Debt Verification Letter Template Free

Debt Verification Letter Template Free - Under federal law, you have a right to get information about any debt you supposedly owe. Provide detailed information on all parties involved, including your legal name and contact information. A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. • verification that this debt was assigned or sold to collector. Was this debt assigned to a debt collector or purchased? A debt verification letter is a written request sent by a consumer to a debt collector or creditor to verify the legitimacy of a debt. For the most effective results and to cover all your legal bases, it’s best to send a debt validation letter. Clarify the original debt amount and payment schedule. It is sent to a creditor or collection agency after receiving a letter requesting payment for an unpaid balance. Debt verification letter templates are used by debt collection companies to provide evidence of a claim for a debt. These letters don’t have official names. It is a crucial tool in protecting consumers’ rights and ensuring that they are not being unfairly pursued for debts they may not owe. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Here's how to compose a debt validation letter pdf, whether you are the debtor or the creditor: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Clarify the original debt amount and payment schedule. If you are working on cleaning up your credit or preparing to file for bankruptcy, often the first step is to confirm your debts. Was this debt assigned to a debt collector or purchased? Specify the nature of the debt, including its origin and any accompanying documentation. Provide all of the following information and submit the appropriate forms and paperwork within 30 days from the date of your receipt of this request for validation. Use our debt validation letter to request the validity of a debt. Was this debt assigned to a debt collector or purchased? Specify the nature of the debt, including its origin and any accompanying documentation. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Clarify the original debt. • verification that this debt was assigned or sold to collector. Was this debt assigned to a debt collector or purchased? A debt validation letter is correspondence you send to debt collectors and creditors to request proof of the debts. Use our debt validation letter to request the validity of a debt. Debt verification letter templates are used by debt. • complete accounting of alleged debt. Agreement with your client that grants ___________________ (collection agency name) the authority to collect this alleged debt. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Use our debt validation letter to request the validity of a debt. Under. • complete accounting of alleged debt. Provide all of the following information and submit the appropriate forms and paperwork within 30 days from the date of your receipt of this request for validation. These letters don’t have official names. It is sent to a creditor or collection agency after receiving a letter requesting payment for an unpaid balance. A debt. Specify the nature of the debt, including its origin and any accompanying documentation. Use our debt validation letter to request the validity of a debt. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. If you are working on cleaning up your credit or preparing to file for. • complete accounting of alleged debt. Agreement with your client that grants ___________________ (collection agency name) the authority to collect this alleged debt. • verification that this debt was assigned or sold to collector. These letters don’t have official names. A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. For the most effective results and to cover all your legal bases, it’s best to send a debt validation letter. Clarify the original debt amount and payment schedule. Specify the nature of the debt, including its origin and any accompanying documentation. It is a crucial tool in protecting consumers’ rights and ensuring that they are not being unfairly pursued for. Provide detailed information on all parties involved, including your legal name and contact information. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Specify the nature of the debt, including its origin and any accompanying documentation. Use our debt validation letter to request the validity. Use our debt validation letter to request the validity of a debt. Specify the nature of the debt, including its origin and any accompanying documentation. A debt verification letter is a form used to confirm whether or not a debt is genuine. Agreement with your client that grants ___________________ (collection agency name) the authority to collect this alleged debt. You. Agreement with your client that grants ___________________ (collection agency name) the authority to collect this alleged debt. Some experts refer to the letter that the alleged debtor writes to a debt collector as the debt verification letter. • commission for debt collector if collection efforts are successful. Was this debt assigned to a debt collector or purchased? Here's how to. If you are working on cleaning up your credit or preparing to file for bankruptcy, often the first step is to confirm your debts. Provide all of the following information and submit the appropriate forms and paperwork within 30 days from the date of your receipt of this request for validation. A debt verification letter is a form used to confirm whether or not a debt is genuine. Debt verification letter templates are used by debt collection companies to provide evidence of a claim for a debt. Some experts refer to the letter that the alleged debtor writes to a debt collector as the debt verification letter. Agreement with your client that grants ___________________ (collection agency name) the authority to collect this alleged debt. A debt validation letter is correspondence you send to debt collectors and creditors to request proof of the debts. Under federal law, you have a right to get information about any debt you supposedly owe. • complete accounting of alleged debt. It is a crucial tool in protecting consumers’ rights and ensuring that they are not being unfairly pursued for debts they may not owe. Here's how to compose a debt validation letter pdf, whether you are the debtor or the creditor: Clarify the original debt amount and payment schedule. Use our debt validation letter to request the validity of a debt. • verification that this debt was assigned or sold to collector. It is sent to a creditor or collection agency after receiving a letter requesting payment for an unpaid balance. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do.50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

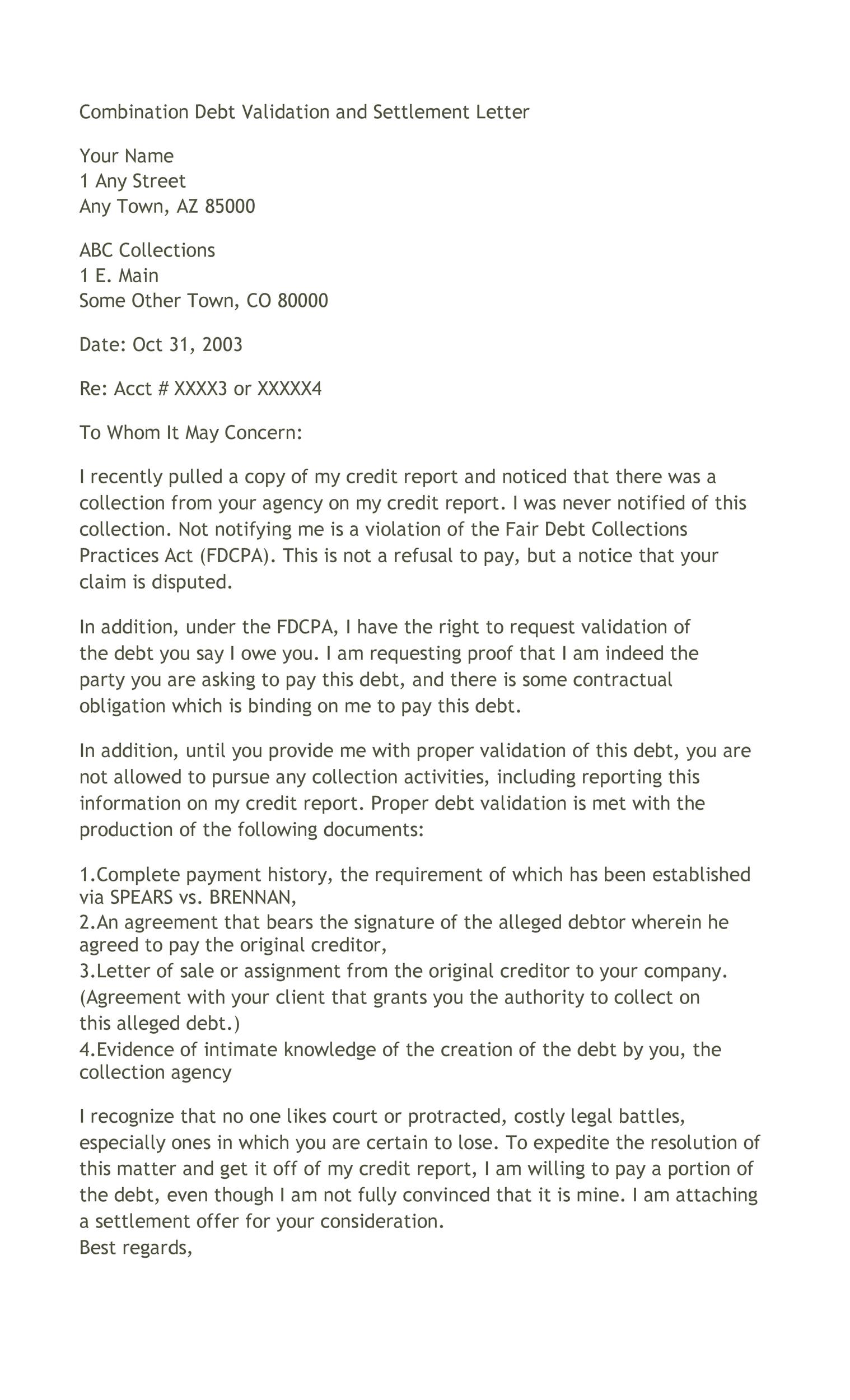

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

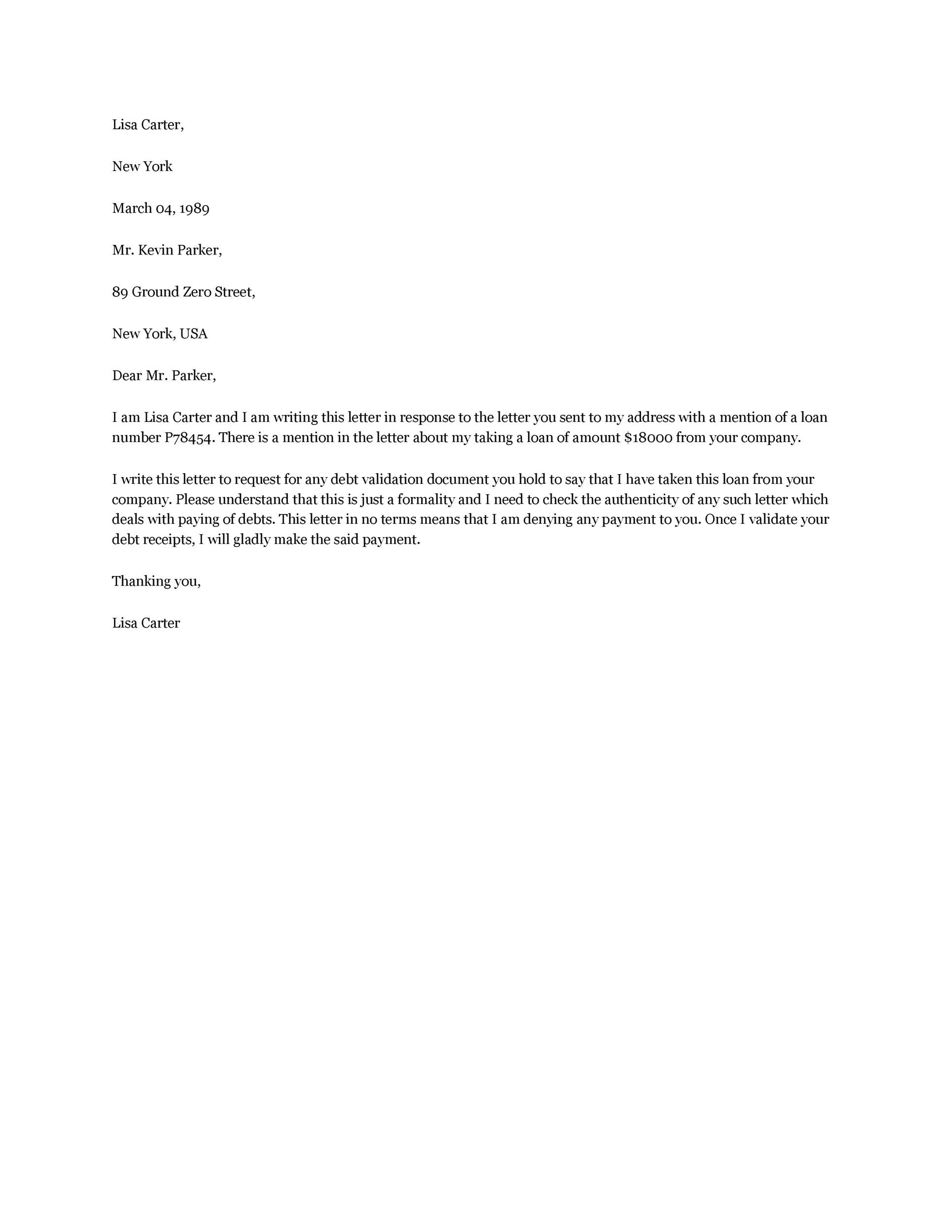

Debt Verification Letter Sample and Examples [Word]

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

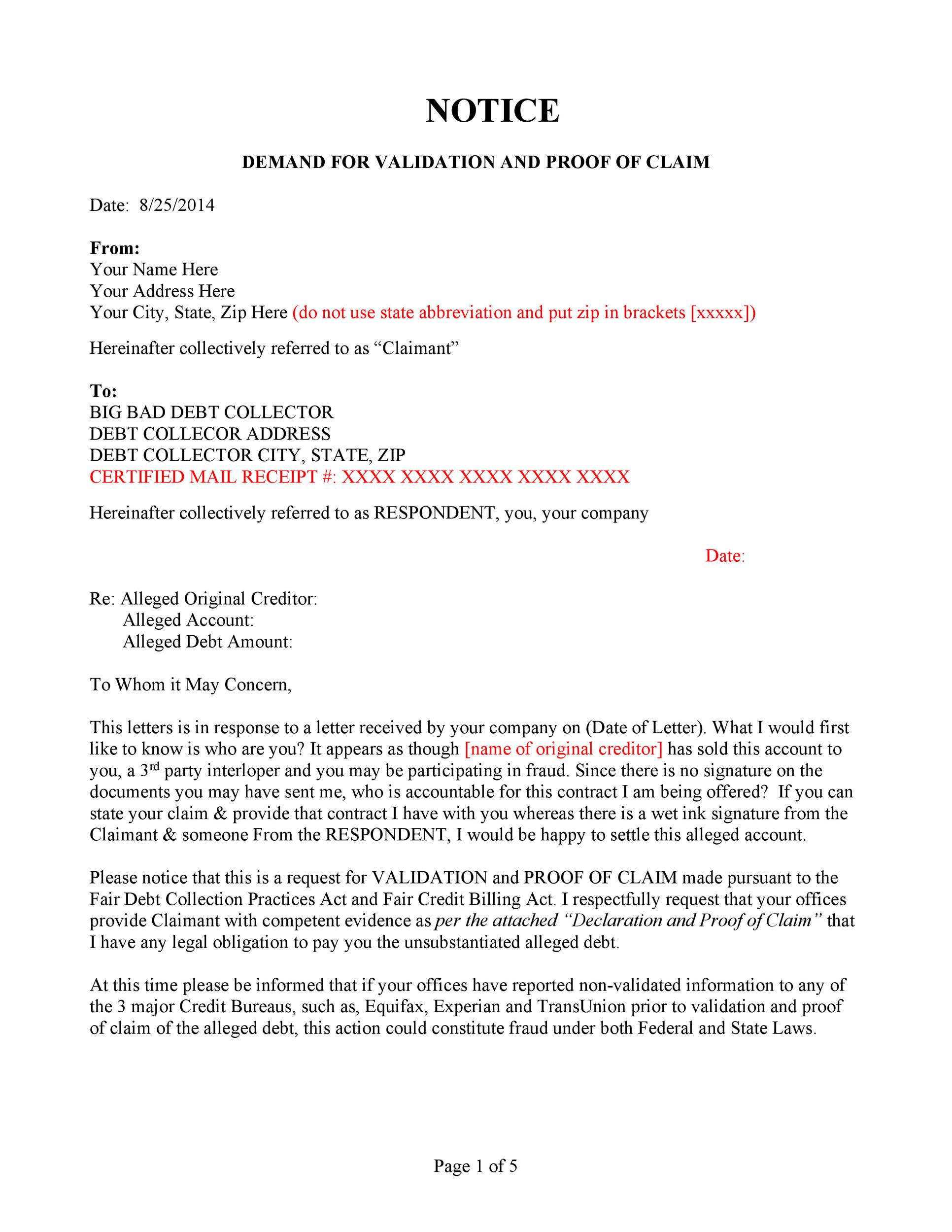

12+ Debt Validation Letter Samples Editable Download [Word, PDF]

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

These Letters Don’t Have Official Names.

For The Most Effective Results And To Cover All Your Legal Bases, It’s Best To Send A Debt Validation Letter.

Was This Debt Assigned To A Debt Collector Or Purchased?

The Right To Know How The Debt Was Incurred Is Guaranteed To All Consumers Through The Fair Debt Collection Practices Act.

Related Post:

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-12-790x1022.jpg)

![Debt Verification Letter Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/09/Debt-Verification-Letter.jpg?w=1414&ssl=1)

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-19-790x1118.jpg)

![12+ Debt Validation Letter Samples Editable Download [Word, PDF]](https://www.opensourcetext.org/wp-content/uploads/2020/07/dvl-7.jpg)

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-43-790x1022.jpg)