Debt Payoff Excel Template

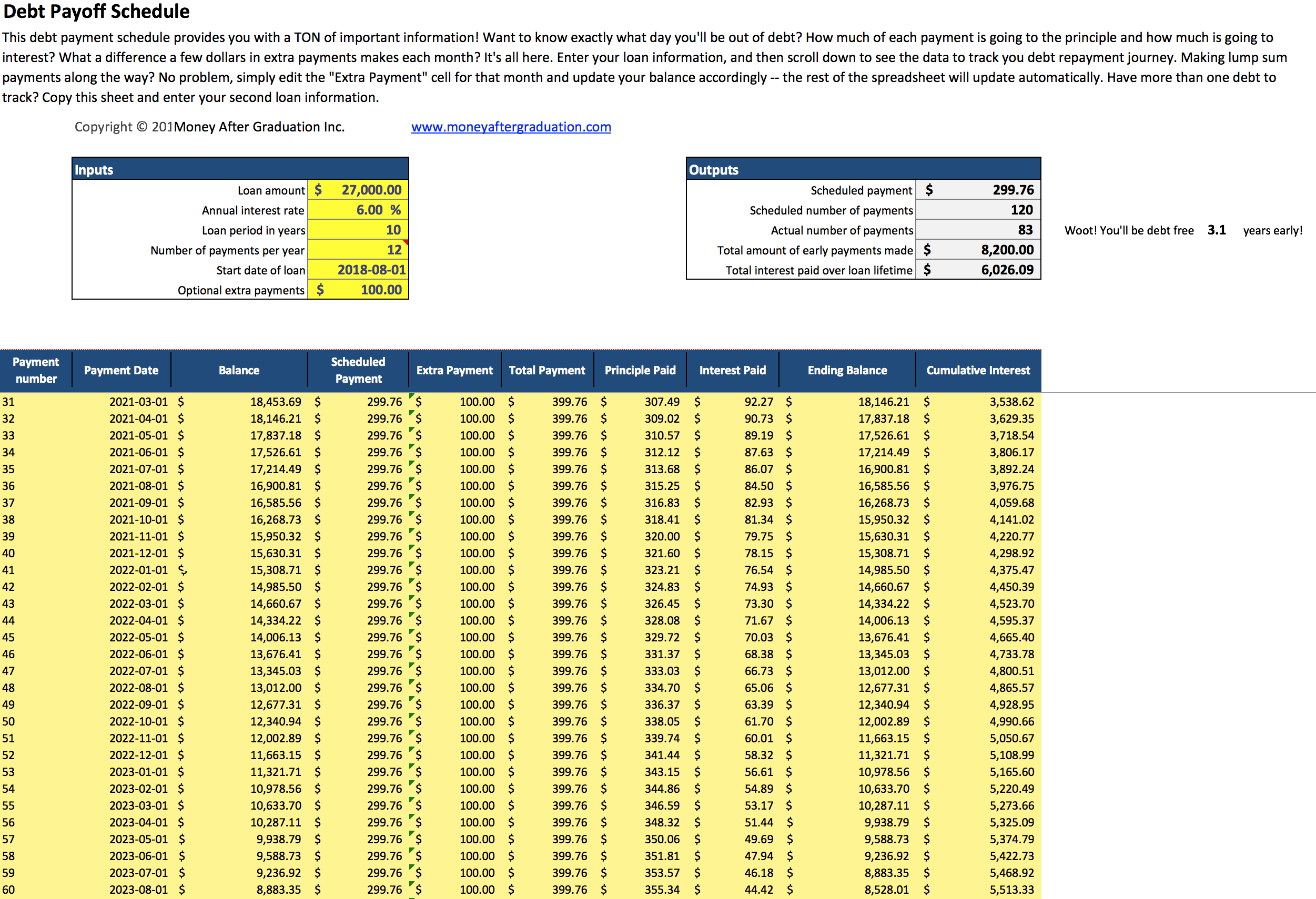

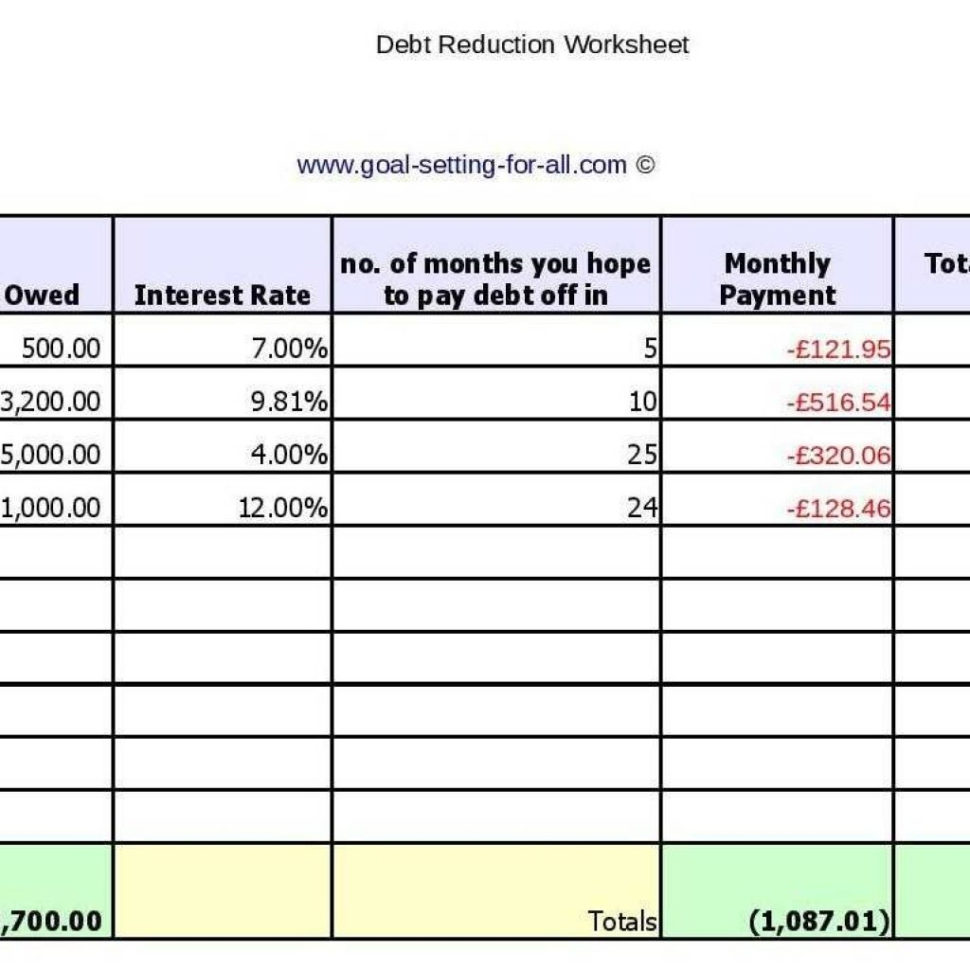

Debt Payoff Excel Template - If you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche excel spreadsheet that's linked a few sections below. These spreadsheets work best with the debt snowball method. Enter the total monthly payment that you can pay each month. Debt snowball spreadsheet from spreadsheet. How to track through debt payoff tracker in excel. Download printable debt payoff charts and trackers for excel and pdf. Experiment with variables including monthly payment amounts and time to debt payoff. Free debt snowball spreadsheets for excel & google sheets. The system generates detailed spreadsheets with debt snowball or avalanche. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. In cell b2, enter your current credit card balance. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. Make a plan to get out of debt and estimate how much you can save. The debt snowball method creates a snowball effect as you pay off each debt which helps you build up momentum toward becoming debt free. The spreadsheet will show you how many months that should take. With it, you'll see exactly how. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. As you eliminate one debt, you free. These spreadsheets work best with the debt snowball method. This spreadsheet assumes a fixed minimum payment for each debt, so you may want to update the calculator every few months. Track your debt payoff goals. The accelerated debt payoff spreadsheet is going to be based on one of the most successful and recognizable debt payoff strategies. A payment schedule excel template is a structured spreadsheet that helps track and manage recurring payments, loans, or financial obligations. How to track through debt payoff tracker in excel. Columns and rows have been. Easily record and monitor your outstanding balances, interest rates, and monthly payments. The debt snowball method creates a snowball effect as you pay off each debt which helps you build up momentum toward becoming debt free. This spreadsheet assumes a fixed minimum payment for each debt, so you may want to update the calculator every few months. With this tool,. Columns and rows have been professionally designed so that you only. The system generates detailed spreadsheets with debt snowball or avalanche. Exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! As you eliminate one debt, you free. Check it out here for a free download. Stay on top of your debt repayment journey with our debt payoff tracker template. You can also make extra payments. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. Download printable debt payoff charts and trackers for excel and. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Manage your personal budget with the help of this free template. This spreadsheet assumes a fixed minimum payment for each debt, so you may want to update the calculator every few months. Check it out here for. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. Customize it to fit your needs and visualize your. Download printable debt payoff charts and trackers for excel and pdf. These spreadsheets work best with the debt snowball method. Accelerated debt payoff spreadsheet template. Free debt snowball spreadsheets for excel & google sheets. The system generates detailed spreadsheets with debt snowball or avalanche. Check it out here for a free download. Accelerated debt payoff spreadsheet template. See how different payoff amounts and other variables impact your debt freedom date. If you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche excel spreadsheet that's linked a few sections below. In cell b2, enter your current credit card balance. Experiment with variables including monthly payment amounts and time to debt payoff. You can also make extra payments. Easily record. Enter the total monthly payment that you can pay each month. Columns and rows have been professionally designed so that you only. Next, input your initial data. Exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! Make minimum payments on everything else. Check it out here for a free download. Track your debt payoff goals. Make a plan to get out of debt and estimate how much you can save. The spreadsheet will show you how many months that should take. This is a critical piece of the puzzle, as it. Experiment with variables including monthly payment amounts and time to debt payoff. Download free credit card payoff and debt reduction calculators for excel. Track your debt payoff goals. Next, input your initial data. Enter the total monthly payment that you can pay each month. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. These spreadsheets work best with the debt snowball method. Accelerated debt payoff spreadsheet template. Check it out here for a free download. Columns and rows have been professionally designed so that you only. The accelerated debt payoff spreadsheet is going to be based on one of the most successful and recognizable debt payoff strategies. The spreadsheet will show you how many months that should take. With this tool, you’ll have a clear and organized overview of your debt, including the total amounts owed, interest rates, minimum payments, and due dates. Track multiple debts with a single worksheet. Exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are always completely free! Customize it to fit your needs and visualize your.Debt Calculator Spreadsheet throughout Debt Consolidation Spreadsheet

Debt Snowball Tracker Digital Excel Payoff Spreadsheet Etsy

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

Debt Payoff Tracker Template in Excel, Google Sheets Download

Loan Payoff Spreadsheet pertaining to Debt Consolidation Spreadsheet

Debt Payoff Excel Spreadsheet, Debt Snowball Calculator, Debt Payoff

Debt Excel Template

Debt Payoff Calculator Spreadsheet Debt Snowball Excel Etsy

Debt Payoff Excel Template

Debt Payoff Excel Spreadsheet, Debt Payoff Tracker Digital Download

Use This Free Debt Payoff Calculator To See How Much You Can Pay Down Your Debt Each Month, And To Forecast Your Debt Freedom Date According To Different Payoff Methods.

With It, You'll See Exactly How.

Edit The Labels For Each Column And Then Enter The Minimum Payment (Min).

A Payment Schedule Excel Template Is A Structured Spreadsheet That Helps Track And Manage Recurring Payments, Loans, Or Financial Obligations.

Related Post: