Excel Discounted Cash Flow Template

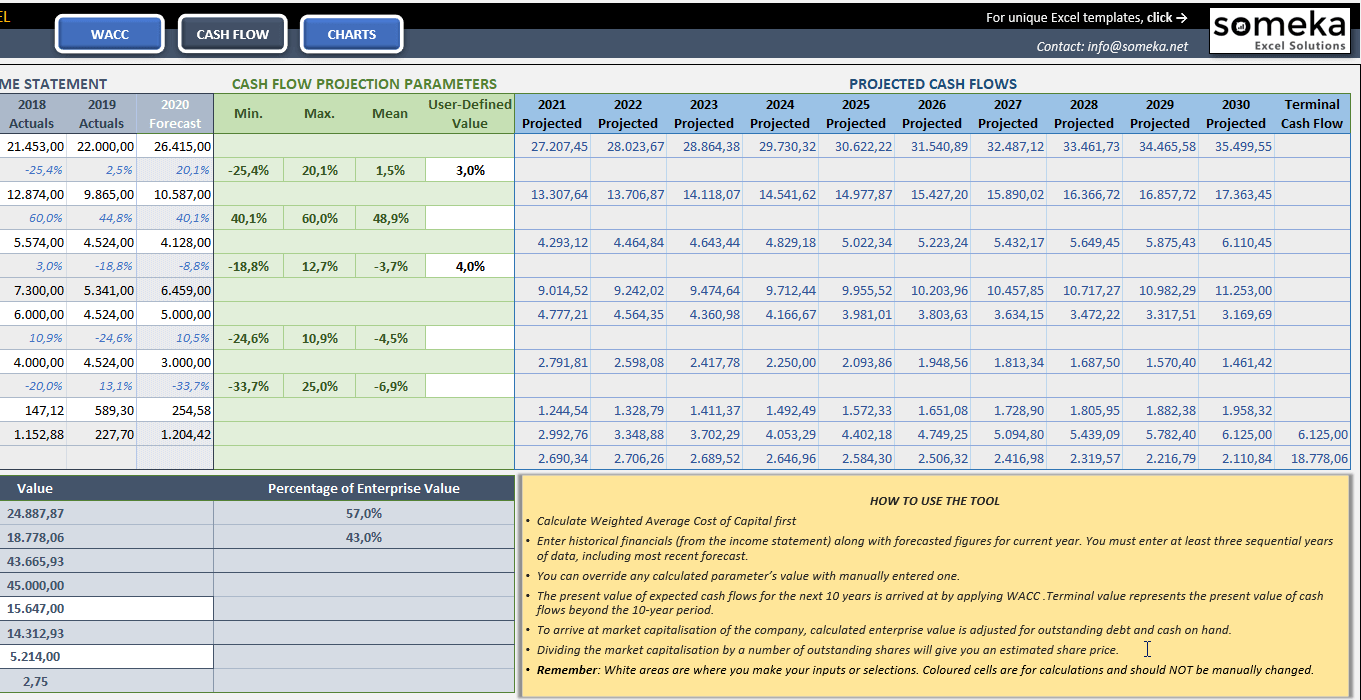

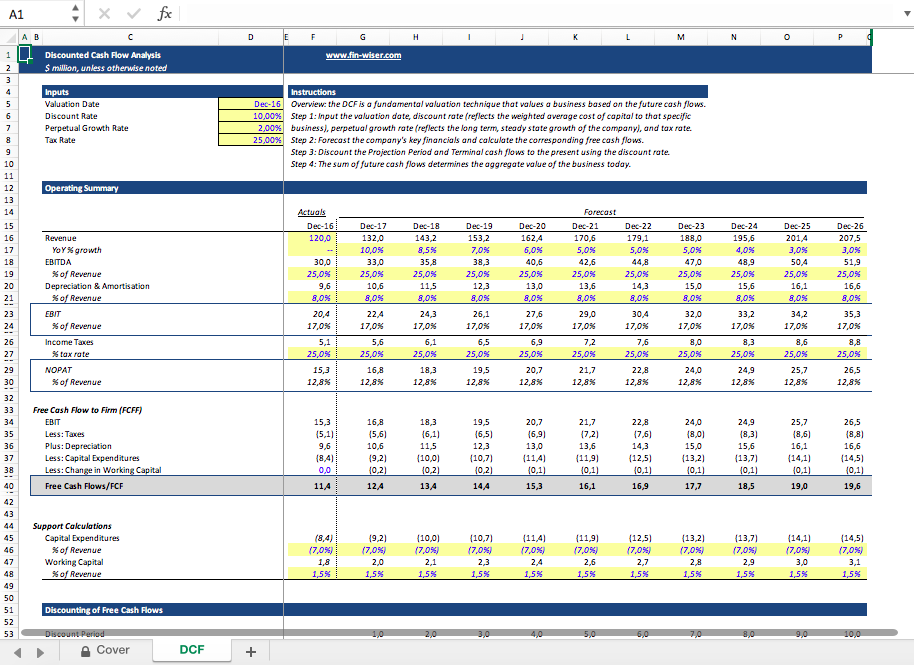

Excel Discounted Cash Flow Template - To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Get insights into the discounted cash flow (dcf) model excel technique. Access our free discounted cash flow template to accurately assess the value of your investments over time. This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. On average, this forecast typically goes out about 5 years. the forecast has to build up to unlevered free cash flow(free cash flow to the firm or fcff). Discounted cash flow (dcf) analysis is a technique used to estimate the value of a future cash flow by considering the time value of money. To simplify this complex process,. It's a simple template with four components: Download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Discounted cash flow (dcf) what it measures. To simplify this complex process,. Manage your retail business finances with the retail cash flow excel template from template.net. Discounted cash flow (dcf) is a method used to estimate the value of an investment based on future cash flow. Get insights into the discounted cash flow (dcf) model excel technique. Indirect cash flow, detailed cash flow, p&l (supporting information), and balance sheet (supporting information). It's a simple template with four components: The first step in the dcf model process is to build a forecast of the three financial statements, based on assumptions about how the business will perform in the future. Download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. Download wso's free discounted cash flow (dcf) model template below! This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. The big idea is that you can use the following formula to value any asset or company that generates cash. What is it. The big idea is that you can use the following formula to value any asset or company that generates cash. This template allows you to build your own discounted cash flow model with different assumptions. Indirect cash flow, detailed cash flow, p&l (supporting information), and balance sheet (supporting information). The first step in the dcf model process is to build. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Discounted cash flow (dcf) analysis is a technique used to estimate the value of a future cash flow by considering the time value of money. What is it and how to calculate it? The first. The big idea is that you can use the following formula to value any asset or company that generates cash. Discounted cash flow (dcf) analysis is a technique used to estimate the value of a future cash flow by considering the time value of money. What is it and how to calculate it? Get insights into the discounted cash flow. Use historical data and future projections to forecast your cash flow and plan accordingly. The first step in the dcf model process is to build a forecast of the three financial statements, based on assumptions about how the business will perform in the future. Access our free discounted cash flow template to accurately assess the value of your investments over. This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. With expert tips and examples. To simplify this complex process,. What is it and how to calculate it? On average, this forecast typically goes out about 5 years. the forecast has to build up. Discounted cash flow (dcf) what it measures. What is it and how to calculate it? Manage your retail business finances with the retail cash flow excel template from template.net. Tailored for both beginners and professionals. The dcf formula allows you to determine the value of a. Tailored for both beginners and professionals. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. Download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. The big idea is that you can use the following formula to. Manage your retail business finances with the retail cash flow excel template from template.net. Manage accounts receivable and payable: This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. What is it and how to calculate it? Access our free discounted cash flow. The big idea is that you can use the following formula to value any asset or company that generates cash. The first step in the dcf model process is to build a forecast of the three financial statements, based on assumptions about how the business will perform in the future. This template allows you to build your own discounted cash. The first step in the dcf model process is to build a forecast of the three financial statements, based on assumptions about how the business will perform in the future. This template allows you to build your own discounted cash flow model with different assumptions. Manage your retail business finances with the retail cash flow excel template from template.net. To help revive your analysis, here is an easy and simple dcf excel template that allows you to value a business in under 20 minutes. What is it and how to calculate it? Download our free discounted cash flow (dcf) template to easily estimate the intrinsic value of a company. Indirect cash flow, detailed cash flow, p&l (supporting information), and balance sheet (supporting information). Access our free discounted cash flow template to accurately assess the value of your investments over time. Tailored for both beginners and professionals. Use historical data and future projections to forecast your cash flow and plan accordingly. To simplify this complex process,. This free excel spreadsheet contains a discounted cash flow (dcf) model template that allows you to build your own discounted cash flow model for your company with. Download wso's free discounted cash flow (dcf) model template below! Discounted cash flow (dcf) analysis is a technique used to estimate the value of a future cash flow by considering the time value of money. The big idea is that you can use the following formula to value any asset or company that generates cash. It's a simple template with four components:Discounted Cash Flow Model (DCF) Free Excel Template Macabacus

discounted cash flow excel template —

Discounted Cash Flow Template Free Excel Download

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Discounted Cash Flow Template Free DCF Valuation Model in Excel!

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Model Excel Template

DCF Discounted Cash Flow Model Excel Template Eloquens

Discounted Cash Flow Excel Template

Discounted Cash Flow Excel Template DCF Valuation Template

On Average, This Forecast Typically Goes Out About 5 Years. The Forecast Has To Build Up To Unlevered Free Cash Flow(Free Cash Flow To The Firm Or Fcff).

With Expert Tips And Examples.

Get Insights Into The Discounted Cash Flow (Dcf) Model Excel Technique.

Discounted Cash Flow (Dcf) What It Measures.

Related Post: