Dispute Letter Template For Collection

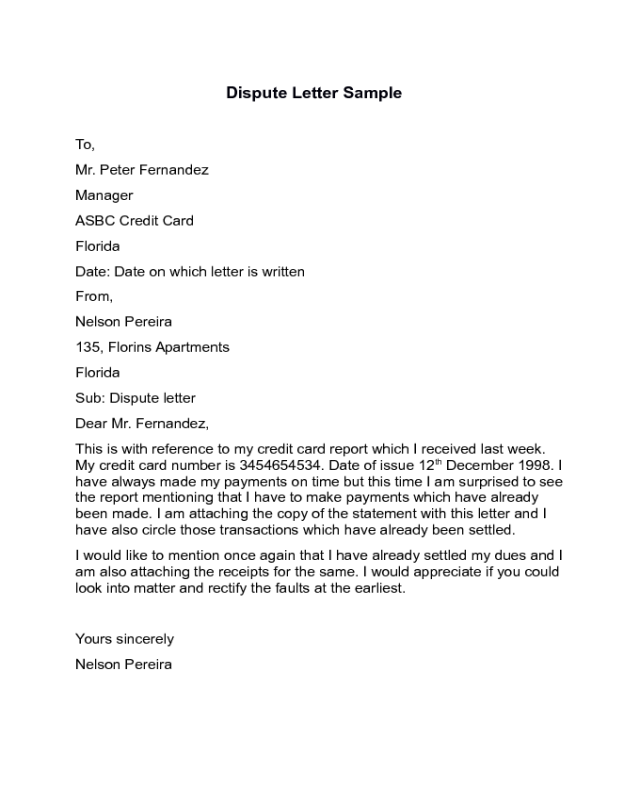

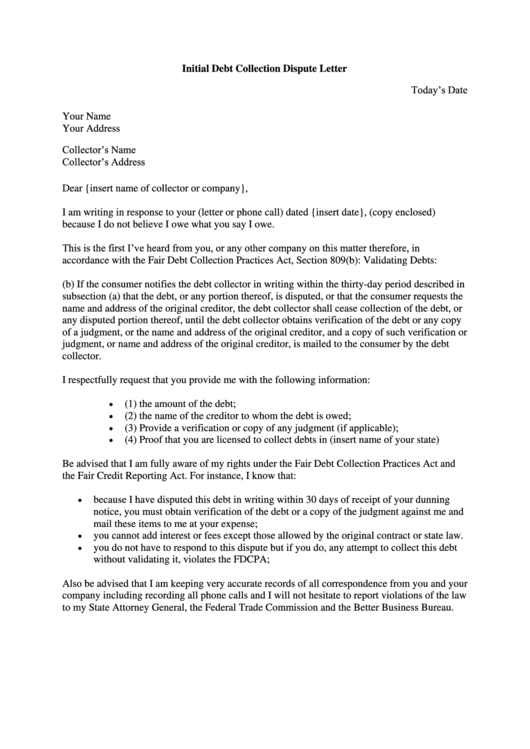

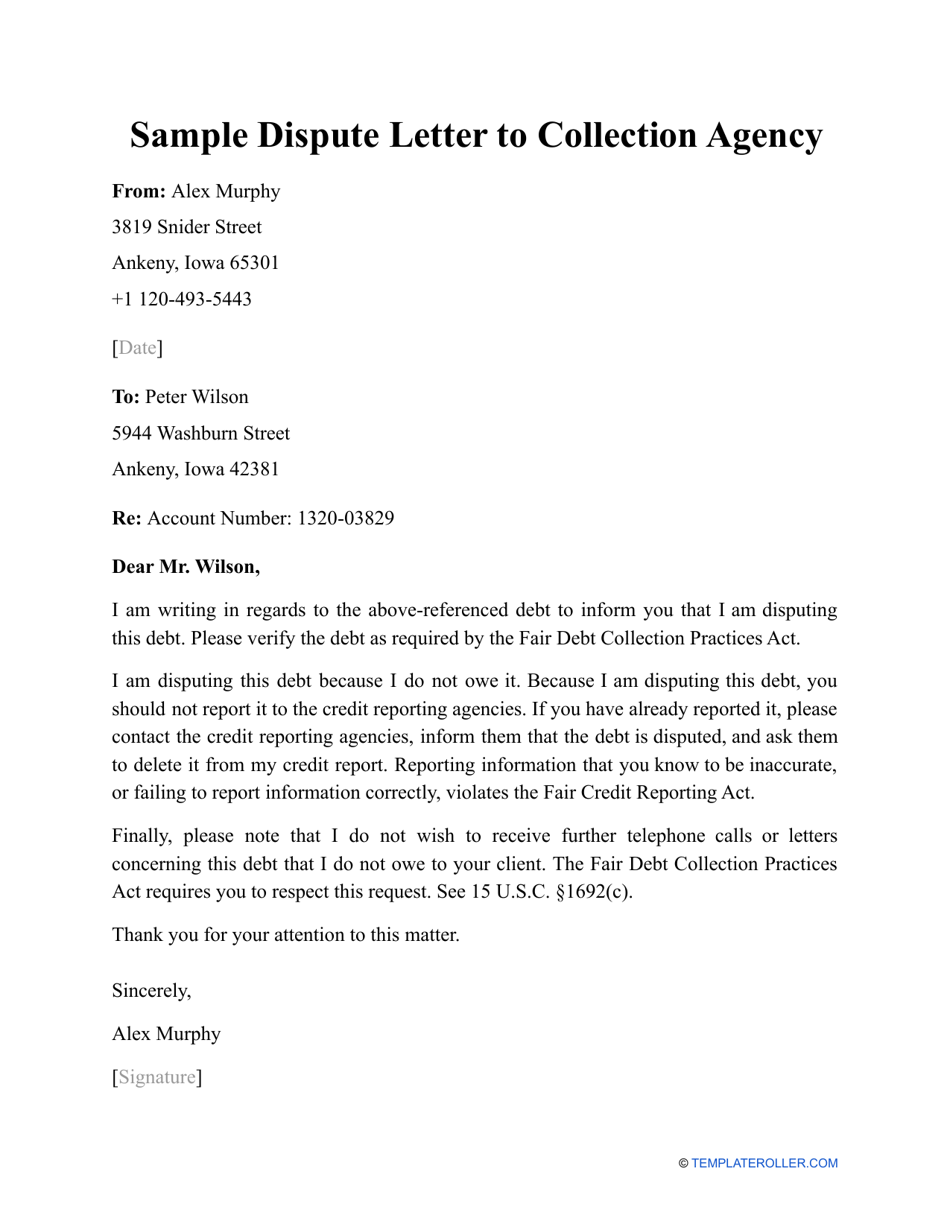

Dispute Letter Template For Collection - If it is determined that the debt is not valid or if you are unable to provide the requested documentation, i demand that you immediately cease all collection efforts and remove any. Dispute of collection account for [account number] dear sir/madam, i am writing to formally dispute the collection account associated with [account number], which is currently. Your account number, if known] to whom it may concern: Below are three unique and detailed templates for disputing a debt with a collection agency. This blank is 100% printable and editable. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. This is the first i’ve heard from you, or any other. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. How the fdcpa regulates communication. According to the fair debt collection practices act (fdcpa) you you have the right. Use this letter to dispute a debt and to tell a collector to stop contacting you. This blank is 100% printable and editable. Below are three unique and detailed templates for disputing a debt with a collection agency. It formally communicates to creditors your. Disputing a debt with a collection agency [date] [collection agency name] [collection agency address] [re: If you find yourself in a situation where you need to dispute a debt, a dispute letter can be a powerful tool to fight back against unfair or inaccurate claims made by collection. A judgment proof letter is a vital tool for those facing debt collection but unable to pay due to limited income or protected assets. Be sure to keep a copy of your letter and. Simplify the process of disputing debt collection efforts. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. If you find yourself in a situation where you need to dispute a debt, a dispute letter can be a powerful tool to fight back against unfair or inaccurate claims made by collection. Include your name, account information. Each template includes a short introductory paragraph and is structured to. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. Include your name, account information and a clear. Get the free collection agency debt dispute letter in a couple of clicks! Be sure to keep a copy. The notice must include the total amount owed, the original creditor’s name, and the consumer’s right to dispute the debt. Disputing a debt with a collection agency [date] [collection agency name] [collection agency address] [re: If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Please consider this. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Your account number, if known] to whom it may concern: Start customizing without restrictions now! Send a written dispute letter: If you send this letter within 30 days from. Your account number, if known] to whom it may concern: This is the first i’ve heard from you, or any other. Then send your letter to the. Disputing a debt with a collection agency [date] [collection agency name] [collection agency address] [re: Each template includes a short introductory paragraph and is structured to. Use this letter to dispute a debt and to tell a collector to stop contacting you. Include your name, account information and a clear. Protect your rights and dispute errors on your credit report today. How the fdcpa regulates communication. Then send your letter to the. If it is determined that the debt is not valid or if you are unable to provide the requested documentation, i demand that you immediately cease all collection efforts and remove any. Include your name, account information and a clear. Below are three unique and detailed templates for disputing a debt with a collection agency. Protect your rights and dispute. Start customizing without restrictions now! If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector. This is the first i’ve heard from you, or any other. Protect your rights and dispute errors on your credit report today. In addition to explaining the problem, you’ll want to also tell the business what. This blank is 100% printable and editable. Start customizing without restrictions now! It formally communicates to creditors your. Simplify the process of disputing debt collection efforts. The notice must include the total amount owed, the original creditor’s name, and the consumer’s right to dispute the debt. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Be sure to keep a copy of your letter and. All you have to do is send an initial dispute letter to stop calls, at least until the debt is fully validated. If you send this letter within 30 days from the date. A judgment proof letter is a vital tool for those facing debt collection but unable to pay due to limited income or protected assets. Disputing a debt with a collection agency [date] [collection agency name] [collection agency address] [re: The notice must include the total amount owed, the original creditor’s name, and the consumer’s right to dispute the debt. Use this letter to dispute a debt and to tell a collector to stop contacting you. If you believe the debt is invalid or there are errors, write a dispute letter to the debt collector. Protect your rights and dispute errors on your credit report today. How the fdcpa regulates communication. I am writing in response to your (letter or phone call) dated {insert date}, (copy enclosed) because i do not believe i owe what you say i owe. Send a written dispute letter: If it is determined that the debt is not valid or if you are unable to provide the requested documentation, i demand that you immediately cease all collection efforts and remove any. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. If you find yourself in a situation where you need to dispute a debt, a dispute letter can be a powerful tool to fight back against unfair or inaccurate claims made by collection. Get the free collection agency debt dispute letter in a couple of clicks! Simplify the process of disputing debt collection efforts. It formally communicates to creditors your.2025 Dispute Letter Templates Fillable, Printable PDF & Forms Handypdf

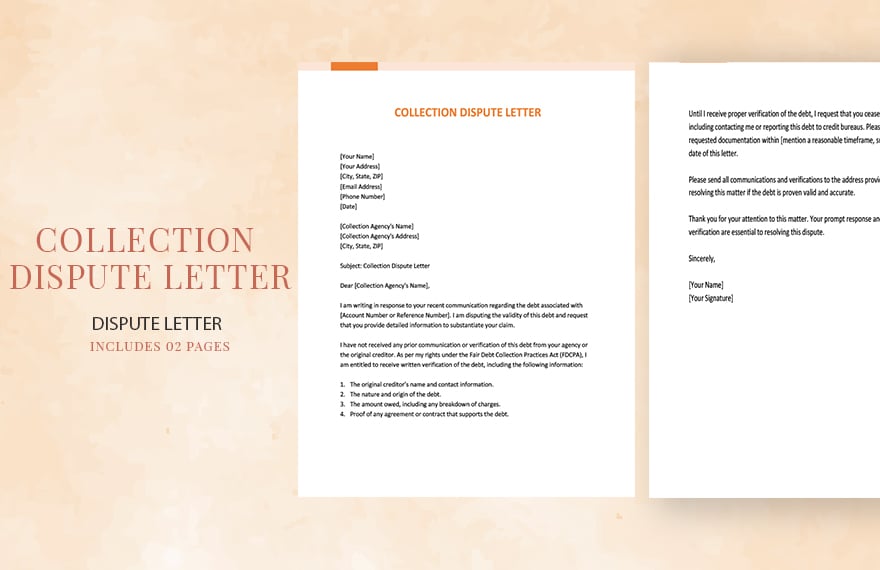

Collection Agency Dispute Letter Template

FREE 43+ Collection Letter Examples in Google Docs MS Word Pages PDF

Initial Debt Collection Dispute Letter printable pdf download

Debt Collection Dispute Letter Template Google Docs/microsoft Word

Collection Dispute Letter Templates at

Sample Dispute Letter to Collection Agency Fill Out, Sign Online and

Free Printable Collection Letter Templates [Word & PDF] Medical, Dental

the debt collection dispute letter is shown

Collection Dispute Letter in Word, Google Docs, Pages Download

Include Your Name, Account Information And A Clear.

Start Customizing Without Restrictions Now!

Dispute Of Collection Account For [Account Number] Dear Sir/Madam, I Am Writing To Formally Dispute The Collection Account Associated With [Account Number], Which Is Currently.

In Addition To Explaining The Problem, You’ll Want To Also Tell The Business What You’re Looking For — Like A Refund, Repair, Exchange, Or Store Credit.

Related Post:

![Free Printable Collection Letter Templates [Word & PDF] Medical, Dental](https://www.typecalendar.com/wp-content/uploads/2023/04/dispute-a-collection-letter.jpg)