Credit Card Payoff Template Excel

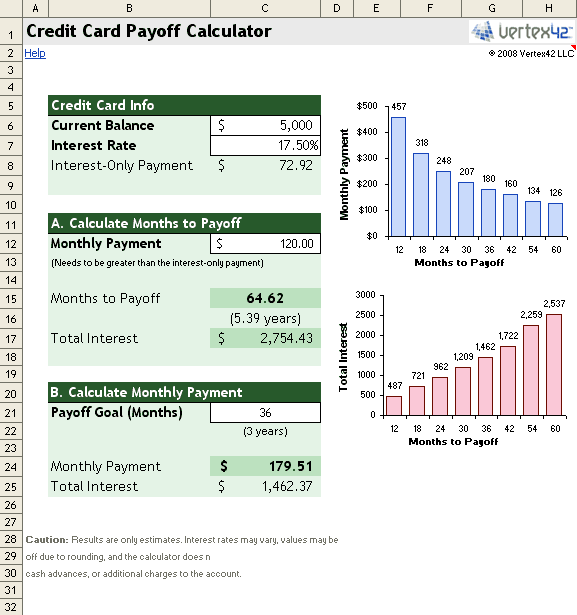

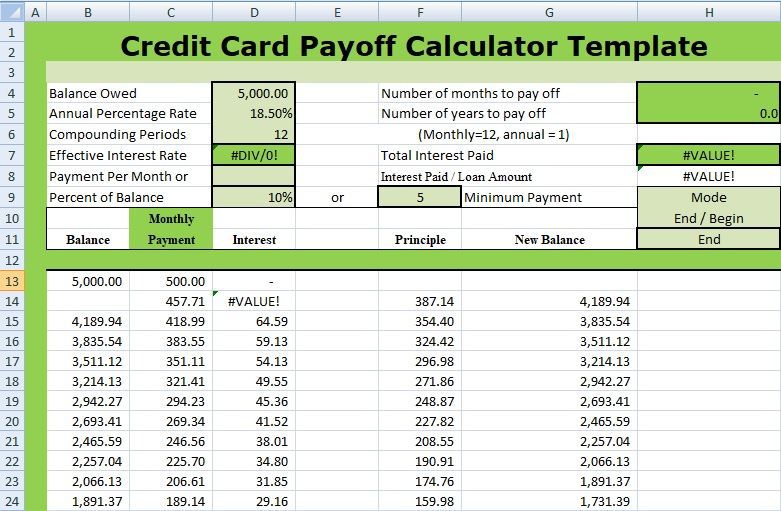

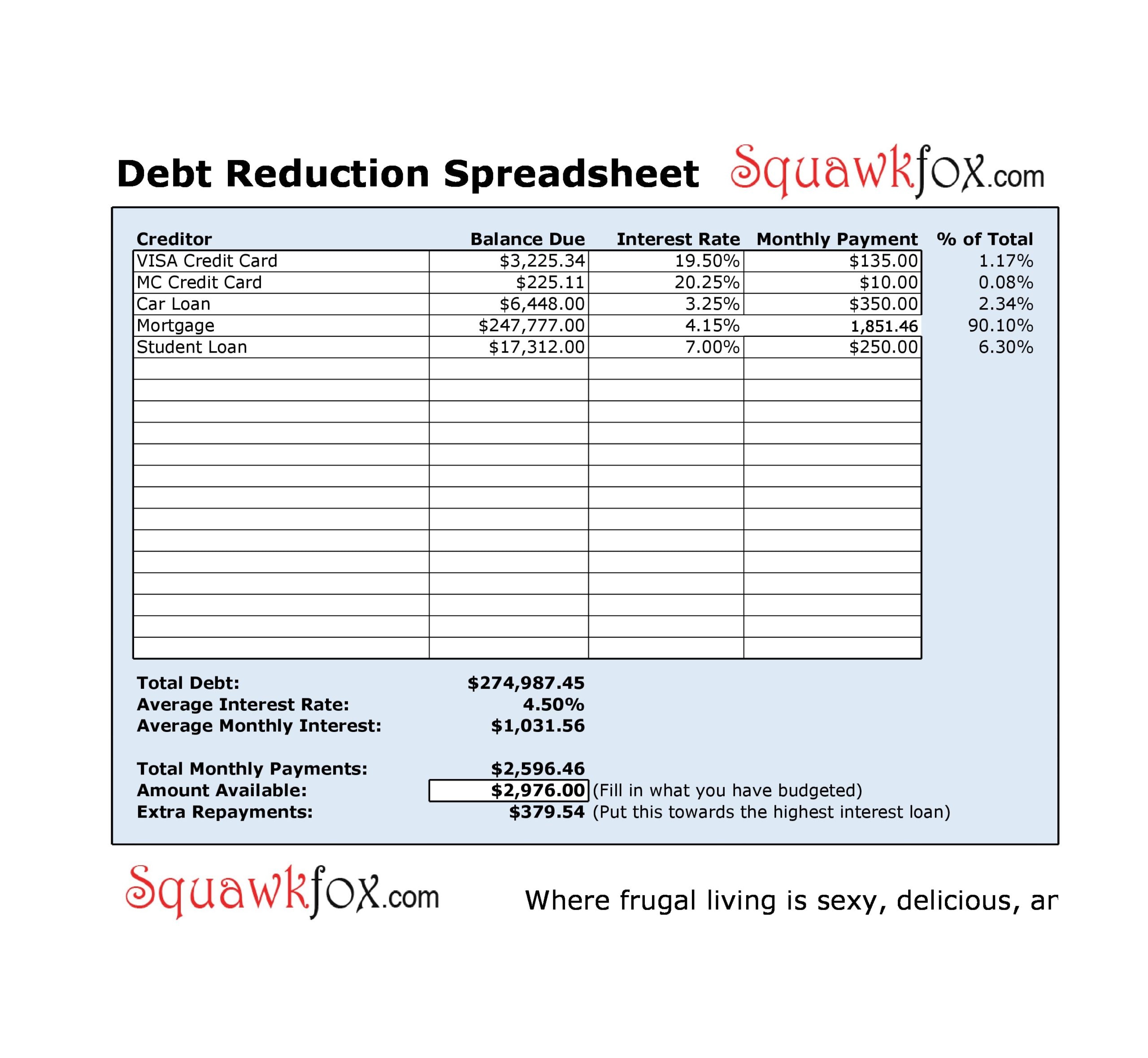

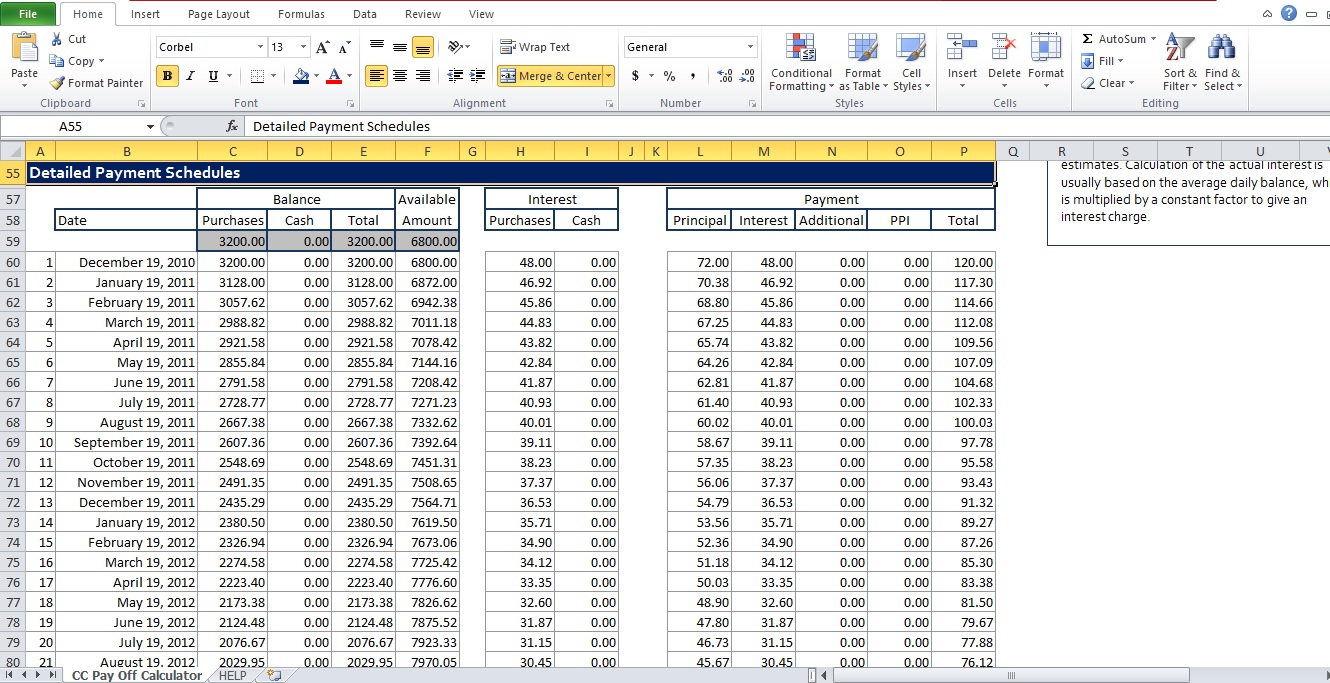

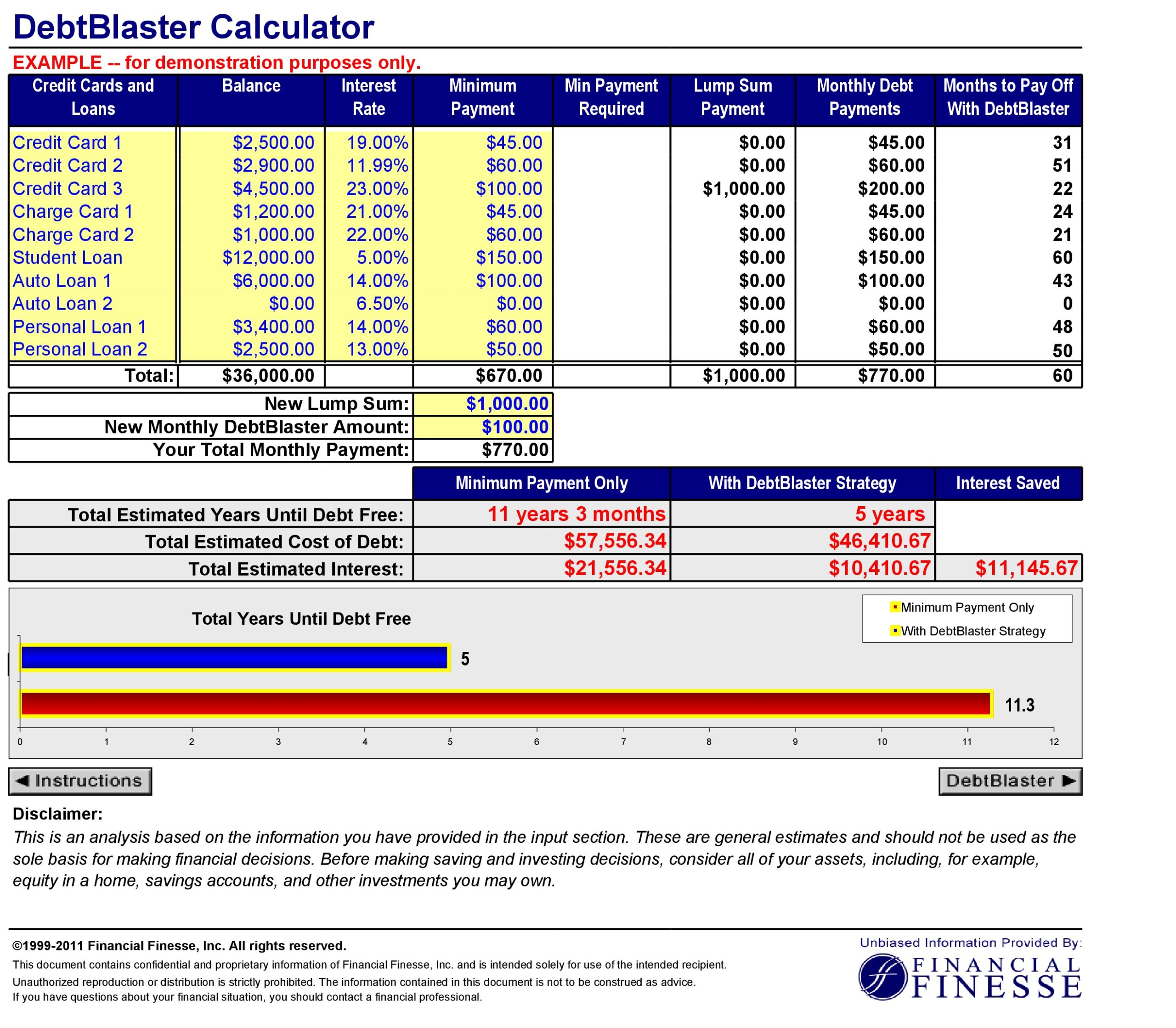

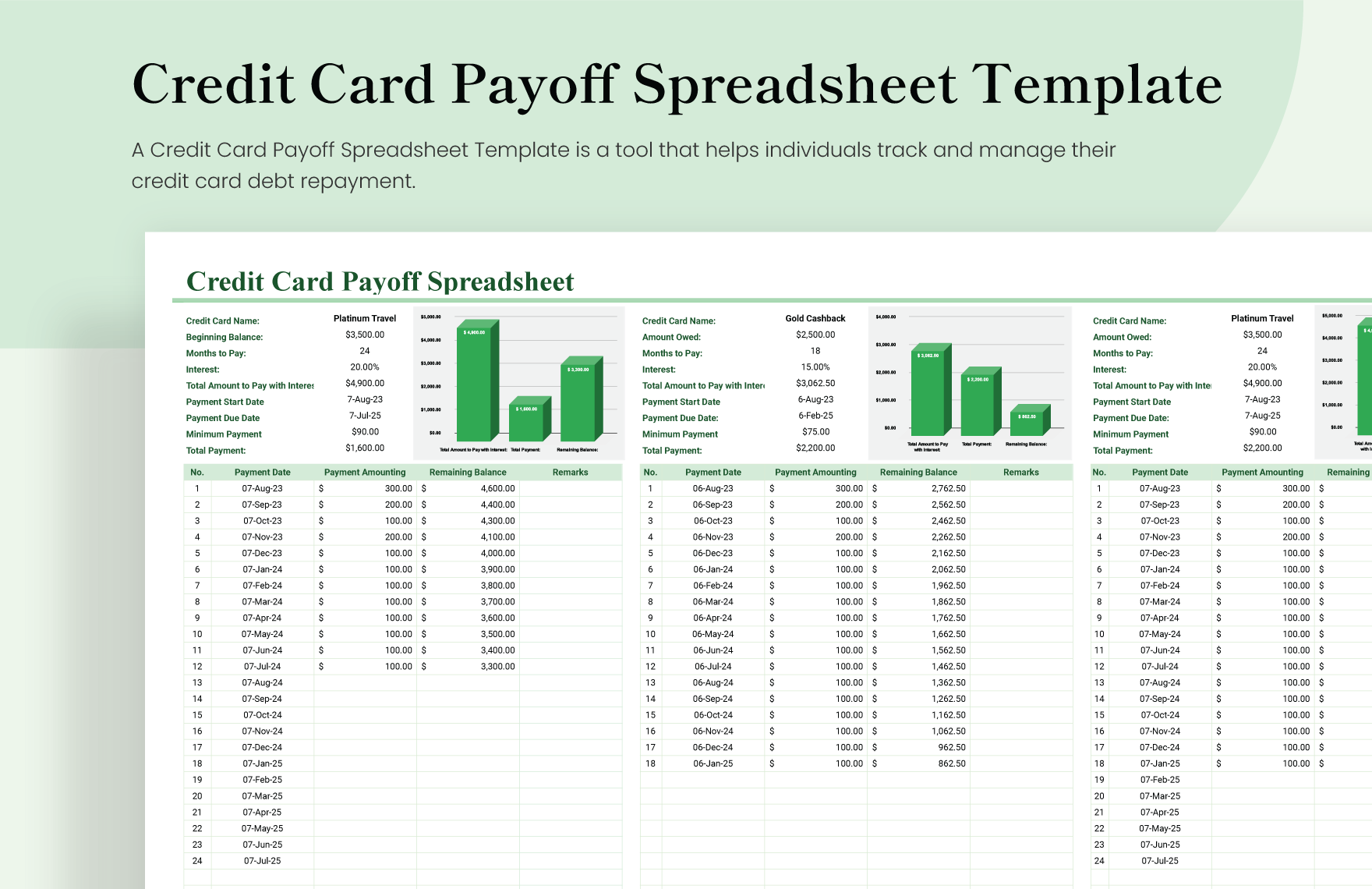

Credit Card Payoff Template Excel - With a few simple steps, you can. This credit card payoff spreadsheet excel template simplifies and automates the process of tracking and paying off your credit card debt. The credit card payoff calculator is an excel template designed to assist individuals in calculating the number of installments required to pay off their outstanding credit card balances. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. Get started today with the credit card payoff spreadsheet 18 excel template. Take control of your credit card debt with our comprehensive credit card payoff spreadsheet template. When a borrower has more than one debt and repays them. You’re not alone, and there’s a handy tool at your disposal—excel! This excel template helps you easily track your credit card payments and balances. It provides a simple way to calculate and compare the cost of different payment plans. Enter your current balance, interest rate, monthly payment or. Download and use these excel templates to track and plan your credit card payments. The credit card payoff calculator is an excel template designed to assist individuals in calculating the number of installments required to pay off their outstanding credit card balances. Get started today with the credit card payoff spreadsheet 18 excel template. This credit card payoff spreadsheet excel template simplifies and automates the process of tracking and paying off your credit card debt. This excel template helps you easily track your credit card payments and balances. Use our credit card payoff calculator to estimate your payoff timeline, monthly payments, and total interest, helping you plan a path to eliminate credit card debt efficiently. When a borrower has more than one debt and repays them. In this article, we will demonstrate how to create a credit card payoff calculator in excel using the snowball method. Learn how to use the snowball technique and other tips to reduce your interest and debt. This editable excel template, available at template.net, encourages you to. Learn about the avalanche and snowball methods, and how to calculat… Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. Download a free excel template to calculate your credit card payoff schedule and goal. Learn how to use the snowball technique and other tips to reduce. With a few simple steps, you can. Learn how to use the snowball technique and other tips to reduce your interest and debt. When a borrower has more than one debt and repays them. This credit card payoff spreadsheet excel template simplifies and automates the process of tracking and paying off your credit card debt. Download a free spreadsheet or. Learn about the avalanche and snowball methods, and how to calculat… In this article, we will demonstrate how to create a credit card payoff calculator in excel using the snowball method. It provides a simple way to calculate and compare the cost of different payment plans. Use it to quickly calculate your. This credit card payoff spreadsheet excel template simplifies. Download and use these excel templates to track and plan your credit card payments. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. Download a free excel template to calculate your credit card payoff schedule and goal. Struggling with credit card debt and looking for a way to get a handle on it? In this article,. It provides a simple way to calculate and compare the cost of different payment plans. In this article, we will demonstrate how to create a credit card payoff calculator in excel using the snowball method. Track and map your credit card payments with our credit card payoff calculator excel template. Struggling with credit card debt and looking for a way. You’re not alone, and there’s a handy tool at your disposal—excel! Get started today with the credit card payoff spreadsheet 18 excel template. Take control of your credit card debt with our comprehensive credit card payoff spreadsheet template. Track and map your credit card payments with our credit card payoff calculator excel template. Struggling with credit card debt and looking. You’re not alone, and there’s a handy tool at your disposal—excel! Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. This credit card payoff spreadsheet excel template simplifies and automates the process of tracking and paying off your credit card debt. Use it to quickly calculate your. With a few simple steps, you can. Use it to quickly calculate your. Take control of your credit card debt with our comprehensive credit card payoff spreadsheet template. You’re not alone, and there’s a handy tool at your disposal—excel! Get started today with the credit card payoff spreadsheet 18 excel template. Credit card payoff calculator template (excel, pdf), open office that will calculate the payment which is. Download a free spreadsheet or use an online calculator to find out how to pay off your credit card debt faster. You’re not alone, and there’s a handy tool at your disposal—excel! When a borrower has more than one debt and repays them. Enter your current balance, interest rate, monthly payment or. In this article, we will demonstrate how to. Get started today with the credit card payoff spreadsheet 18 excel template. Learn how to use the snowball technique and other tips to reduce your interest and debt. Enter your current balance, interest rate, monthly payment or. When a borrower has more than one debt and repays them. Download and use these excel templates to track and plan your credit. Learn how to use the snowball technique and other tips to reduce your interest and debt. Credit card payoff calculator template (excel, pdf), open office that will calculate the payment which is required to pay off your all credit card debt in the specified. Download and use these excel templates to track and plan your credit card payments. Struggling with credit card debt and looking for a way to get a handle on it? This editable excel template, available at template.net, encourages you to. Use it to quickly calculate your. This excel template helps you easily track your credit card payments and balances. This credit card payoff spreadsheet excel template simplifies and automates the process of tracking and paying off your credit card debt. You’re not alone, and there’s a handy tool at your disposal—excel! Download a free excel template to calculate your credit card payoff schedule and goal. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff. Take control of your credit card debt with our comprehensive credit card payoff spreadsheet template. Track and map your credit card payments with our credit card payoff calculator excel template. In this article, we will demonstrate how to create a credit card payoff calculator in excel using the snowball method. The credit card payoff calculator is an excel template designed to assist individuals in calculating the number of installments required to pay off their outstanding credit card balances. Learn about the avalanche and snowball methods, and how to calculat…Excel Credit Card Payoff Calculator and Timeline Easy Financial Tracker

Credit Card Debt Payoff Tracker Template in Excel, Google Sheets

EXCEL of Credit Card Payoff Calculator.xlsx WPS Free Templates

3 Free Credit Card Payoff Spreadsheet Templates Word Excel Templates

Credit Card Excel Template

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Credit Card Payoff Calculator Excel Template Excel TMP

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

How to Create a Credit Card Payoff Spreadsheet in Excel (2 Ways)

Credit Card Payoff Spreadsheet Template in Excel, Google Sheets

Enter Your Current Balance, Interest Rate, Monthly Payment Or.

Use Our Credit Card Payoff Calculator To Estimate Your Payoff Timeline, Monthly Payments, And Total Interest, Helping You Plan A Path To Eliminate Credit Card Debt Efficiently.

It Provides A Simple Way To Calculate And Compare The Cost Of Different Payment Plans.

When A Borrower Has More Than One Debt And Repays Them.

Related Post: