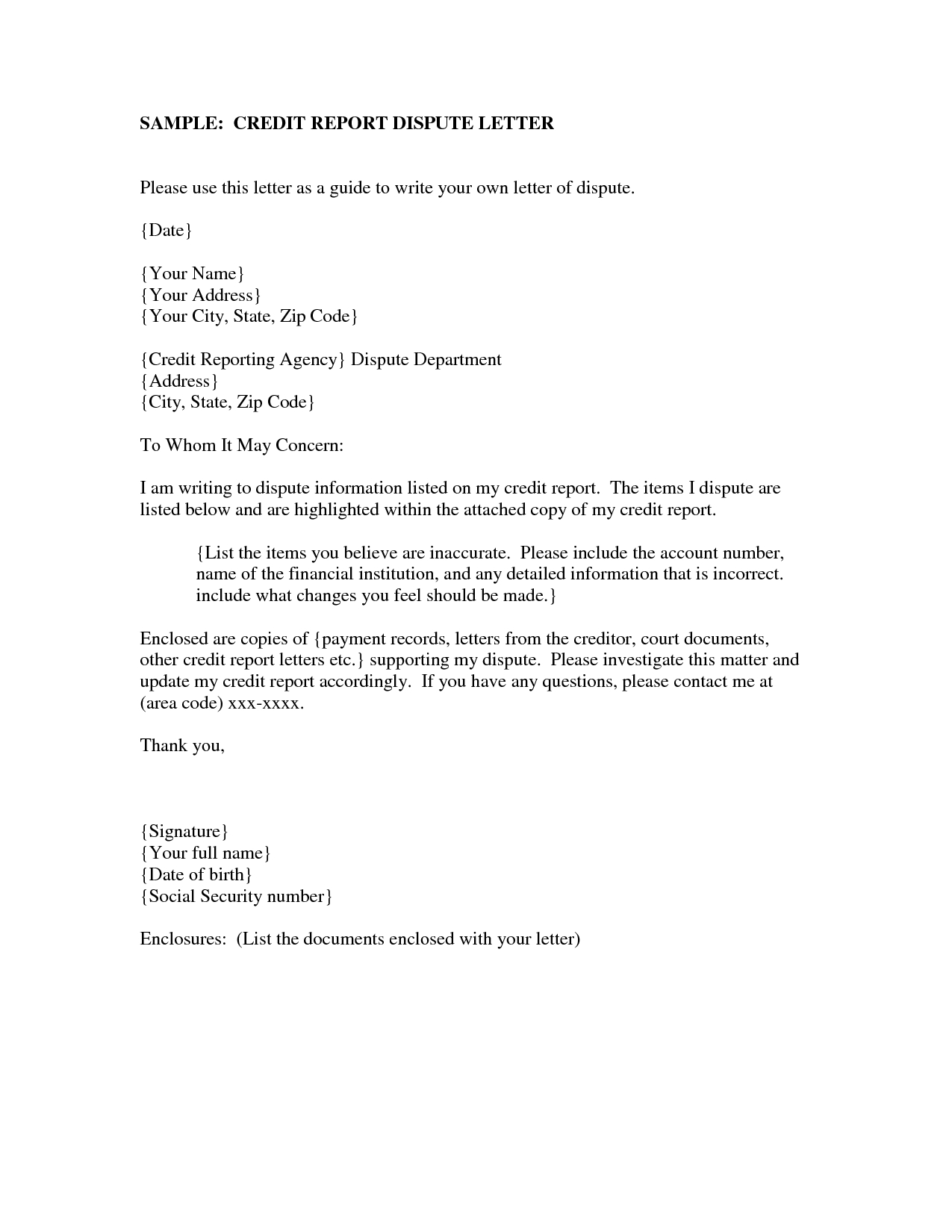

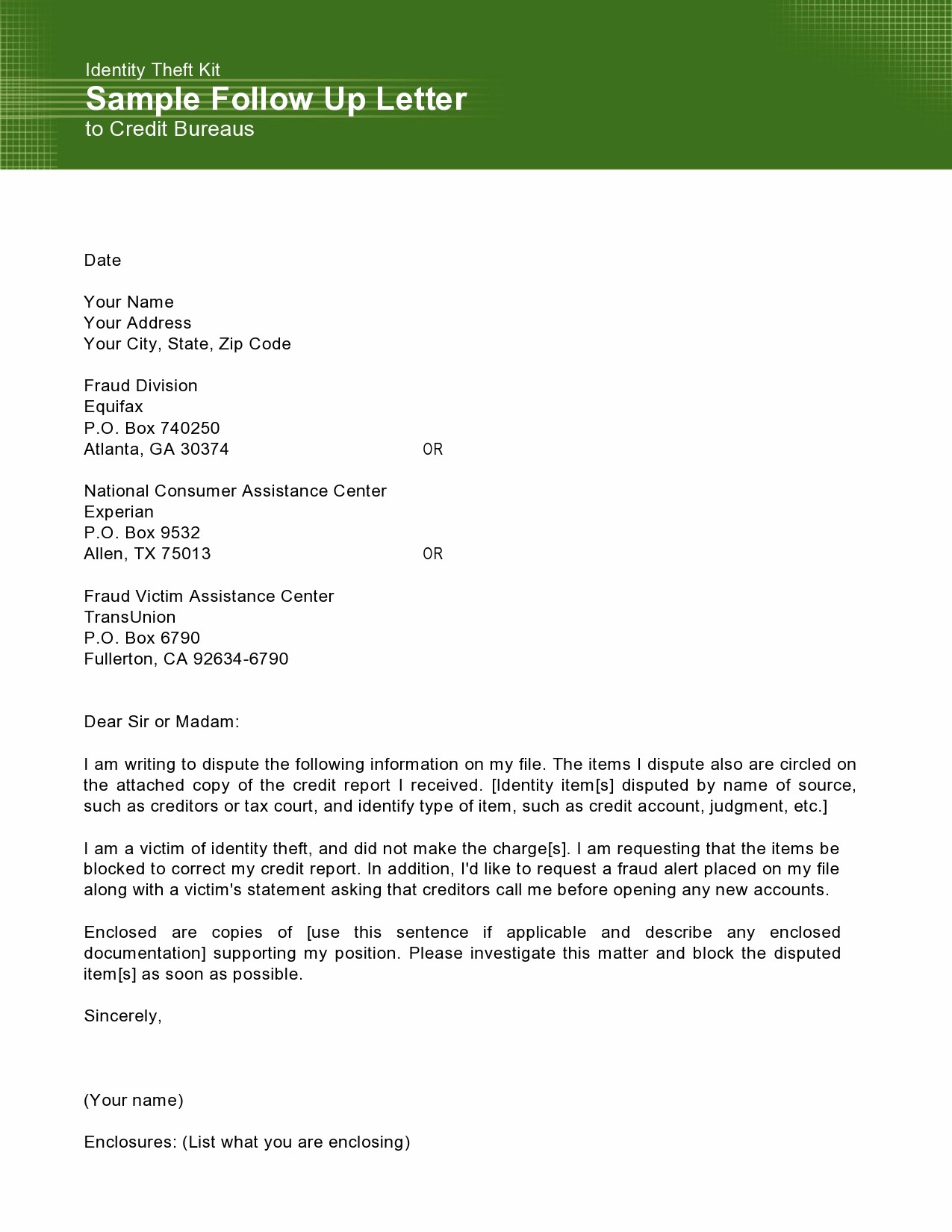

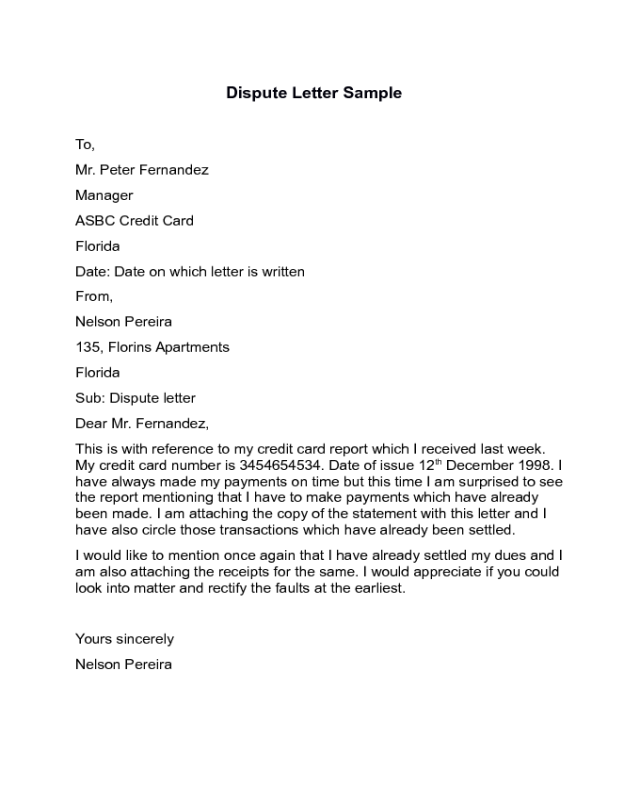

Charge Dispute Letter Template - If you spot an incorrect or invalid charge, your first move should be to reach out to the merchant. It can cause too many issues down the line. Its a frustrating experience that can leave you feeling vulnerable and anxious. Banks require you to try sorting things out with the seller first. Ensure the error has been removed by requesting confirmation from the consumer reporting company. Whether it's a billing error or an unfamiliar transaction, knowing how to address these issues effectively can save you both money and stress. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. To whom it may concer n: Use this sample letter to help you write your dispute letter. Notice of disputed charge to account no. Notice of disputed charge to account no. There is no charge for submitting a dispute. While you may be able to dispute these charges over the phone, some companies may also require you to send a written, more formal letter to explain the issue and why you are. To whom it may concer n: [your account number] [date of the charge]. Findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute. So, lets dive in and uncover how you can advocate for your. In this article, well guide you through a simple letter template to. The charge is in error because. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. Findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute. In this article, well guide you through a simple letter template to address. I am writing to formally dispute a charge on my account and request your prompt assistance in resolving this matter.. Whether it's a billing error or an unfamiliar transaction, knowing how to address these issues effectively can save you both money and stress. Findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute. On october 25, 2060, an amount of $250.00 was debited. The charge is dated _____________ and is in the amount of ____________. Banks require you to try sorting things out with the seller first. On october 25, 2060, an amount of $250.00 was debited from my. In this article, well guide you through a simple letter template to address. I am writing to dispute a charge of [$_____] to my. In your letter, include the transaction or transactions that you’re disputing and the reason you’re making the. Ensure the error has been removed by requesting confirmation from the consumer reporting company. So, if you re ready to tackle. [your account number] [date of the charge]. The charge is in error because. So, if you re ready to tackle. On october 25, 2060, an amount of $250.00 was debited from my. I am disputing a charge on my bill dated ___________. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. Ensure the error has been removed by requesting confirmation from the consumer reporting company. Use this letter to dispute an incorrect charge on your credit card bill. Learn more about this engagement letter, plus a free template to use. Have you ever found yourself staring at your bank statement, bewildered by unfamiliar transactions? It can cause too many issues down the line. There is no charge for submitting a dispute. Learn more about this engagement letter, plus a free template to use. Ensure the error has been removed by requesting confirmation from the consumer reporting company. Notice of disputed charge to account no. I am disputing a charge on my bill dated ___________. There is no charge for submitting a dispute. In your letter, include the transaction or transactions that you’re disputing and the reason you’re making the. To guide you through writing an effective dispute letter for credit and debit card charges. The charge is in error because. In this article, well guide you through a simple letter template to. The charge is in error because [explain the problem briefly. Learn more about this engagement letter, plus a free template to use. For best results, send this letter within 60 days after receiving the first statement containing the incorrect charge Don’t start any client’s project without a tax engagement letter. The charge is dated _____________ and is in the amount of ____________. The charge is in error because. Findlaw explains your rights when dealing with false charges on your credit card and provides a sample letter to send to your lender in a billing dispute. To guide you through writing an effective dispute letter for credit and debit card charges. So, if you re ready to tackle. Its a frustrating experience that can leave you feeling vulnerable and. It's crucial to act swiftly and effectively to dispute these charges, ensuring your finances stay secure. Learn more about this engagement letter, plus a free template to use. There is no charge for submitting a dispute. I am writing to formally dispute a charge on my account and request your prompt assistance in resolving this matter. In your letter, include the transaction or transactions that you’re disputing and the reason you’re making the. In this article, well guide you through a simple letter template to address. Its a frustrating experience that can leave you feeling vulnerable and anxious. In this article, well guide you through a simple letter template to. For best results, send this letter within 60 days after receiving the first statement containing the incorrect charge 3 unique templates for writing a credit card dispute letter. If you spot an incorrect or invalid charge, your first move should be to reach out to the merchant. Navigating unauthorized charges can be daunting, but understanding how to dispute them can empower you as a consumer. Banks require you to try sorting things out with the seller first. I am writing to dispute a charge of [$_____] to my [credit or debit card] account on [date of the charge]. Whether it's a billing error or an unfamiliar transaction, knowing how to address these issues effectively can save you both money and stress. On october 25, 2060, an amount of $250.00 was debited from my.Charge Off Dispute Letter Template Collection Letter Template Collection

Free Dispute Letter Template Templates Printable

Free Credit Report Dispute Letter Template Sample PDF Word eForms

2025 Dispute Letter Templates Fillable, Printable PDF & Forms Handypdf

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Letter Of Dispute Template Dispute Letter Collection Pdf For

9 Dispute Letter Templates SampleTemplatess SampleTemplatess

Charge Off Dispute Letter Template Collection Letter Template Collection

Free Dispute Letter Template Templates Printable

FREE 23+ Sample Letter Templates in PDF MS Word Excel

To Guide You Through Writing An Effective Dispute Letter For Credit And Debit Card Charges.

A Credit Card Dispute Letter Is A Document That Individuals Can Use When They Would Like To Dispute And Remove A Charge From Their Credit Card.

Don’t Start Any Client’s Project Without A Tax Engagement Letter.

So, If You Re Ready To Tackle.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-22-790x1022.jpg)