Debt Recovery Letter Template

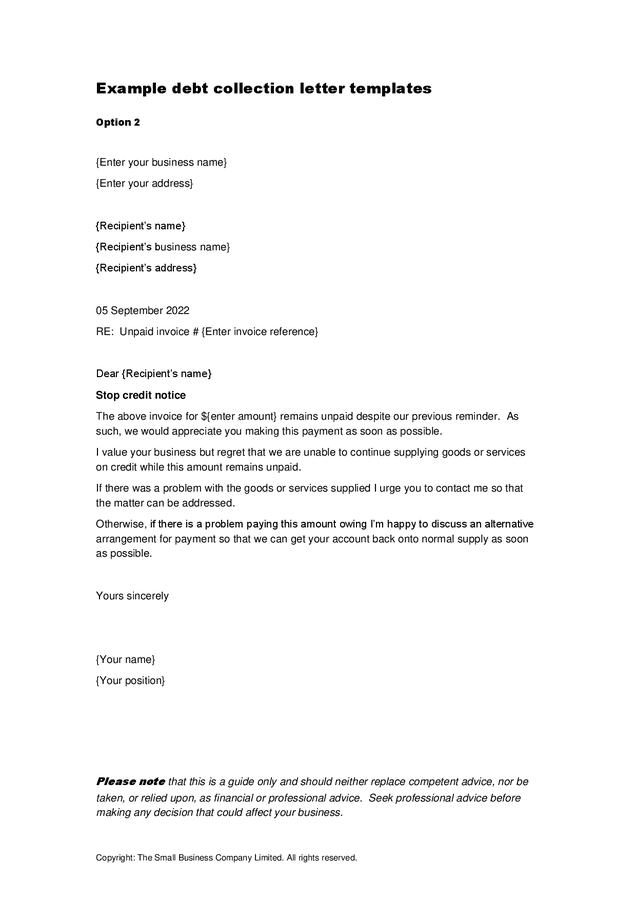

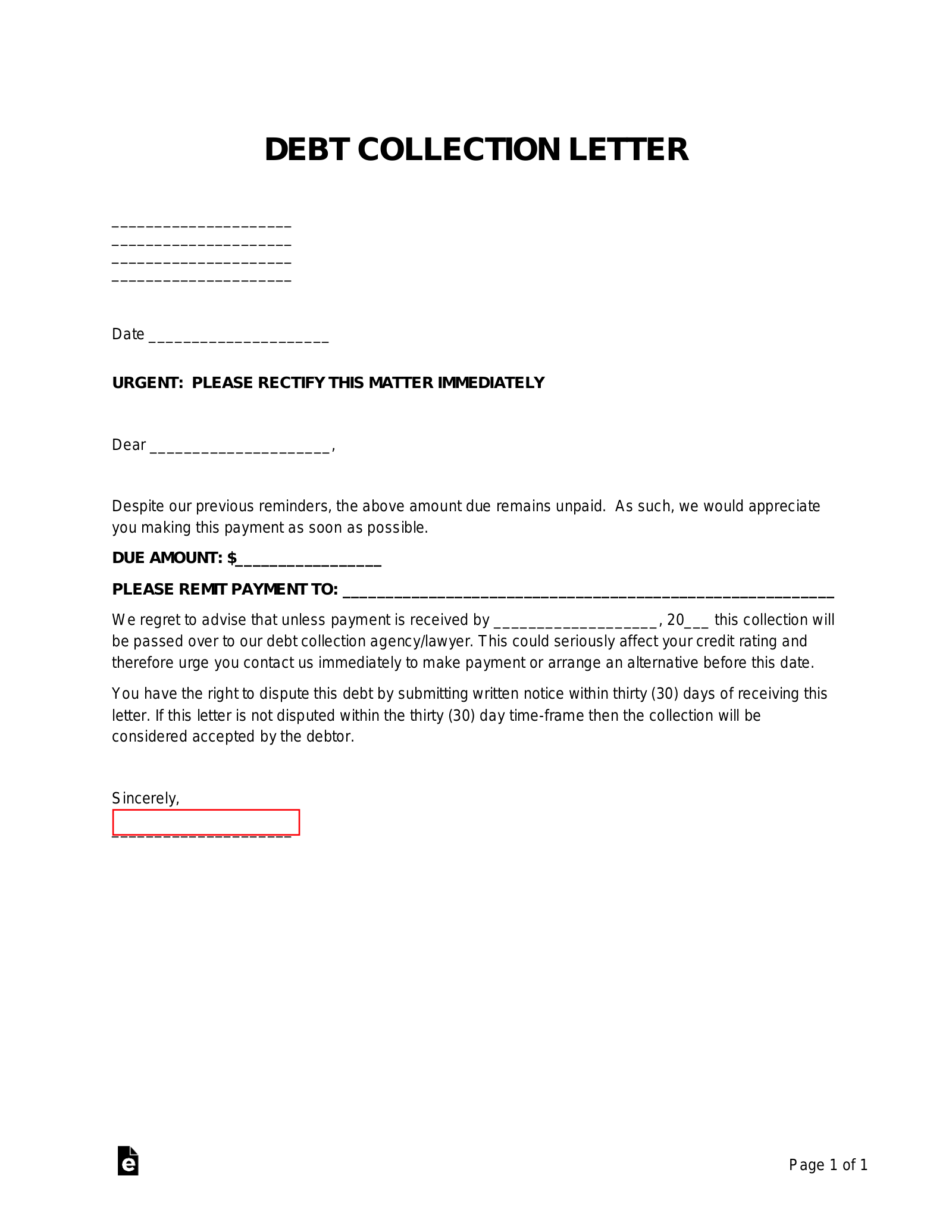

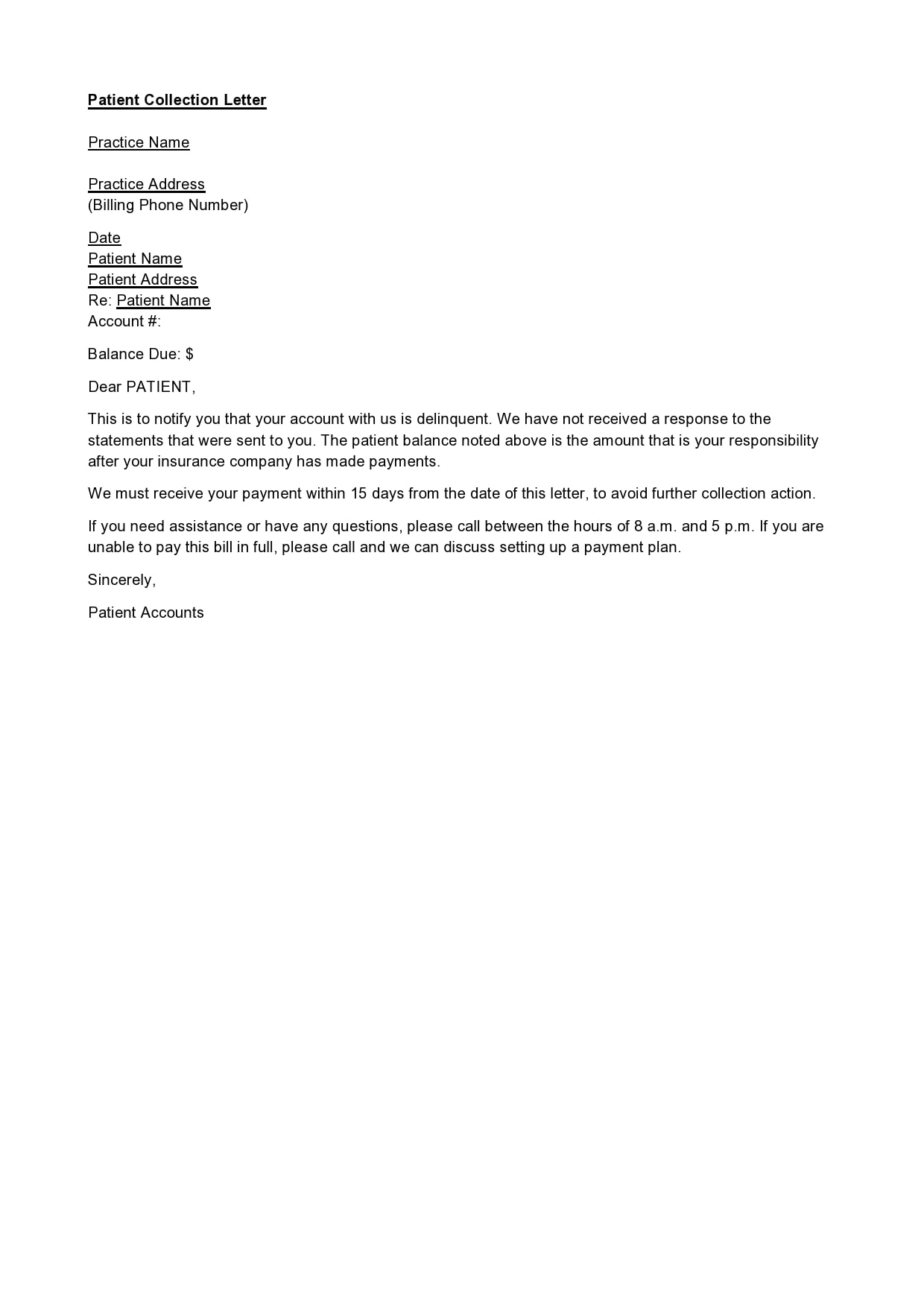

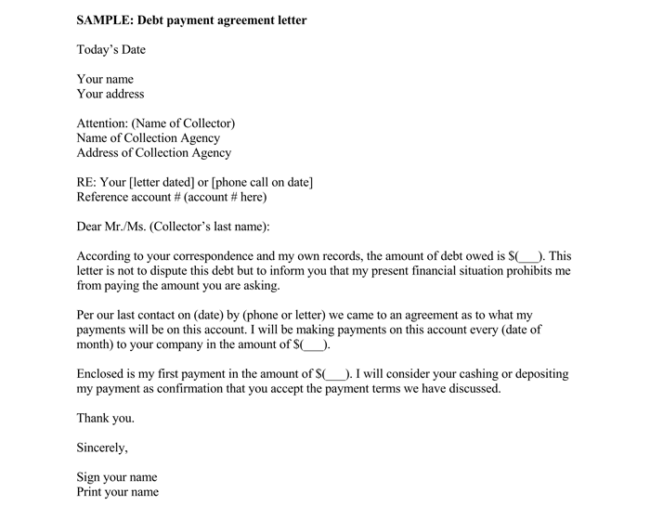

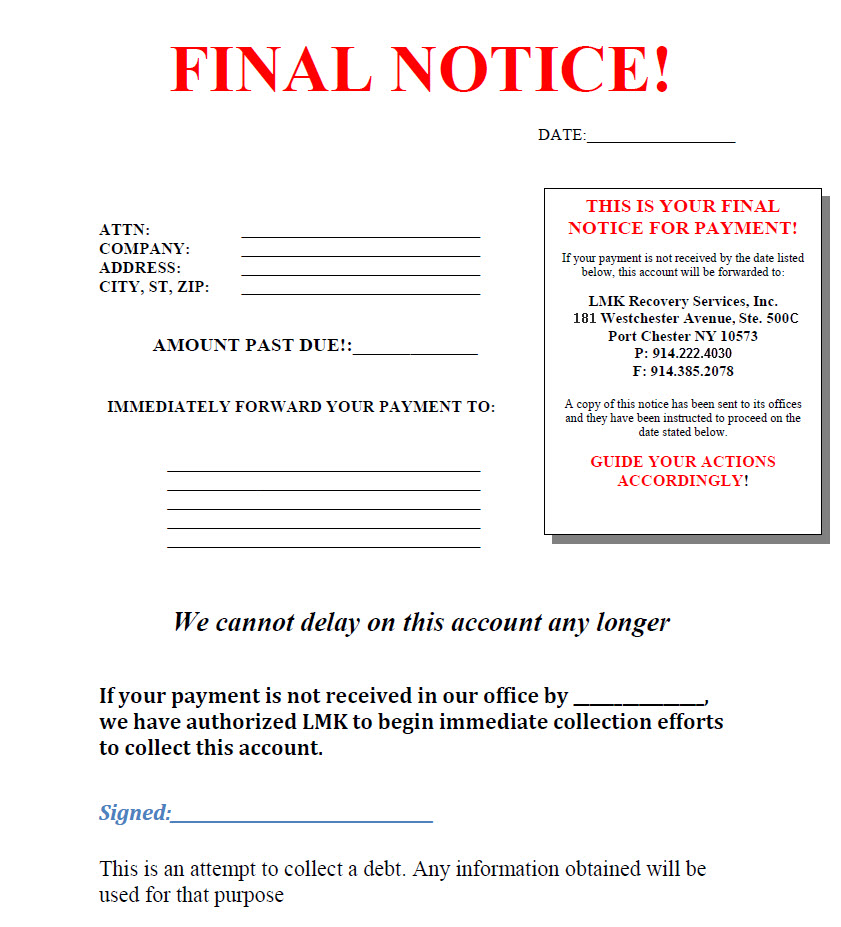

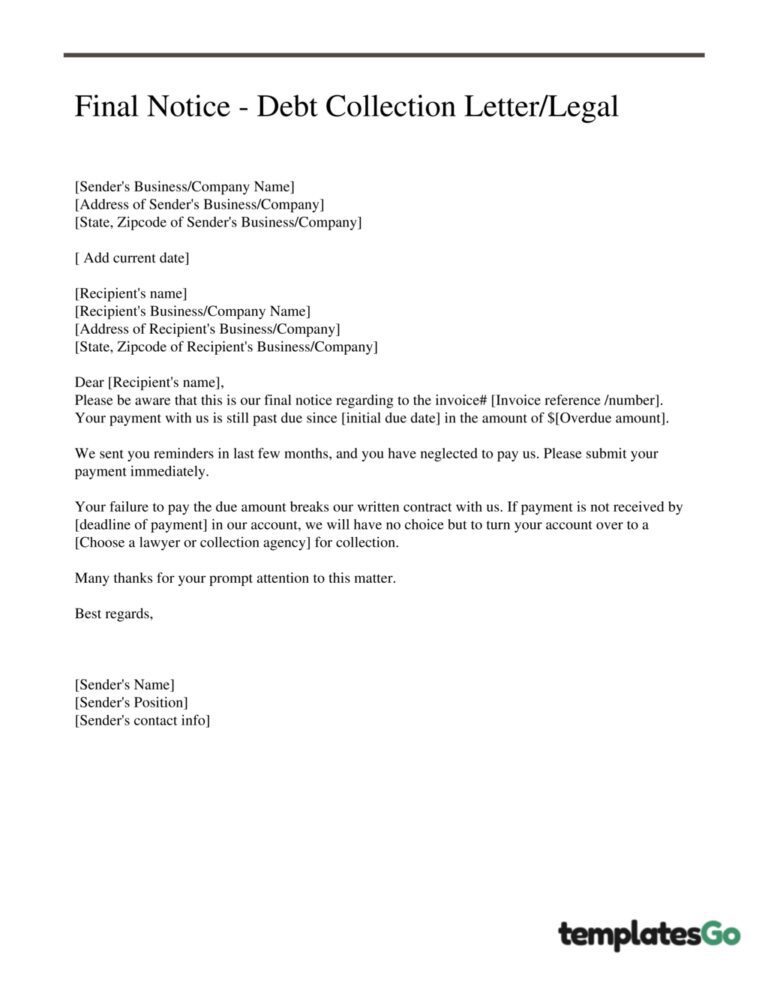

Debt Recovery Letter Template - Our free debt collection letter template to help you collect overdue amounts from your customers and get advice on how you can recover debts. Writing a collection letter sample requires that one follows the right steps and includes the right tone to inform your clients that a debt is owed and is past due. Our debt recovery section focuses on letter templates to enable you to maintain good credit control and actively pursue late payments. Debt collection letters are formal communications sent by creditors or collection agencies to individuals or businesses with outstanding debts. A document of this kind usually serves as the last. Looking to send a professional demand letter? Debt collection letters are an essential tool used by creditors and collection agencies to remind individuals or businesses of overdue payments. Streamline your debt recovery with our effective friendly collection letter templates. The role of a demand letter in. As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring the debt letter. Writing a debt recovery demand letter can be a crucial step toward reclaiming what is rightfully yours. As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring the debt letter. The role of a demand letter in. A debt recovery letter or a letter of demand is a letter that demands the subject of a debt to settle their outstanding bill, which is in default, within the certain time specified and informs him. Get practical examples and tips to craft compelling letters and improve collection rates! It links to free documents and forms, such as a sample “stop contact” letter to send to debt collectors and a “dispute” letter to. Our debt recovery section focuses on letter templates to enable you to maintain good credit control and actively pursue late payments. Simplify debt recovery with debt collection letter templates tailored for every stage, including legal notices and firm yet polite payment reminders. Optimize your debt recovery process with our debt collection letter guide. Looking to send a professional demand letter? As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring the debt letter. Get practical examples and tips to craft compelling letters and improve collection rates! Debt collection letters are formal communications sent by creditors or collection agencies to individuals or businesses with outstanding debts. A debt recovery letter or a letter of. A debt collection letter is a formal statement prepared by a lender and sent to a borrower with the request to handle the unpaid debt. With the right tone and structure, you can clearly communicate your expectations and. While generating your own can work, having a lawyer or. Writing a debt recovery demand letter can be a crucial step toward. As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring the debt letter. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Our free debt collection letter template to help you collect overdue amounts from your customers and get advice on how you can recover debts. Our debt recovery section. Looking to send a professional demand letter? A debt recovery letter or a letter of demand is a letter that demands the subject of a debt to settle their outstanding bill, which is in default, within the certain time specified and informs him. As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring. Debt collection letters are an essential tool used by creditors and collection agencies to remind individuals or businesses of overdue payments. While generating your own can work, having a lawyer or. Debt collection letters are formal communications sent by creditors or collection agencies to individuals or businesses with outstanding debts. Simplify debt recovery with debt collection letter templates tailored for. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring the debt letter. The digital edition of surviving debt is free online. These letters serve as a. Streamline your debt recovery with our effective friendly collection letter templates. Looking to send a professional demand letter? Requesting creditors to stop collection activities is a critical part of the letter. A document of this kind usually serves as the last. Our debt recovery section focuses on letter templates to enable you to maintain good credit control and actively pursue late payments. The role of a demand letter in. It links to free documents and forms, such as a sample “stop contact” letter to send to debt collectors and a “dispute” letter to. Streamline your debt recovery with our effective friendly collection letter templates. Writing a debt recovery demand letter can be a crucial step toward reclaiming what is rightfully yours. These letters serve as a. A debt recovery. Requesting creditors to stop collection activities is a critical part of the letter. As you terminate the letter, it’s essential to warn the debtor of the repercussions of not honoring the debt letter. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Writing a debt recovery demand letter can be a crucial step toward reclaiming what is. The digital edition of surviving debt is free online. These letters serve as a. A debt collection letter is a formal statement prepared by a lender and sent to a borrower with the request to handle the unpaid debt. With the right tone and structure, you can clearly communicate your expectations and. Writing a debt recovery demand letter can be. A document of this kind usually serves as the last. These letters serve as a. It links to free documents and forms, such as a sample “stop contact” letter to send to debt collectors and a “dispute” letter to. The role of a demand letter in. Our debt recovery section focuses on letter templates to enable you to maintain good credit control and actively pursue late payments. While generating your own can work, having a lawyer or. Writing a debt recovery demand letter can be a crucial step toward reclaiming what is rightfully yours. A debt collection letter is a formal statement prepared by a lender and sent to a borrower with the request to handle the unpaid debt. Our free debt collection letter template to help you collect overdue amounts from your customers and get advice on how you can recover debts. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Requesting creditors to stop collection activities is a critical part of the letter. Looking to send a professional demand letter? Writing a collection letter sample requires that one follows the right steps and includes the right tone to inform your clients that a debt is owed and is past due. With the right tone and structure, you can clearly communicate your expectations and. Debt collection letters are formal communications sent by creditors or collection agencies to individuals or businesses with outstanding debts. Optimize your debt recovery process with our debt collection letter guide.Debt collection letter templates in Word and Pdf formats page 2 of 3

Debt Collection Letter Templates

30 Best Debt Collection Letter Templates TemplateArchive

3 Effective Debt Collection Letter Templates

Debt Collection Letter Samples (for Debtors) Guide & Tips

Free Debt Recovery Letter Template & FAQs Rocket Lawyer UK

Debt Recovery Letter UK Template Make Yours For Free

letter debt collection Doc Template pdfFiller

Debt Collection Letter Free Printable Documents

Debt Collection Letter with 4 Effective Examples

Simplify Debt Recovery With Debt Collection Letter Templates Tailored For Every Stage, Including Legal Notices And Firm Yet Polite Payment Reminders.

A Debt Recovery Letter Or A Letter Of Demand Is A Letter That Demands The Subject Of A Debt To Settle Their Outstanding Bill, Which Is In Default, Within The Certain Time Specified And Informs Him.

Your Letter Should End With A Complimentary Close, Followed By A Valid Signature.

Streamline Your Debt Recovery With Our Effective Friendly Collection Letter Templates.

Related Post: