Ein Name Change Letter Template

Ein Name Change Letter Template - If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name change with the internal revenue service. However, you must update the name on your ein. Up to $40 cash back a sample letter to the irs for a business name change should include your business's old name, the new name, employer identification number (ein), date of name. The letter to the irs will vary depending on your type of business. Up to $40 cash back in your letter to the irs for a business name change, you should include your old business name, new business name, your business tax identification number (ein),. Most business name changes do not require a new ein, but the irs must be informed. Insert text and images to your ein name change letter template, underline important details, erase parts of content and replace them. The method you use to notify the irs of the name change depends on the type of business you have. The ein number for the business, the old business name, as well as the. Usually, changing your business name does not require you to obtain a new employer identification number (ein). The specific action required may vary depending on the type of business. If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name change with the internal revenue service. The letter to the irs will vary depending on your type of business. The easiest and fastest option available is to write to the irs directly to let them know about your business’s new name and to request an ein verification letter. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. If restructuring (e.g., changing from an llc to a corporation), a new ein may be. The method you use to notify the irs of the name change depends on the type of business you have. The ein number for the business, the old business name, as well as the. Up to $40 cash back in your letter to the irs for a business name change, you should include your old business name, new business name, your business tax identification number (ein),. You can also download it, export it or print it out. To update your business name on an ein, notify the irs following guidelines specific to your business entity type. Up to $40 cash back a sample letter to the irs for a business name change should include your business's old name, the new name, employer identification number (ein), date of name. Sole proprietors can send a letter detailing the old. Business owners and other authorized individuals can submit a name change for their business. You can also download it, export it or print it out. The method you use to notify the irs of the name change depends on the type of business you have. Sole proprietors can send a letter detailing the old and. To update your business name. Most business name changes do not require a new ein, but the irs must be informed. You can also download it, export it or print it out. Insert text and images to your ein name change letter template, underline important details, erase parts of content and replace them. Up to 40% cash back make any adjustments required: The irs will. The easiest and fastest option available is to write to the irs directly to let them know about your business’s new name and to request an ein verification letter. Up to 40% cash back make any adjustments required: Visit the irs web page, business name change to get directions. However, you must update the name on your ein. If you. Up to 40% cash back send ein name change letter template via email, link, or fax. The specific action required may vary depending on the type of business. Usually, changing your business name does not require you to obtain a new employer identification number (ein). (i) the ein number for the business, (ii) the old business name, and (iii) the.. Up to $40 cash back in your letter to the irs for a business name change, you should include your old business name, new business name, your business tax identification number (ein),. If the ein was recently assigned and filing liability has yet to be determined, send business name. Sole proprietors can send a letter detailing the old and. People. Up to 40% cash back make any adjustments required: The easiest and fastest option available is to write to the irs directly to let them know about your business’s new name and to request an ein verification letter. Sole proprietors can send a letter detailing the old and. Insert text and images to your ein name change letter template, underline. Usually, changing your business name does not require you to obtain a new employer identification number (ein). However, you must update the name on your ein. (i) the ein number for the business, (ii) the old business name, and (iii) the. Most business name changes do not require a new ein, but the irs must be informed. The ein number. The letter to the irs will vary depending on your type of business. You can also download it, export it or print it out. If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name change with the internal revenue service. Up to 40% cash back send. Up to 40% cash back send ein name change letter template via email, link, or fax. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. Insert text and images to your ein name change letter template, underline important details, erase parts of. However, you must update the name on your ein. The irs will automatically update the business name associated with your current ein after you send the name change letter and certificate of amendment to the appropriate. Business owners and other authorized individuals can submit a name change for their business. The letter to the irs will vary depending on your type of business. Up to $40 cash back a sample letter to the irs for a business name change should include your business's old name, the new name, employer identification number (ein), date of name. The specific action required may vary depending on the type of business. Visit the irs web page, business name change to get directions. Sole proprietors can send a letter detailing the old and. Up to 40% cash back make any adjustments required: If restructuring (e.g., changing from an llc to a corporation), a new ein may be. If you change the legal name of your business, then as the owner, partner or corporate officer, you are authorized to file the name change with the internal revenue service. Up to 40% cash back send ein name change letter template via email, link, or fax. Insert text and images to your ein name change letter template, underline important details, erase parts of content and replace them. People who change their legal names can inform banks, creditors and other organizations of the change using this free, printable notification. The ein number for the business, the old business name, as well as the. You can also download it, export it or print it out.FREE 12+ Sample Business Name Change Letter Templates in Word, PDF

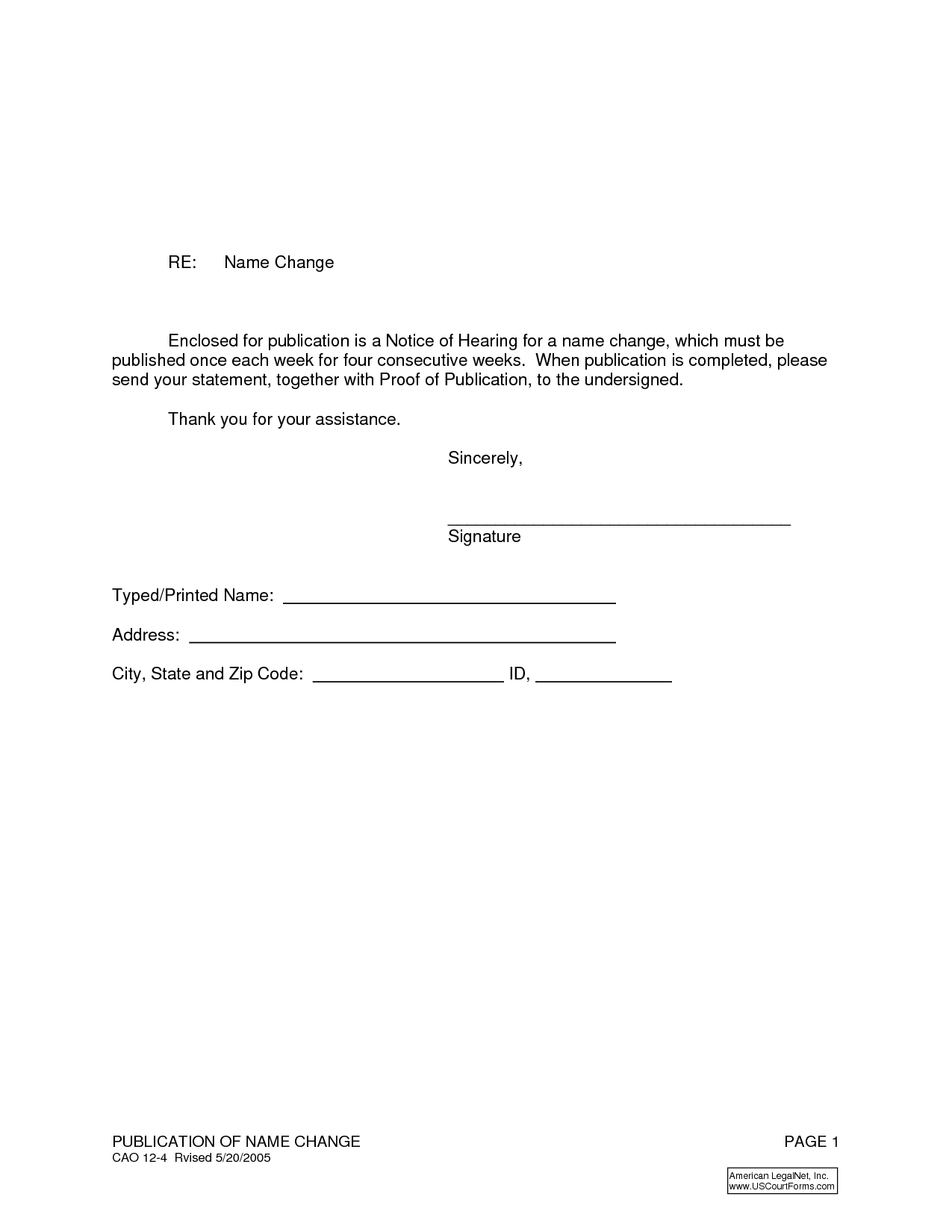

Name Change Letter Free Printable Documents

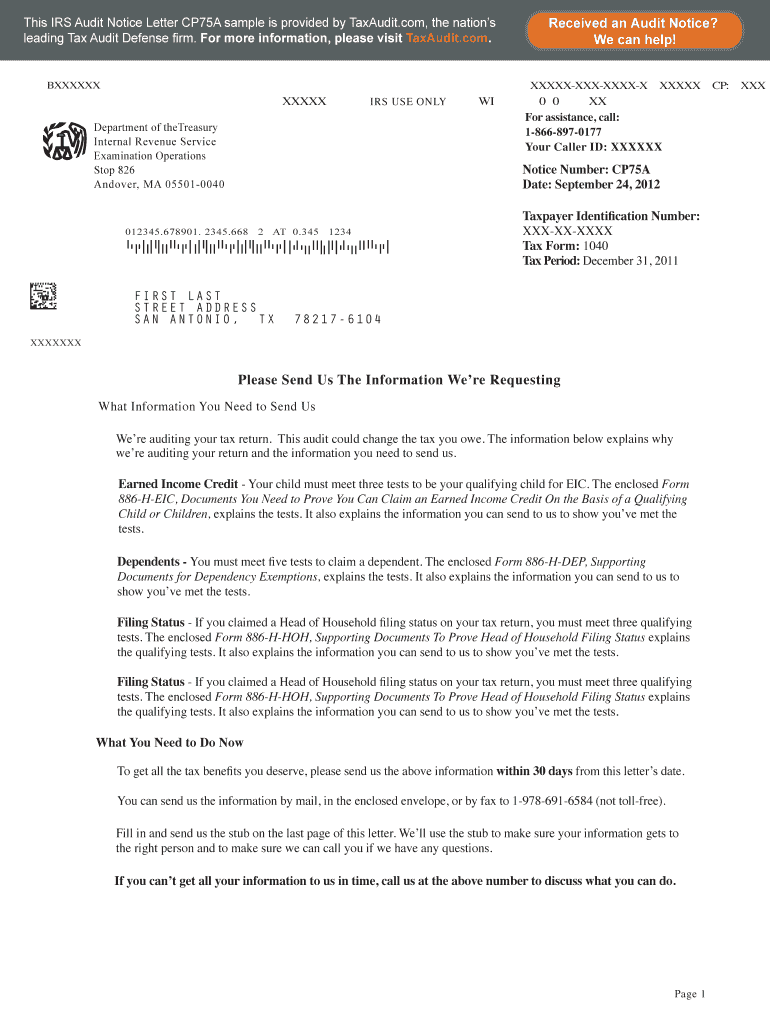

Irs Name Change Letter Sample Irs Name Change Letter Sample 20

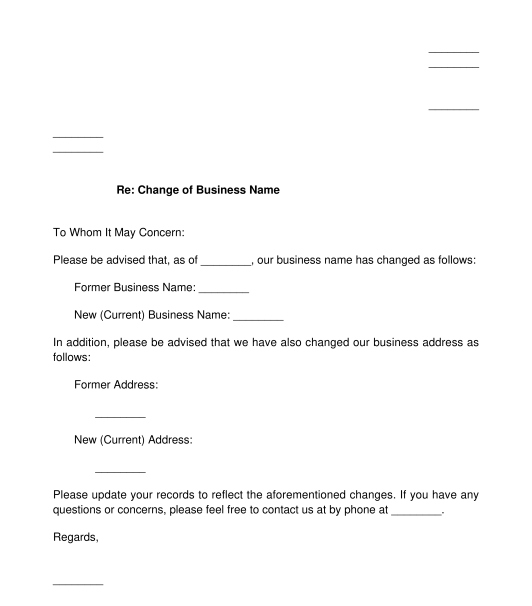

Sample Letter To Irs For Business Name Change

Irs Business Name Change Letter Template

Irs Business Name Change Letter Template

Business Name Change Irs Sample Letter / Lovely Irs Ein Name Change

Irs Business Name Change Letter Template

Business Name Change Irs Sample Letter Irs Ein Name Change Form

Business Name Change Letter Template To Irs

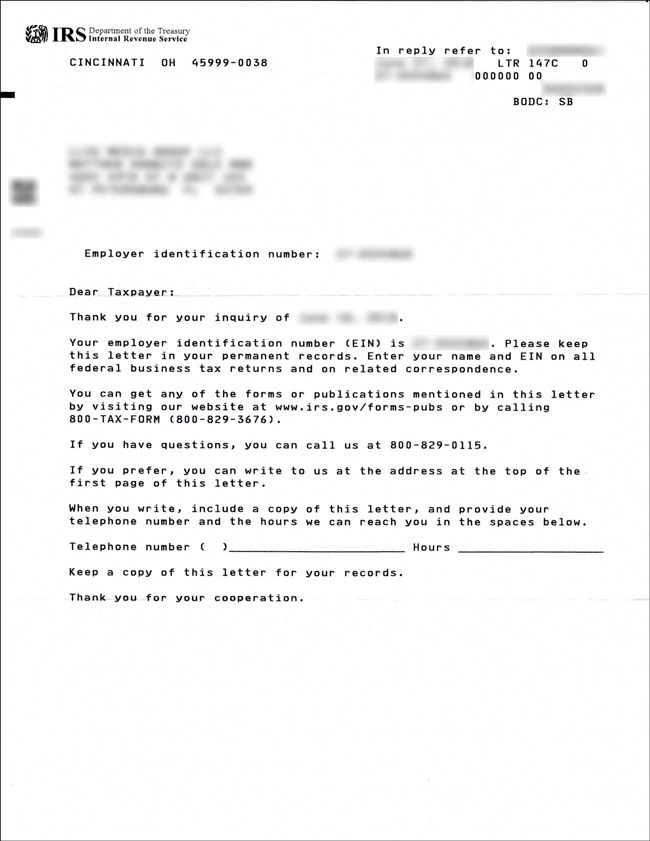

The Easiest And Fastest Option Available Is To Write To The Irs Directly To Let Them Know About Your Business’s New Name And To Request An Ein Verification Letter.

Write A Letter To Inform Them Of The Name Change.

The Method You Use To Notify The Irs Of The Name Change Depends On The Type Of Business You Have.

(I) The Ein Number For The Business, (Ii) The Old Business Name, And (Iii) The.

Related Post: