Dcf Model Template

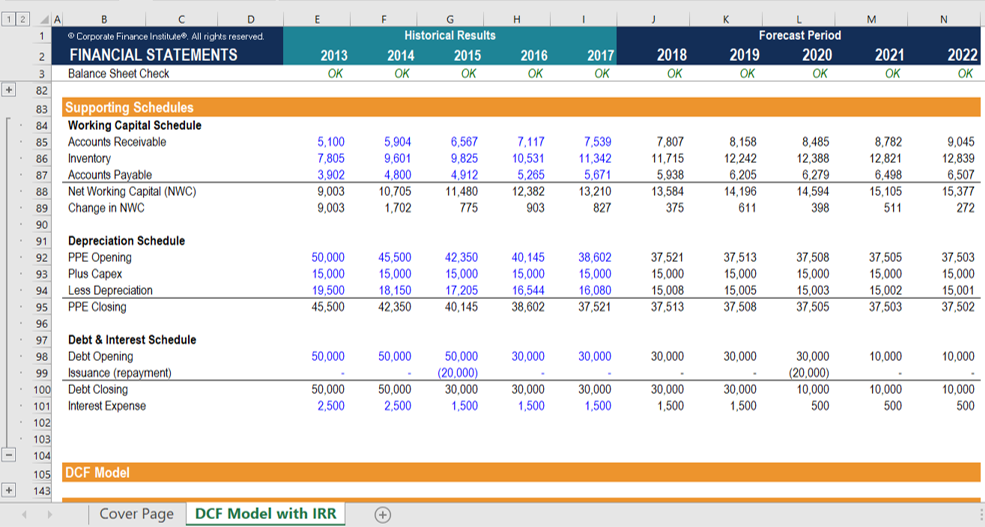

Dcf Model Template - Wso provides its readers with a free dcf model template that you can use to build your model with different assumptions and practice the steps that have been explained. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Advanced financial model with dcf and relative valuation for all industries. The template includes other tabs for other elements of a financial model. How to build dcf model excel structures? Download a free dcf template and see. This discounted free cash flow financial model template allows you to estimate return potential by discounting future cash flow projections to a present value. Download a free excel template to build your own discounted cash flow model with different assumptions. Learn how to conduct a discounted cash flow (dcf) analysis to value a business or asset based on its ability to generate cash flows. Advanced financial model with dcf and relative valuation for all industries. Unlock the power of comprehensive financial analysis with this advanced financial model template. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Download a free excel template to build your own discounted cash flow model with different assumptions. The template includes other tabs for other elements of a financial model. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Financial model templates for discounted cash flow (dcf) analysis provide a structured framework to evaluate the present value of an investment based on its projected future cash. How to build dcf model excel structures? This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Download a free dcf template and see. All included here with examples and real life case studies. Unlock the power of comprehensive financial analysis with this advanced financial model template. How to build dcf model excel structures? Wso provides its readers with a free dcf model template that you can use to build your model with different assumptions and practice the steps that have been explained. The. Financial model templates for discounted cash flow (dcf) analysis provide a structured framework to evaluate the present value of an investment based on its projected future cash. Download a free dcf template and see. Unlock the power of comprehensive financial analysis with this advanced financial model template. The template includes other tabs for other elements of a financial model. To. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. How to build dcf model excel structures? The template includes other tabs for other elements of a financial model. Learn how to conduct a discounted cash flow (dcf) analysis to value a business or asset based on its ability to. Download a free dcf template and see. Download a free excel template to build your own discounted cash flow model with different assumptions. Financial model templates for discounted cash flow (dcf) analysis provide a structured framework to evaluate the present value of an investment based on its projected future cash. This dcf model template provides you with a foundation to. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Learn how to conduct a discounted cash flow (dcf) analysis to value a business or asset based on its ability to generate cash flows. Advanced financial model with dcf and relative valuation for all industries.. Learn how to conduct a discounted cash flow (dcf) analysis to value a business or asset based on its ability to generate cash flows. All included here with examples and real life case studies. How to build dcf model excel structures? The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by. Download a free dcf template and see. Unlock the power of comprehensive financial analysis with this advanced financial model template. Download a free excel template to build your own discounted cash flow model with different assumptions. How to build dcf model excel structures? Learn how to conduct a discounted cash flow (dcf) analysis to value a business or asset based. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Advanced financial model with dcf and relative valuation for all industries. Download a free excel template to build your own discounted cash flow model with different assumptions. All included here with examples and real life case studies. Financial model templates. Unlock the power of comprehensive financial analysis with this advanced financial model template. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Financial model templates for discounted cash flow (dcf) analysis provide a structured framework to evaluate the present. The template includes other tabs for other elements of a financial model. Learn how to conduct a discounted cash flow (dcf) analysis to value a business or asset based on its ability to generate cash flows. Advanced financial model with dcf and relative valuation for all industries. Financial model templates for discounted cash flow (dcf) analysis provide a structured framework. Download a free dcf template and see. The template includes other tabs for other elements of a financial model. Unlock the power of comprehensive financial analysis with this advanced financial model template. Advanced financial model with dcf and relative valuation for all industries. How to build dcf model excel structures? The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive at a. Financial model templates for discounted cash flow (dcf) analysis provide a structured framework to evaluate the present value of an investment based on its projected future cash. All included here with examples and real life case studies. This dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Wso provides its readers with a free dcf model template that you can use to build your model with different assumptions and practice the steps that have been explained. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes.DCF Model Template with IRR Eloquens

Discounted Cash Flow (DCF) Model Template + Instructions Eloquens

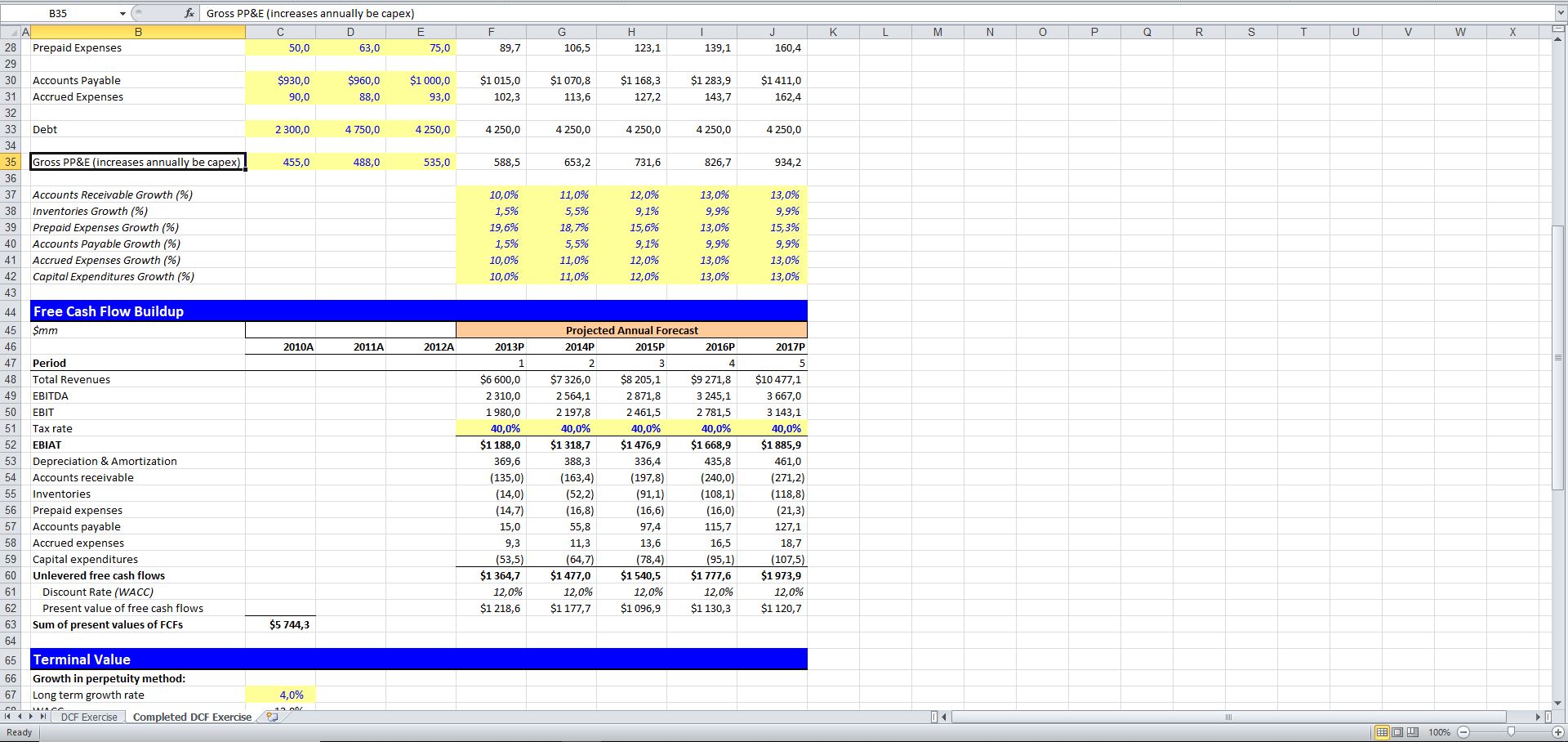

DCF Model Training The Ultimate Free Guide to DCF Models

DCF model tutorial with free Excel

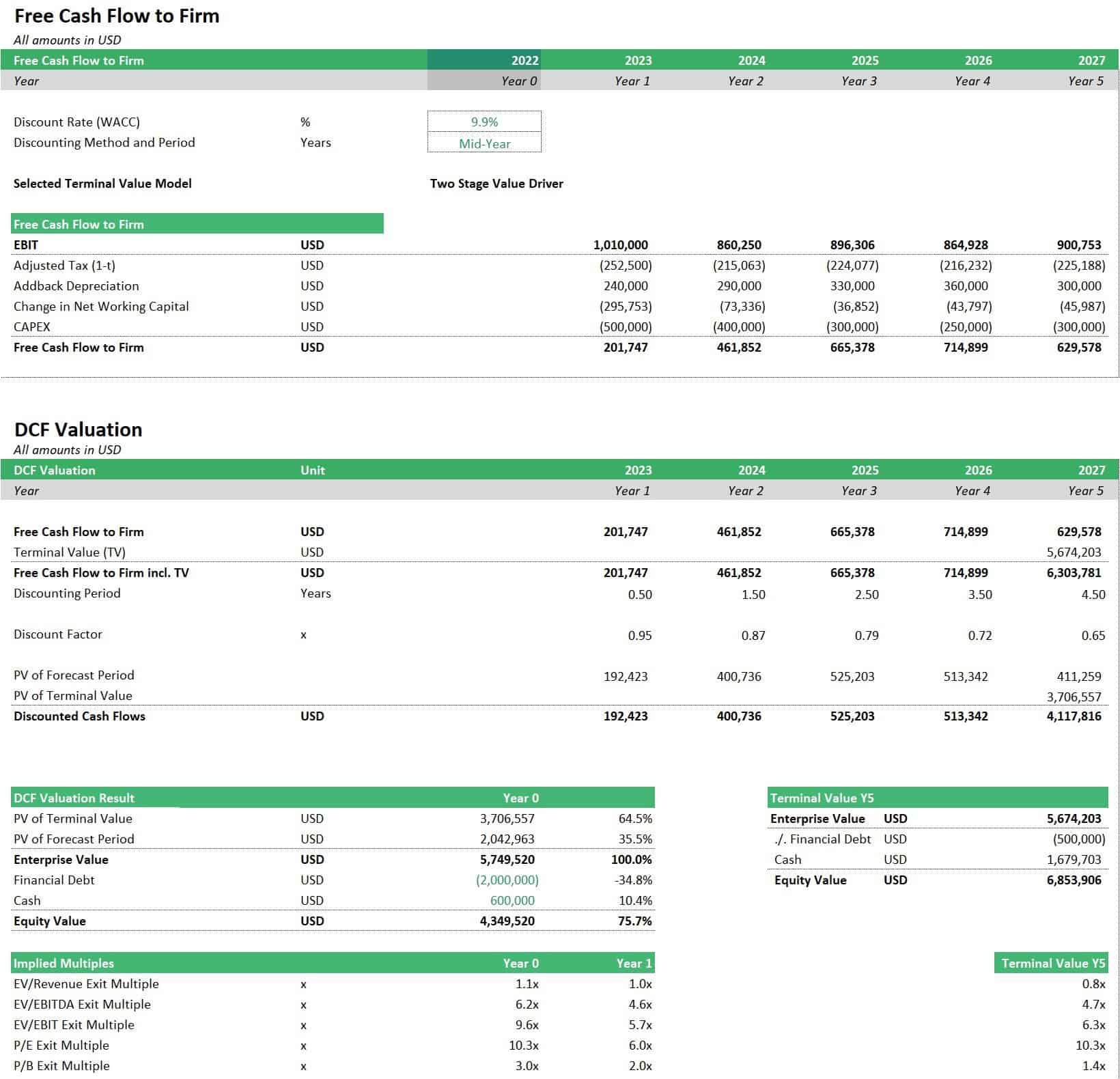

DCF model Discounted Cash Flow Valuation eFinancialModels

Discounted Cash Flow (DCF) Template eFinancialModels

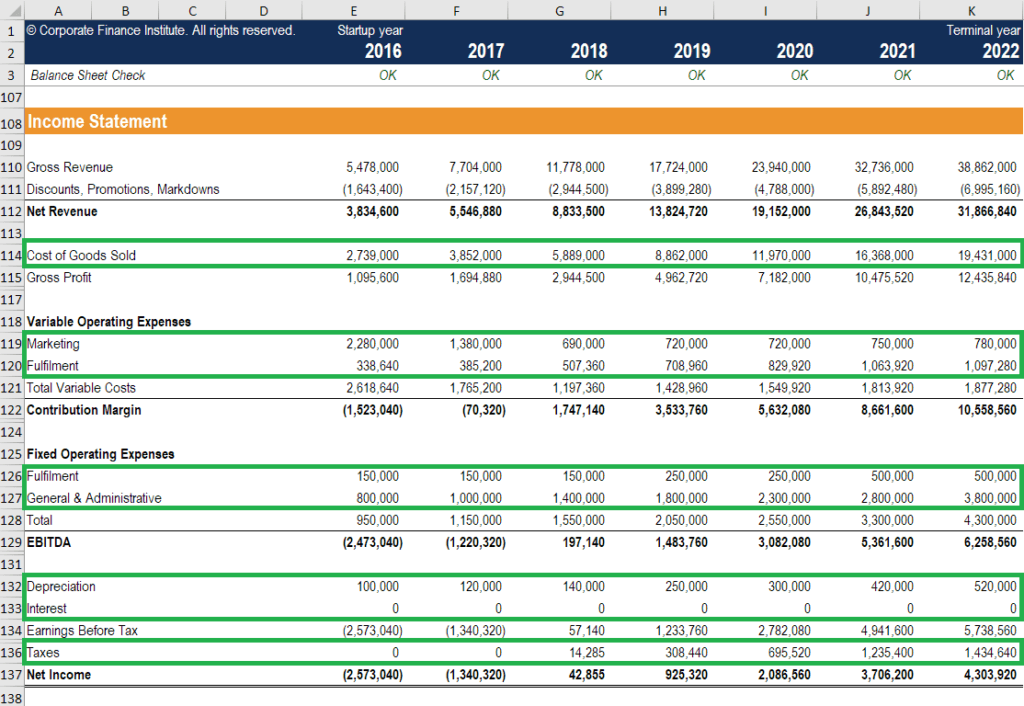

DCF Model Full Guide, Excel Templates, and Video Tutorial (2022)

Discounted Cash Flow Template Free Excel Download

DCF model Discounted Cash Flow Valuation eFinancialModels

Discounted Cash Flow Model Template, Below is a preview of the dcf

Download A Free Excel Template To Build Your Own Discounted Cash Flow Model With Different Assumptions.

Learn How To Conduct A Discounted Cash Flow (Dcf) Analysis To Value A Business Or Asset Based On Its Ability To Generate Cash Flows.

This Discounted Free Cash Flow Financial Model Template Allows You To Estimate Return Potential By Discounting Future Cash Flow Projections To A Present Value.

Related Post: