Google Sheets Snowball Debt Template

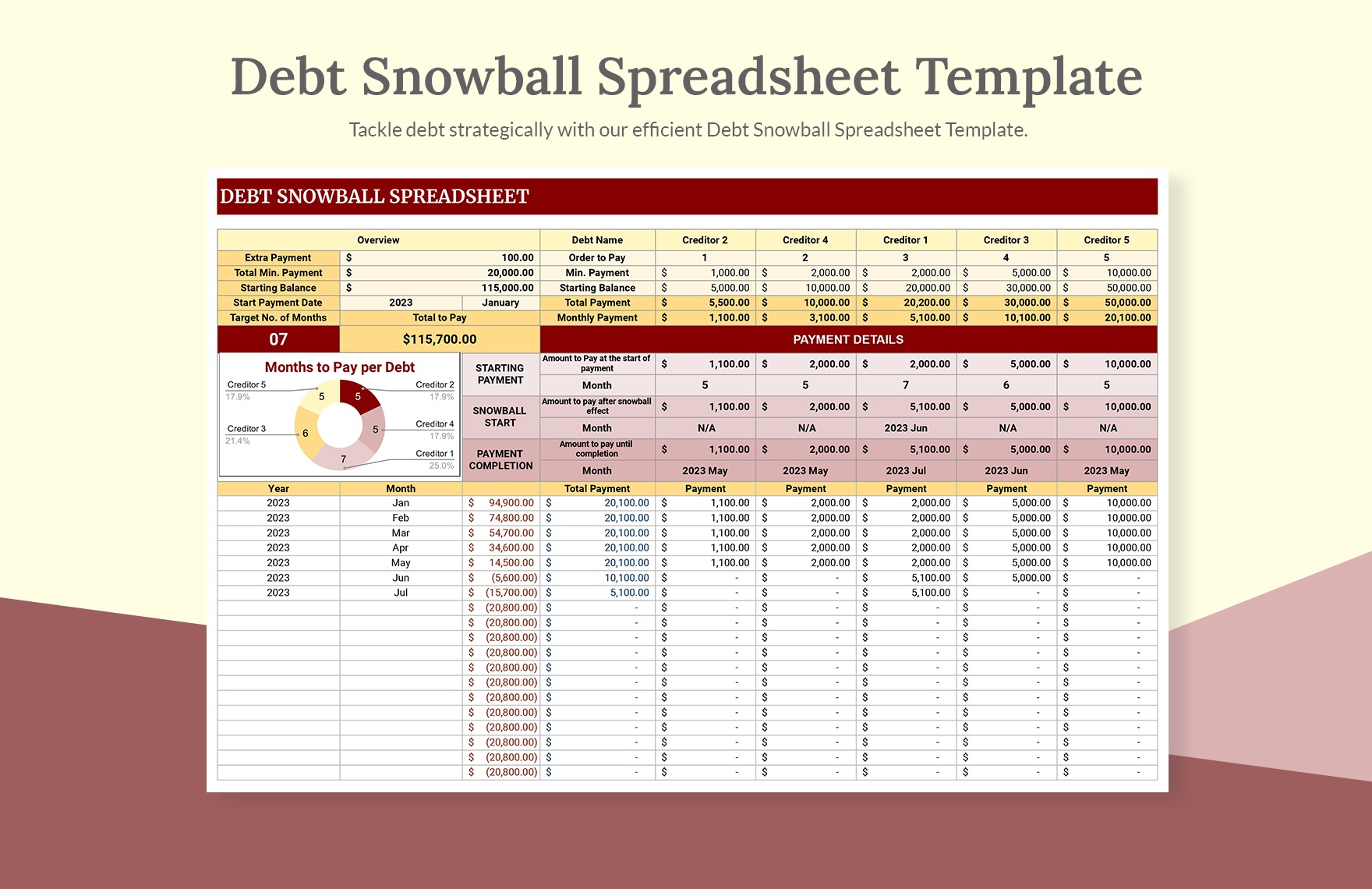

Google Sheets Snowball Debt Template - This powerful tool empowers you to systematically eliminate your debts, allowing. You start by listing your debts from smallest to. Get free google sheets debt payoff templates and debt snowball calculators! The debt snowball is a debt payoff method where you pay. In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Download your free copy of our debt snowball worksheet. Let’s say, for example, you have four debts to pay off with the smallest amount being $50, the next $100, the next $150 and. For beginners, we will also provide you. One of the best methods available for getting rid of debt is known as the snowball method. Use it to automaticaly create a debt repayment plan using the debt snowball methods. This powerful tool empowers you to systematically eliminate your debts, allowing. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Accelerate your journey to financial freedom with our editable debt snowball spreadsheet template. This powerful tool harnesses the proven strategy of the debt snowball method and digitizes it for maximum. Get free google sheets debt payoff templates and debt snowball calculators! Download this debt snowball calculator template design in excel, google sheets format. Get the free debt snowball spreadsheet to quickly pay off small debts first. Supercharge your debt payoff journey with our digital debt snowball template! You start by listing your debts from smallest to. With the debt snowball method, you pay off your smaller debt obligations first, thereby freeing up funds to pay off the larger amounts next until such a point where you are debt free for good. You start by listing your debts from smallest to. Use it to automaticaly create a debt repayment plan using the debt snowball methods. One of the best methods available for getting rid of debt is known as the snowball method. Supercharge your debt payoff journey with our digital debt snowball template! The debt snowball google sheets template is the perfect. Get free google sheets debt payoff templates and debt snowball calculators! In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Instead, copy this sheet to your drive with file > make a copy. Accelerate your journey to financial freedom with our editable debt snowball. The debt snowball google sheets template is the perfect tool for guiding you through the debt snowball process of paying off your debt. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. Use it to automaticaly create a debt repayment plan using the debt snowball methods. You start by listing your debts from smallest to. Supercharge. Instead, copy this sheet to your drive with file > make a copy. Use snowball, avalanche, or whatever payoff strategy works best for you. Download this debt snowball calculator template design in excel, google sheets format. Use it to automaticaly create a debt repayment plan using the debt snowball methods. With the debt snowball method, you pay off your smaller. This powerful tool empowers you to systematically eliminate your debts, allowing. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. One of the best methods available for getting rid of debt is known as the snowball method. Accelerate your journey to financial freedom with our editable debt snowball spreadsheet template. You start by listing your debts. With the debt snowball method, you pay off your smaller debt obligations first, thereby freeing up funds to pay off the larger amounts next until such a point where you are debt free for good. You start by listing your debts from smallest to. Here is how it works. Use our spreadsheets for debt tracking and payoff to simplify your. This powerful tool harnesses the proven strategy of the debt snowball method and digitizes it for maximum. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. Instead, copy this sheet to your drive with file > make a copy. In this article, we’ll detail what a debt snowball method is, how it works, and how to. This powerful tool empowers you to systematically eliminate your debts, allowing. Use it to automaticaly create a debt repayment plan using the debt snowball methods. Download your free copy of our debt snowball worksheet. Get the free debt snowball spreadsheet to quickly pay off small debts first. Accelerate your journey to financial freedom with our editable debt snowball spreadsheet template. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. You start by listing your debts from smallest to. This powerful tool harnesses the proven strategy of the debt snowball method and digitizes it for maximum. Get the free debt snowball spreadsheet to quickly pay off small debts first. One of the best methods available for. In this article, we’ll detail what a debt snowball method is, how it works, and how to create a debt snowball spreadsheet in google sheets. Track and achieve your debt payoff goals with the flexible debt payoff planner spreadsheet. Use it to automaticaly create a debt repayment plan using the debt snowball methods. For beginners, we will also provide you.. Download your free copy of our debt snowball worksheet. Use it to automaticaly create a debt repayment plan using the debt snowball methods. Supercharge your debt payoff journey with our digital debt snowball template! For beginners, we will also provide you. This powerful tool empowers you to systematically eliminate your debts, allowing. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. One of the best methods available for getting rid of debt is known as the snowball method. Instead, copy this sheet to your drive with file > make a copy. The debt snowball google sheets template is the perfect tool for guiding you through the debt snowball process of paying off your debt. The debt snowball is a debt payoff method where you pay. Get the free debt snowball spreadsheet to quickly pay off small debts first. Here is how it works. Get free google sheets debt payoff templates and debt snowball calculators! Let’s say, for example, you have four debts to pay off with the smallest amount being $50, the next $100, the next $150 and. You start by listing your debts from smallest to. With the debt snowball method, you pay off your smaller debt obligations first, thereby freeing up funds to pay off the larger amounts next until such a point where you are debt free for good.Google Sheets Debt Payoff Template Debt Snowball Spreadsheet Etsy

Debt Tracker Template in Excel, Google Sheets Download

Google Sheets Templates

Debt Snowball Tracker Spreadsheet for Google Sheets Snowball Debt

Google Sheets Debt Snowball Spreadsheet Tracker Get Out Of Etsy

Debt Snowball Spreadsheet Debt Snowball Google Sheets Etsy

Debt Snowball Calculator Google Sheets Debt Tracker Spreadsheet Finance

Debt Snowball Spreadsheet for Google Sheets Debt Tracker Etsy

Debt Snowball Excel Spreadsheet Google Sheets Debt Payoff Etsy Canada

Debt Snowball Spreadsheet Template for Google Sheets Debt Etsy

In This Article, We’ll Detail What A Debt Snowball Method Is, How It Works, And How To Create A Debt Snowball Spreadsheet In Google Sheets.

Use Snowball, Avalanche, Or Whatever Payoff Strategy Works Best For You.

Track And Achieve Your Debt Payoff Goals With The Flexible Debt Payoff Planner Spreadsheet.

Accelerate Your Journey To Financial Freedom With Our Editable Debt Snowball Spreadsheet Template.

Related Post: