Gasb 87 Template Lgers Nc

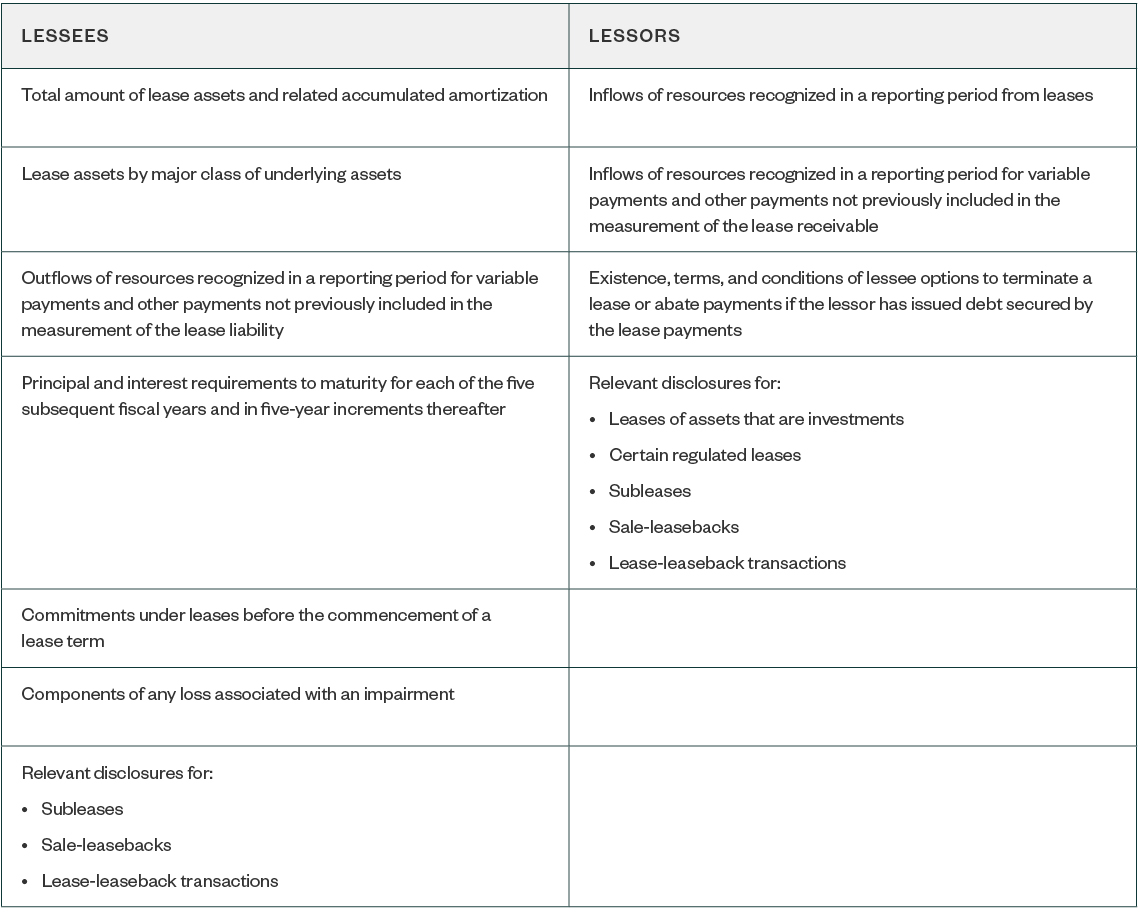

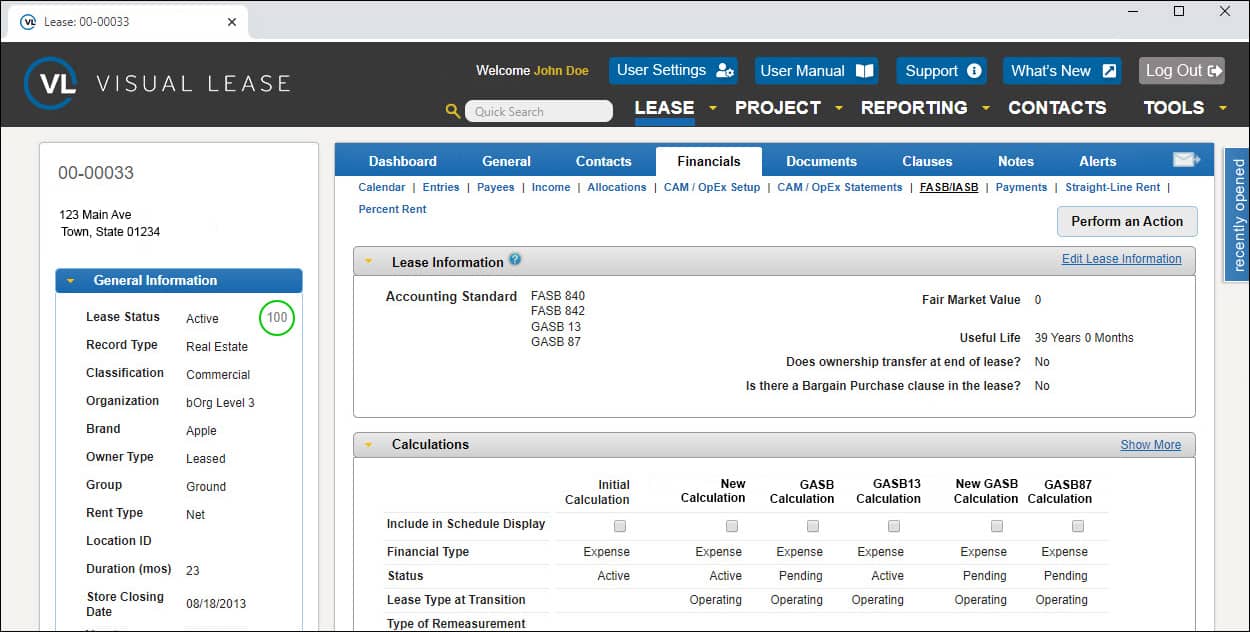

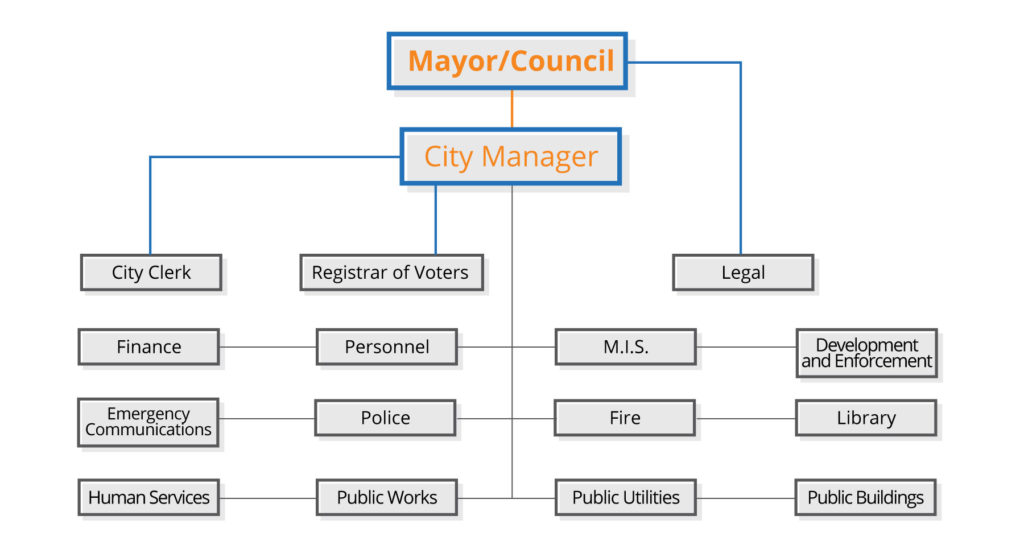

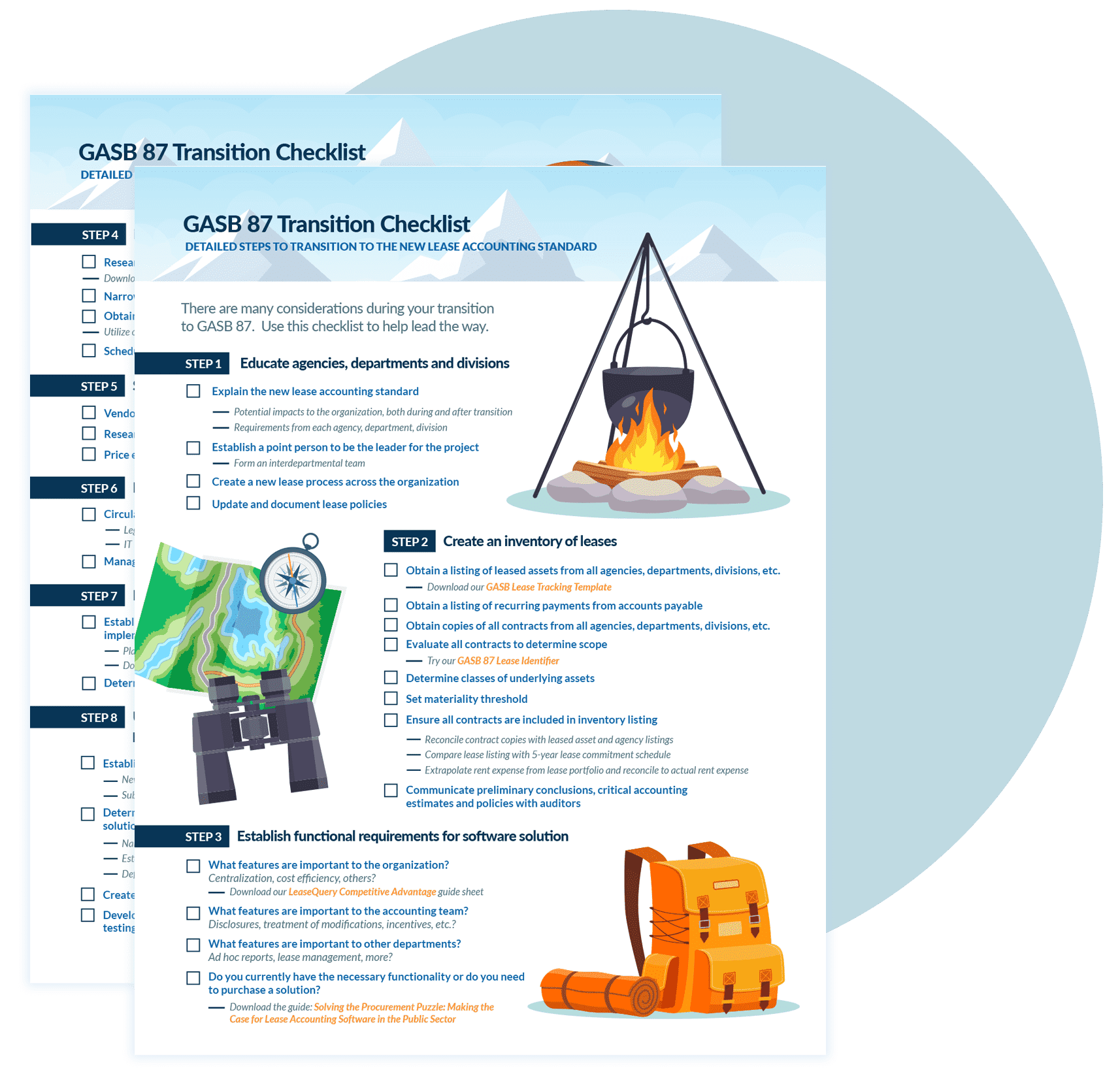

Gasb 87 Template Lgers Nc - To learn more, view our full privacy policy. Mailing address 1410 mail service center raleigh, nc 27699. Gasb 87 lease amortization template. An official website of the state of north carolina an official website of nc how you know. Gasb statement number 87, leases, eliminates operating leases, all contracts that meet the definition of lease are to be accounted for as assets and liabilities by lessees, similar in some. Inventory) of leases held by each entity that comprises the state of north. • lessor workbook and lessee workbook • the workbooks may assist with gasb 87. The objective of this statement is to better meet the information needs of financial statement users by improving accounting and financial. Physical address 3514 bush street raleigh, nc 27609 map it! This statement increases the usefulness of governments’ financial statements by requiring recognition of certain lease assets and liabilities for leases that previously were classified as. Lgc staff has created an implementation worksheet similar to the previously released gasb 87 templates that may be useful in implementing gasb statement 96. State government websites value user privacy. • two excel workbooks will be posted on our website. For fiscal years beginning after june 15, 2021, and all reporting periods thereafter; Inventory) of leases held by each entity that comprises the state of north. Mailing address 1410 mail service center raleigh, nc 27699. Gasb 87 lease amortization template. North carolina local governments will be required to implement gasb statement no. Discover a comprehensive gasb 87 template for lgers nc, streamlining lease accounting with expert guidance on implementation, compliance, and reporting requirements. 87, leases, for the fiscal year that ends june 30, 2022. 87, leases, for the fiscal year that ends june 30, 2022. Gasb 87 lease amortization template. To learn more, view our full privacy policy. Templates to post gasb statement 73 journal entries are provided below. An important new memo from lgc staff has been issued related to gasb statement 87, (leases). Lgc staff has created an implementation worksheet similar to the previously released gasb 87 templates that may be useful in implementing gasb statement 96. Mailing address 1410 mail service center raleigh, nc 27699. Gasb statement number 87, leases, eliminates operating leases, all contracts that meet the definition of lease are to be accounted for as assets and liabilities by lessees,. Gasb 87 overhauls the accounting and financial reporting of leases for state and local governments by establishing a single model for lease accounting based on the foundational. 87, leases, for the fiscal year that ends june 30, 2022. An important new memo from lgc staff has been issued related to gasb statement 87, (leases). Templates to post gasb statement 73. Inventory) of leases held by each entity that comprises the state of north. State government websites value user privacy. The objective of this statement is to better meet the information needs of financial statement users by improving accounting and financial. Lgc staff has created an implementation worksheet similar to the previously released gasb 87 templates that may be useful in. Templates to post gasb statement 73 journal entries are provided below. This statement increases the usefulness of governments’ financial statements by requiring recognition of certain lease assets and liabilities for leases that previously were classified as. To learn more, view our full privacy policy. Gasb 87 lease amortization template. An important new memo from lgc staff has been issued related. • lessor workbook and lessee workbook • the workbooks may assist with gasb 87. • two excel workbooks will be posted on our website. For fiscal years beginning after june 15, 2021, and all reporting periods thereafter; The following instructions and worksheets are intended to assist state entities in creating a central repository (i.e. 87, leases, for the fiscal year. This statement increases the usefulness of governments’ financial statements by requiring recognition of certain lease assets and liabilities for leases that previously were classified as. The objective of this statement is to better meet the information needs of financial statement users by improving accounting and financial. Mailing address 1410 mail service center raleigh, nc 27699. Gasb statement 87 states that. To learn more, view our full privacy policy. An official website of the state of north carolina an official website of nc how you know. State government websites value user privacy. Mailing address 1410 mail service center raleigh, nc 27699. Discover a comprehensive gasb 87 template for lgers nc, streamlining lease accounting with expert guidance on implementation, compliance, and reporting. This statement increases the usefulness of governments’ financial statements by requiring recognition of certain lease assets and liabilities for leases that previously were classified as. An important new memo from lgc staff has been issued related to gasb statement 87, (leases). Lgc staff has created an implementation worksheet similar to the previously released gasb 87 templates that may be useful. For fiscal years beginning after june 15, 2021, and all reporting periods thereafter; North carolina local governments will be required to implement gasb statement no. Gasb 87 overhauls the accounting and financial reporting of leases for state and local governments by establishing a single model for lease accounting based on the foundational. Lgc staff has created an implementation worksheet similar. The following instructions and worksheets are intended to assist state entities in creating a central repository (i.e. • two excel workbooks will be posted on our website. Inventory) of leases held by each entity that comprises the state of north. Gasb 87 overhauls the accounting and financial reporting of leases for state and local governments by establishing a single model for lease accounting based on the foundational. These templates may be used to post entries for pension plans for which assets have not been set aside in gasb. North carolina local governments will be required to implement gasb statement no. An important new memo from lgc staff has been issued related to gasb statement 87, (leases). State government websites value user privacy. To learn more, view our full privacy policy. Gasb 87 lease amortization template. An official website of the state of north carolina an official website of nc how you know. 87, leases, for the fiscal year that ends june 30, 2022. Templates to post gasb statement 73 journal entries are provided below. Gasb statement number 87, leases, eliminates operating leases, all contracts that meet the definition of lease are to be accounted for as assets and liabilities by lessees, similar in some. Mailing address 1410 mail service center raleigh, nc 27699. Physical address 3514 bush street raleigh, nc 27609 map it!Webinar A Detailed Example of Applying the New GASB 87 Standard

Gasb 87 Excel Template

Gasb 87 Excel Template

Gasb 87 Excel Template

Gasb 87 Excel Template

Gasb 87 Excel Template

Gasb 87 Excel Template

Gasb 87 Template

Guide GASB 87 Transition Checklist LeaseQuery

Fillable Online Form GASB 87 Instructions. Instructions on completing

This Statement Increases The Usefulness Of Governments’ Financial Statements By Requiring Recognition Of Certain Lease Assets And Liabilities For Leases That Previously Were Classified As.

Lgc Staff Has Created An Implementation Worksheet Similar To The Previously Released Gasb 87 Templates That May Be Useful In Implementing Gasb Statement 96.

For Fiscal Years Beginning After June 15, 2021, And All Reporting Periods Thereafter;

• Lessor Workbook And Lessee Workbook • The Workbooks May Assist With Gasb 87.

Related Post: