Letter Of Explanation For Credit Inquiries Template

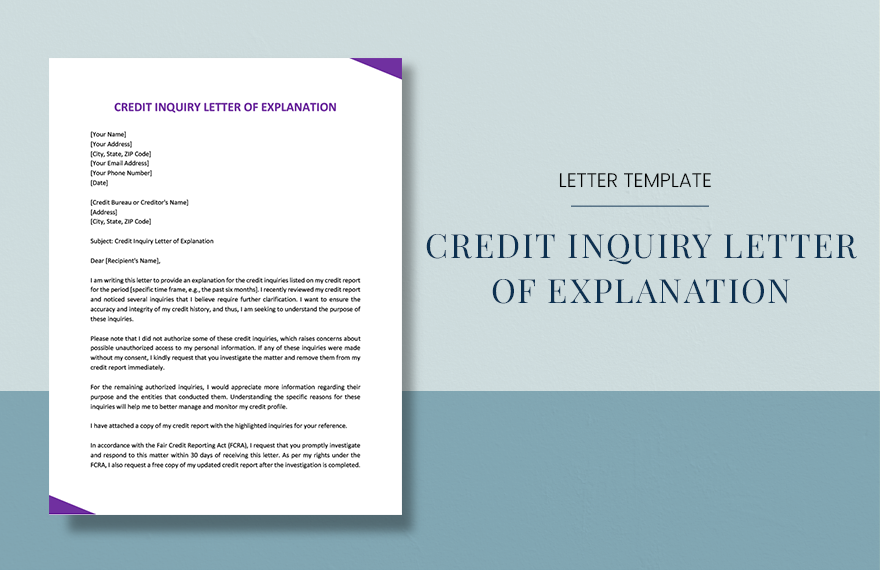

Letter Of Explanation For Credit Inquiries Template - View, download and print letter of explanation (credit inquiries) pdf template or form online. Here are some of the tips to write credit inquiry explanation letter: This document serves as a formal explanation for credit inquiries on your credit report. Writing an explanation letter to answer the inquiries should be considered and paid a lot of attention so that it cannot badly impact your credit score. I value my relationship with your esteemed institution and. 1 dear [name of the recipient] in response to a letter you sent me dated [insert date] regarding [insert number] late payments. Why removing inquiries matters and how it can improve your credit score. Up to $40 cash back these letters are typically used to clarify any discrepancies or concerns raised by lenders, creditors, or potential employers when reviewing someone's credit history. And this guide will tell. Access our free letter of explanation credit inquiry template, available in ms word and google docs formats. Here are some of the tips to write credit inquiry explanation letter: A letter of explanation can allow you to clarify any complications, including glitches in your credit history or employment, to help you qualify for a home loan. Writing an explanation letter to answer the inquiries should be considered and paid a lot of attention so that it cannot badly impact your credit score. A simple, yet effective letter to remove unauthorized or inaccurate. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: Credit explanation letter is in editable, printable format. Up to $40 cash back these letters are typically used to clarify any discrepancies or concerns raised by lenders, creditors, or potential employers when reviewing someone's credit history. And this guide will tell. We also included an editable letter of explanation template below that can be customized—whether you’re explaining inconsistent income, hard inquiries on your credit. Sample email of explanation for credit inquiries: Simplify the process of addressing credit inquiries on your credit report with this. Sample email of explanation for credit inquiries: Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: We also included an editable letter of explanation template below that can be customized—whether you’re explaining inconsistent income, hard inquiries on your credit.. 10 letter of explanation are collected for any of your needs. Late payments, collections and major derogatory credit problems like foreclosures or bankruptcies almost always require a letter of explanation. Enhance this design & content with free ai. Always include the mailing address along with contact details. How to write a credit inquiry explanation letter. Underwriters look at how you’ve. Customize and download this credit explanation letter. 1 dear [name of the recipient] in response to a letter you sent me dated [insert date] regarding [insert number] late payments. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: Simplify the process of addressing credit inquiries on your. How to write a credit inquiry explanation letter. Use it to clarify the reasons for inquiries within the past 120 days. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: Enhance this design & content with free ai. A letter of explanation can allow you to clarify any complications, including glitches in. This document serves as a formal explanation for credit inquiries on your credit report. Here are some of the tips to write credit inquiry explanation letter: Sample email of explanation for credit inquiries: Simplify the process of addressing credit inquiries on your credit report with this. Always include the mailing address along with contact details. Customize and download this credit explanation letter. Access our free letter of explanation credit inquiry template, available in ms word and google docs formats. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: 1 dear [name of the recipient] in response to a letter you sent me dated [insert date] regarding [insert. We also included an editable letter of explanation template below that can be customized—whether you’re explaining inconsistent income, hard inquiries on your credit. We are providing here the. Access our free letter of explanation credit inquiry template, available in ms word and google docs formats. It's essential for financial applications. A letter of explanation can allow you to clarify any. How to write a credit inquiry explanation letter. 1 dear [name of the recipient] in response to a letter you sent me dated [insert date] regarding [insert number] late payments. View, download and print letter of explanation (credit inquiries) pdf template or form online. And this guide will tell. Writing an explanation letter to answer the inquiries should be considered. Sample email of explanation for credit inquiries: Always include the mailing address along with contact details. Up to $40 cash back these letters are typically used to clarify any discrepancies or concerns raised by lenders, creditors, or potential employers when reviewing someone's credit history. This document serves as a formal explanation for credit inquiries on your credit report. And this. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: I understand the importance of maintaining a positive credit history, and i want to assure you. This document serves as a formal explanation for credit inquiries on your credit report. We also included an editable letter of explanation template below that can be. View, download and print letter of explanation (credit inquiries) pdf template or form online. I sincerely request that you consider my explanation and review my credit report with the updated understanding of these inquiries. Letter of explanation for credit inquiries (please use additional forms if needed for more account inquiries) date: We are providing here the. A letter of explanation can allow you to clarify any complications, including glitches in your credit history or employment, to help you qualify for a home loan. Here are some of the tips to write credit inquiry explanation letter: Late payments, collections and major derogatory credit problems like foreclosures or bankruptcies almost always require a letter of explanation. Underwriters look at how you’ve. We also included an editable letter of explanation template below that can be customized—whether you’re explaining inconsistent income, hard inquiries on your credit. And this guide will tell. Enhance this design & content with free ai. I understand the importance of maintaining a positive credit history, and i want to assure you. A simple, yet effective letter to remove unauthorized or inaccurate. This letter is to address all credit inquiries reporting on my credit report in the. Use it to clarify the reasons for inquiries within the past 120 days. Why removing inquiries matters and how it can improve your credit score.Credit Inquiry Letter Of Explanation in Word, PDF, Google Docs, Pages

Letter Of Explanation For Credit Inquiries Sample

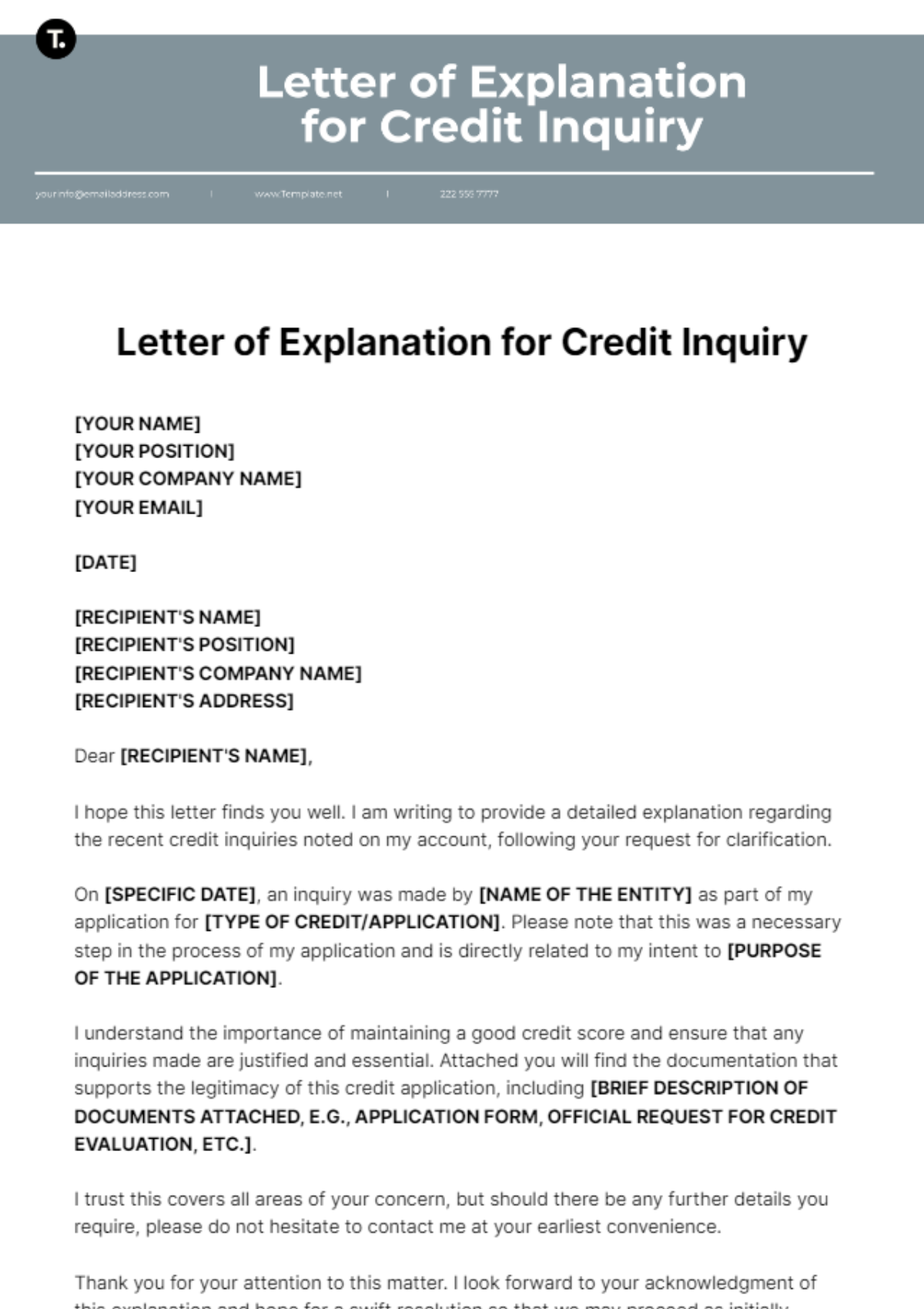

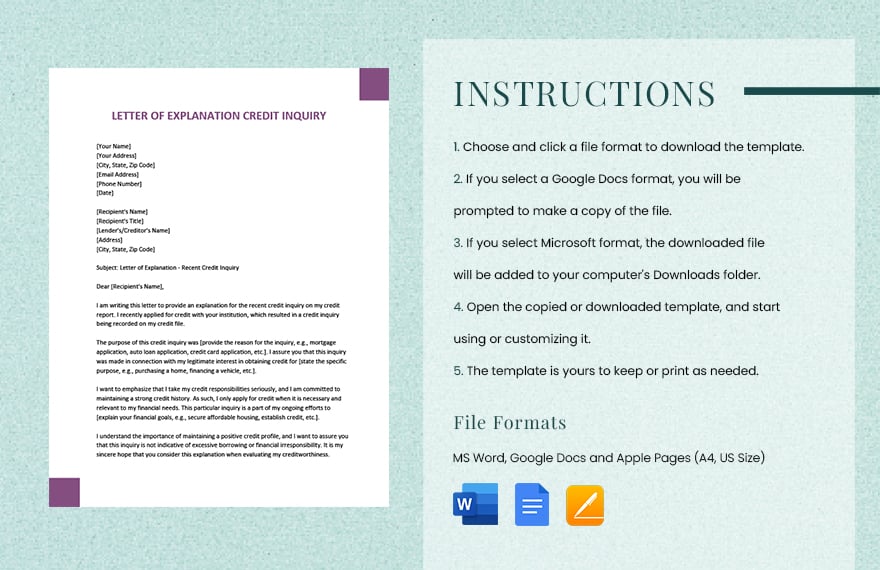

Letter Of Explanation Credit Inquiry Template Edit Online & Download

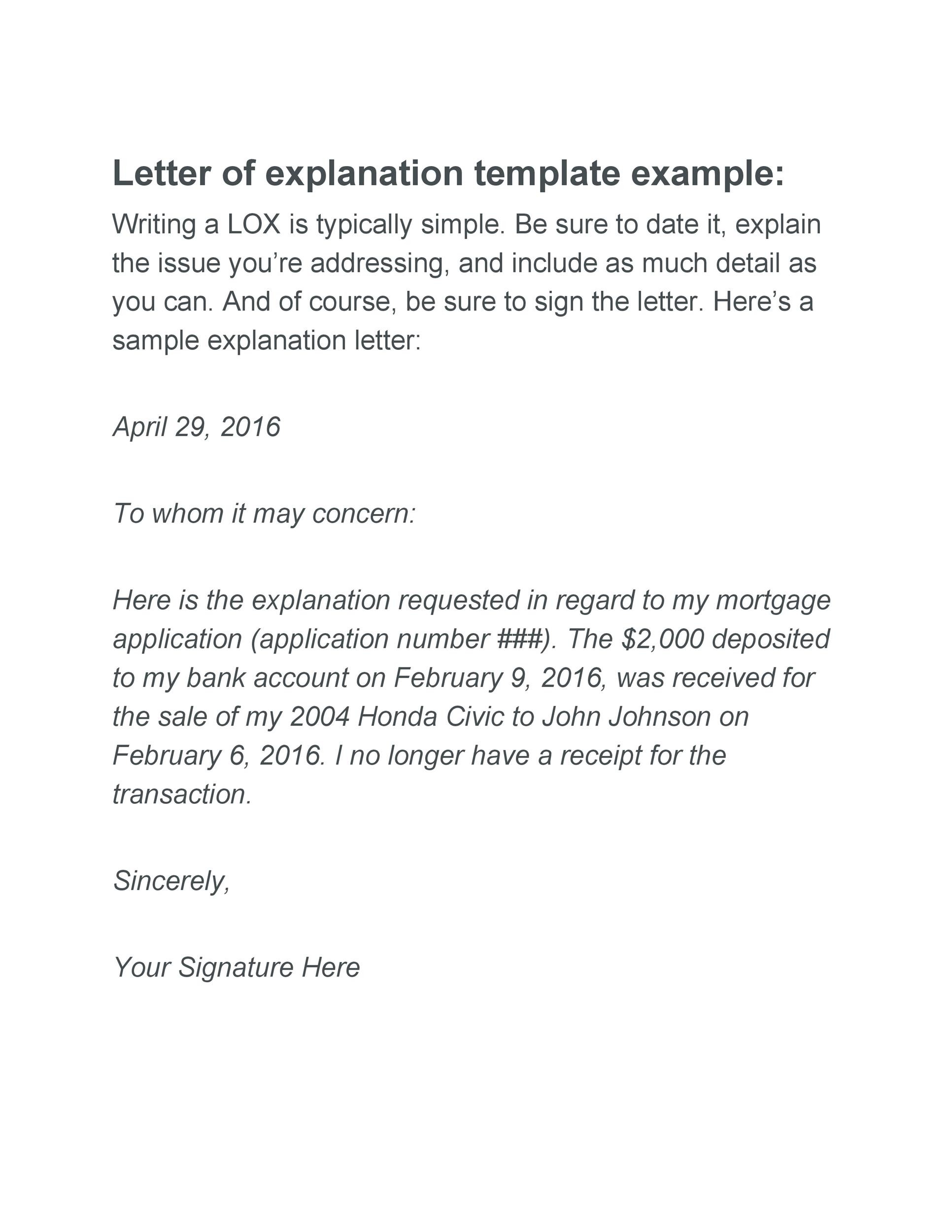

Letter Of Explanation Sample

Letter Of Explanation For Credit Inquiries Template, Whether Applying

Free Letter Of Explanation Credit Inquiry Template Edit Online

FREE 12+ Letter of Explanation Samples & Templates

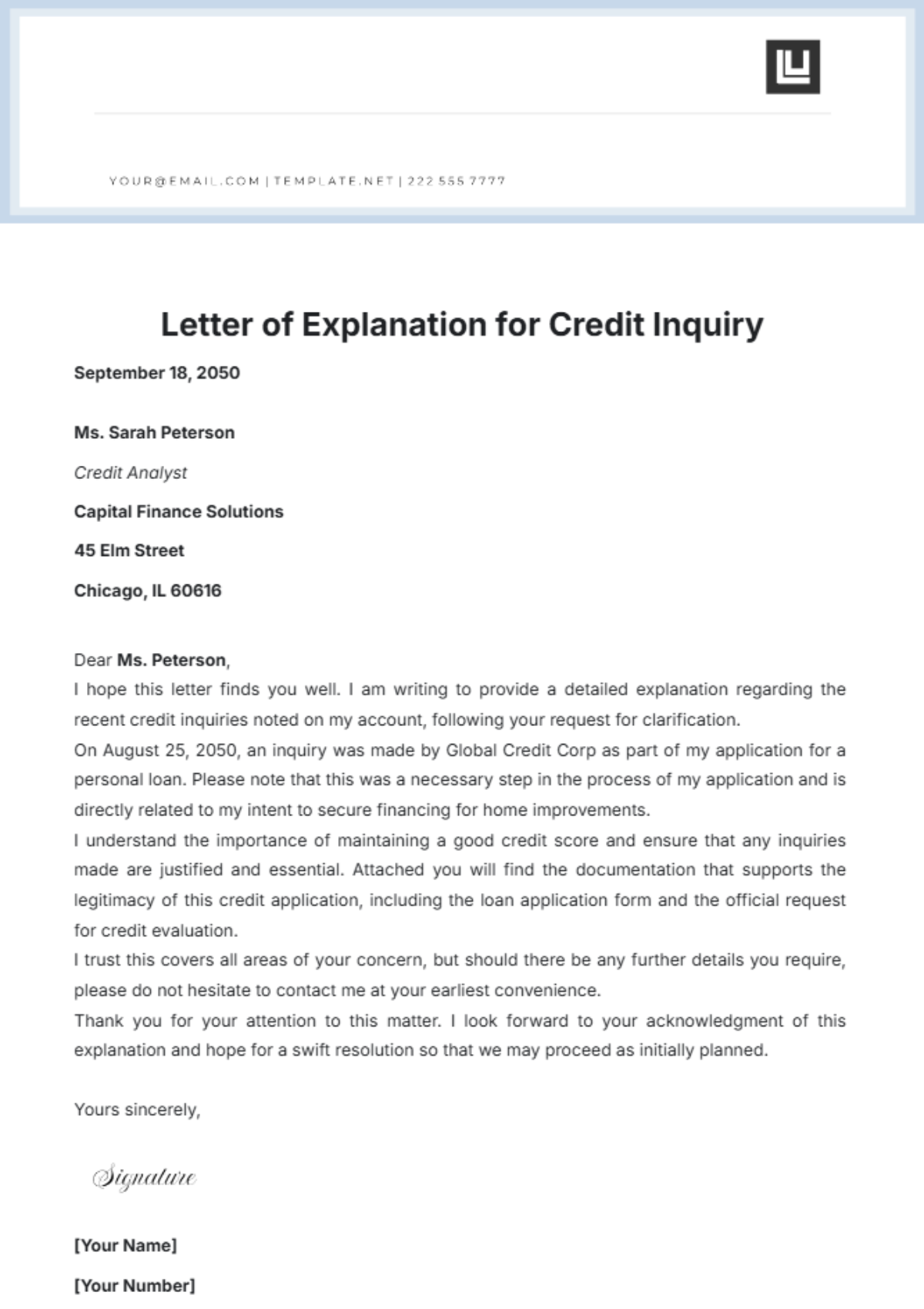

Letter Of Explanation Credit Inquiry Sample

Letter Of Explanation Credit Inquiry in Word, Google Docs, Pages

Letter Of Explanation Credit Inquiry Sample

I Am Writing To Provide An Explanation For A Recent Credit Inquiry That Appeared On My Credit Report.

Sample Email Of Explanation For Credit Inquiries:

Up To $40 Cash Back These Letters Are Typically Used To Clarify Any Discrepancies Or Concerns Raised By Lenders, Creditors, Or Potential Employers When Reviewing Someone's Credit History.

Always Include The Mailing Address Along With Contact Details.

Related Post: