Letter Of Goodwill Template

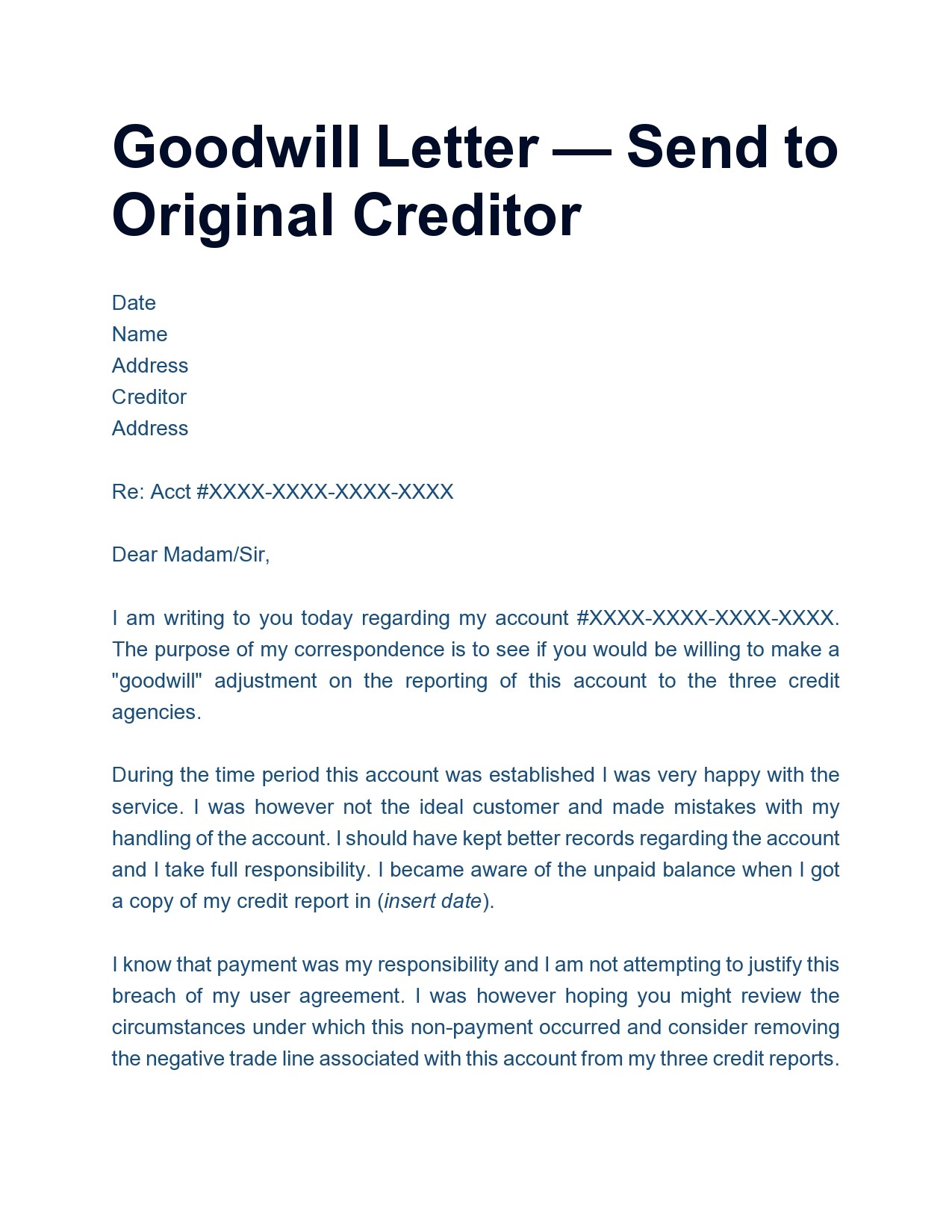

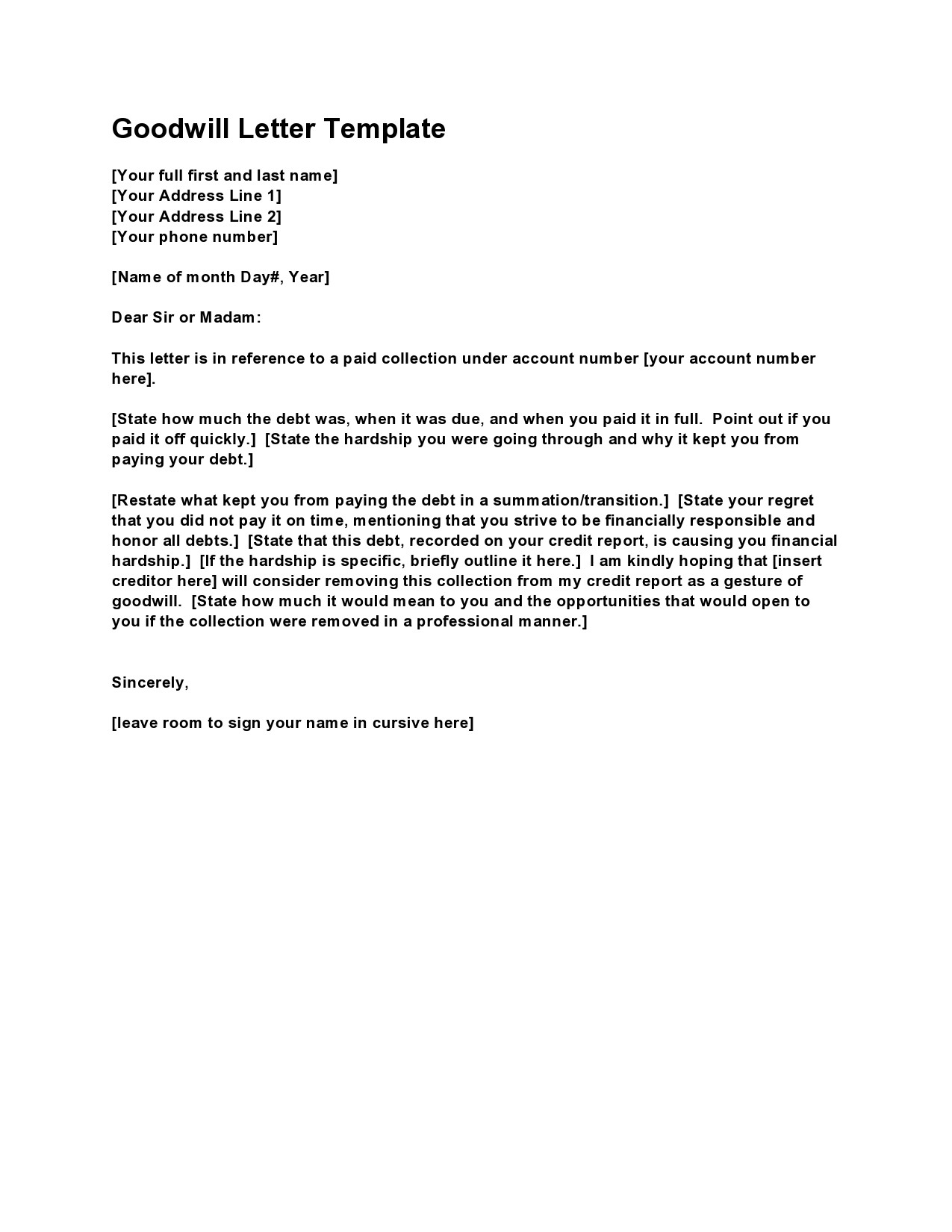

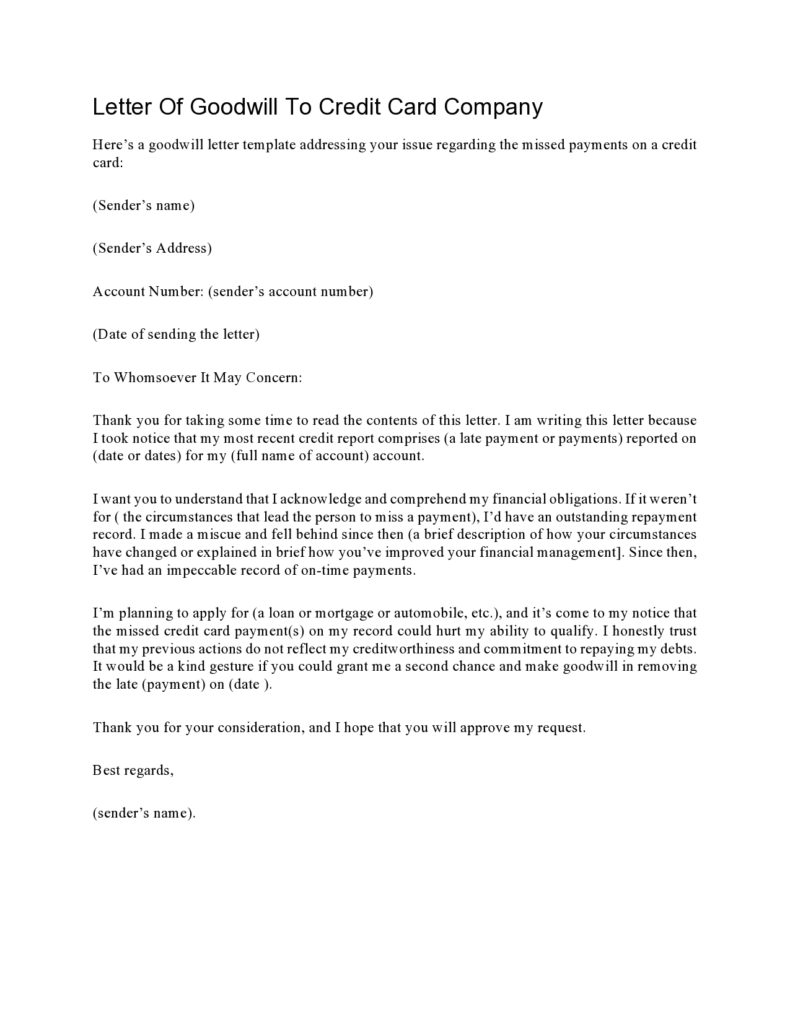

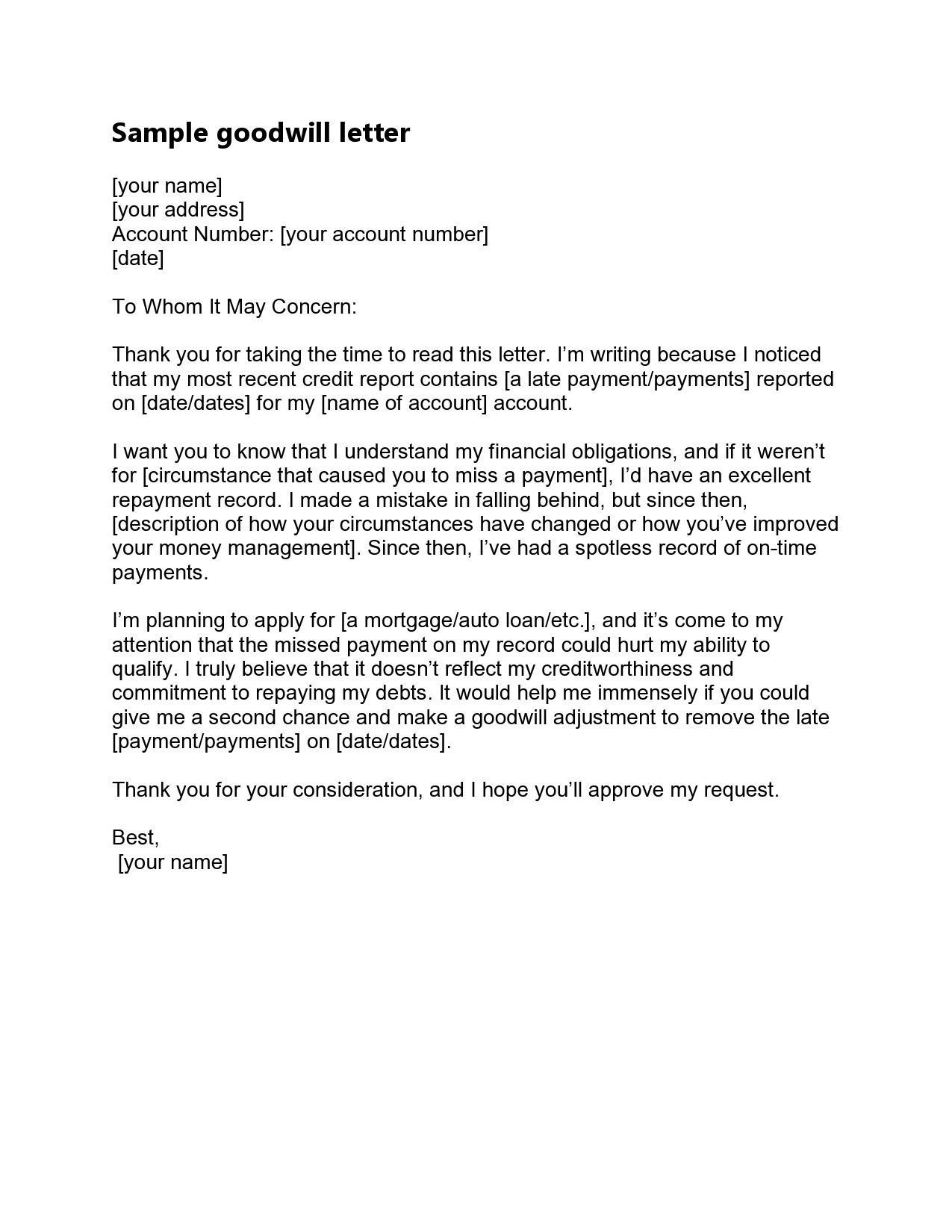

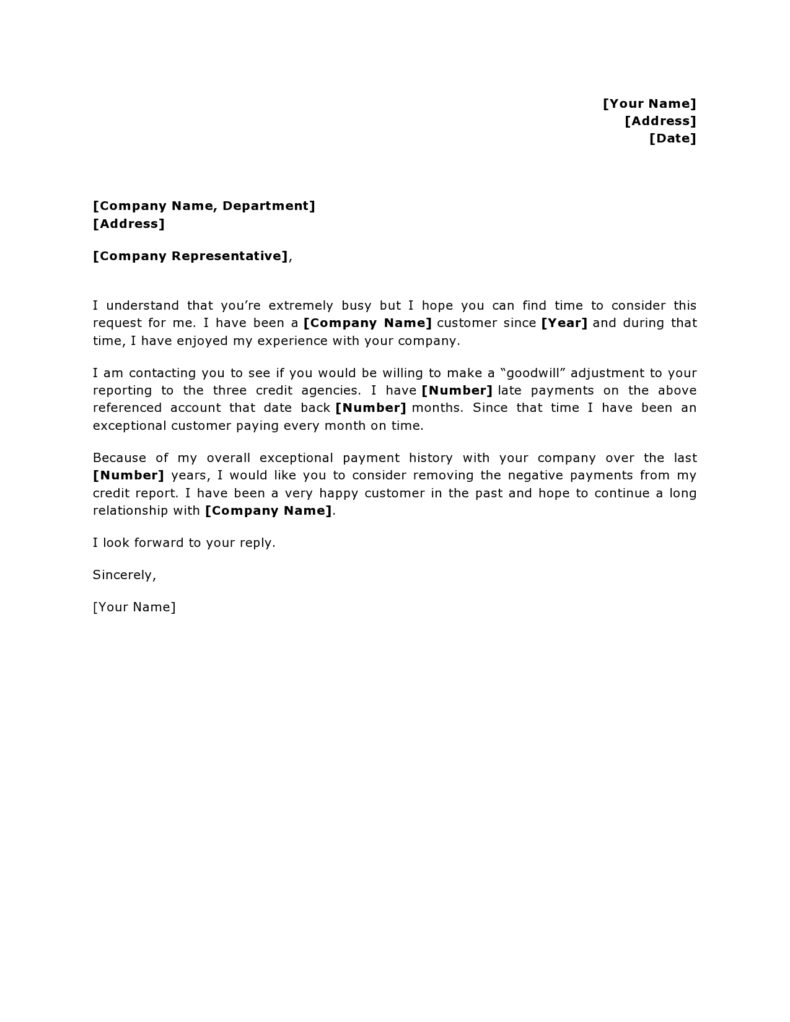

Letter Of Goodwill Template - Providing enough information about your situation will most help convince your creditor to grant your request. If you fell on hard times and missed payments, but have since become a model customer and made payments on time, you might be able to convince your creditor to give you. With the right approach, you can exit your role gracefully while maintaining professional relationships. I am writing to express my sincere regret and to request your. Request for goodwill consideration dear [company name], i hope this letter finds you well. A goodwill letter is a respectful request to remove or adjust a late payment mark from your credit report. When writing a goodwill letter, maintain a polite, professional, and respectful tone throughout. Here are some things to remember to write a letter successfully: What is a goodwill letter? Goodwill letters can be sent to your credit card creditors, your auto financing company, your bank, or any other type of lender. A goodwill letter is a correspondence that asks creditors to remove negative remarks from your credit reports. Providing enough information about your situation will most help convince your creditor to grant your request. A goodwill letter is a respectful request to remove or adjust a late payment mark from your credit report. With the right approach, you can exit your role gracefully while maintaining professional relationships. A goodwill letter is your attempt to convince creditors and lenders to remove a late or missed payment from your credit reports. All you have to do is write the letter. Take responsibility for any mistakes or past actions that led to the negative items on the credit. • when to use it: What is a goodwill letter? Goodwill letters can be sent to your credit card creditors, your auto financing company, your bank, or any other type of lender. Goodwill letters can be sent to your credit card creditors, your auto financing company, your bank, or any other type of lender. Take responsibility for any mistakes or past actions that led to the negative items on the credit. What is a goodwill letter? • when to use it: A goodwill letter is a respectful request to remove or adjust. • purpose of a goodwill letter: • when to use it: What is a goodwill letter? Fill it online or download in pdf or word format. Learn how to erase late payments on your credit report by writing a goodwill letter that works. When writing a goodwill letter, maintain a polite, professional, and respectful tone throughout. Goodwill letters boost your credit score by erasing bad marks on your credit report. All you have to do is write the letter. Download a free goodwill letter template to effectively communicate with your creditor and improve your credit score. When writing a goodwill letter to your. I am writing to express my sincere regret and to request your. Use our template to draft your own letter. Request for goodwill consideration dear [company name], i hope this letter finds you well. • purpose of a goodwill letter: What is a goodwill letter? What is a goodwill letter? A goodwill letter is a correspondence that asks creditors to remove negative remarks from your credit reports. Here are some things to remember to write a letter successfully: If you fell on hard times and missed payments, but have since become a model customer and made payments on time, you might be able to convince. A goodwill letter is a correspondence that asks creditors to remove negative remarks from your credit reports. Use a sincere but professional tone. Goodwill letters can be sent to your credit card creditors, your auto financing company, your bank, or any other type of lender. • when to use it: All you have to do is write the letter. When writing a goodwill letter, maintain a polite, professional, and respectful tone throughout. Here are some things to remember to write a letter successfully: • when to use it: A goodwill letter is a respectful request to remove or adjust a late payment mark from your credit report. All you have to do is write the letter. • when to use it: Here are some things to remember to write a letter successfully: Fill it online or download in pdf or word format. When writing a goodwill letter to your creditor, include as many details as possible. Goodwill letters boost your credit score by erasing bad marks on your credit report. Here are some things to remember to write a letter successfully: Take responsibility for any mistakes or past actions that led to the negative items on the credit. With the right approach, you can exit your role gracefully while maintaining professional relationships. What is a goodwill letter? When writing a goodwill letter, maintain a polite, professional, and respectful tone throughout. If you’ve never written a goodwill letter to a creditor before, it can be helpful to use a goodwill letter template to help get you started. Goodwill letters boost your credit score by erasing bad marks on your credit report. What is a goodwill letter? I am writing to express my sincere regret and to request your. • when to. • purpose of a goodwill letter: What is a goodwill letter? Here are some things to remember to write a letter successfully: Learn how to erase late payments on your credit report by writing a goodwill letter that works. Use a sincere but professional tone. Fill it online or download in pdf or word format. • when to use it: A goodwill letter is a correspondence that asks creditors to remove negative remarks from your credit reports. A goodwill letter is a respectful request to remove or adjust a late payment mark from your credit report. Goodwill letters boost your credit score by erasing bad marks on your credit report. All you have to do is write the letter. Goodwill letters can be sent to your credit card creditors, your auto financing company, your bank, or any other type of lender. When writing a goodwill letter to your creditor, include as many details as possible. Providing enough information about your situation will most help convince your creditor to grant your request. Use our template to draft your own letter. A goodwill letter is your attempt to convince creditors and lenders to remove a late or missed payment from your credit reports.40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

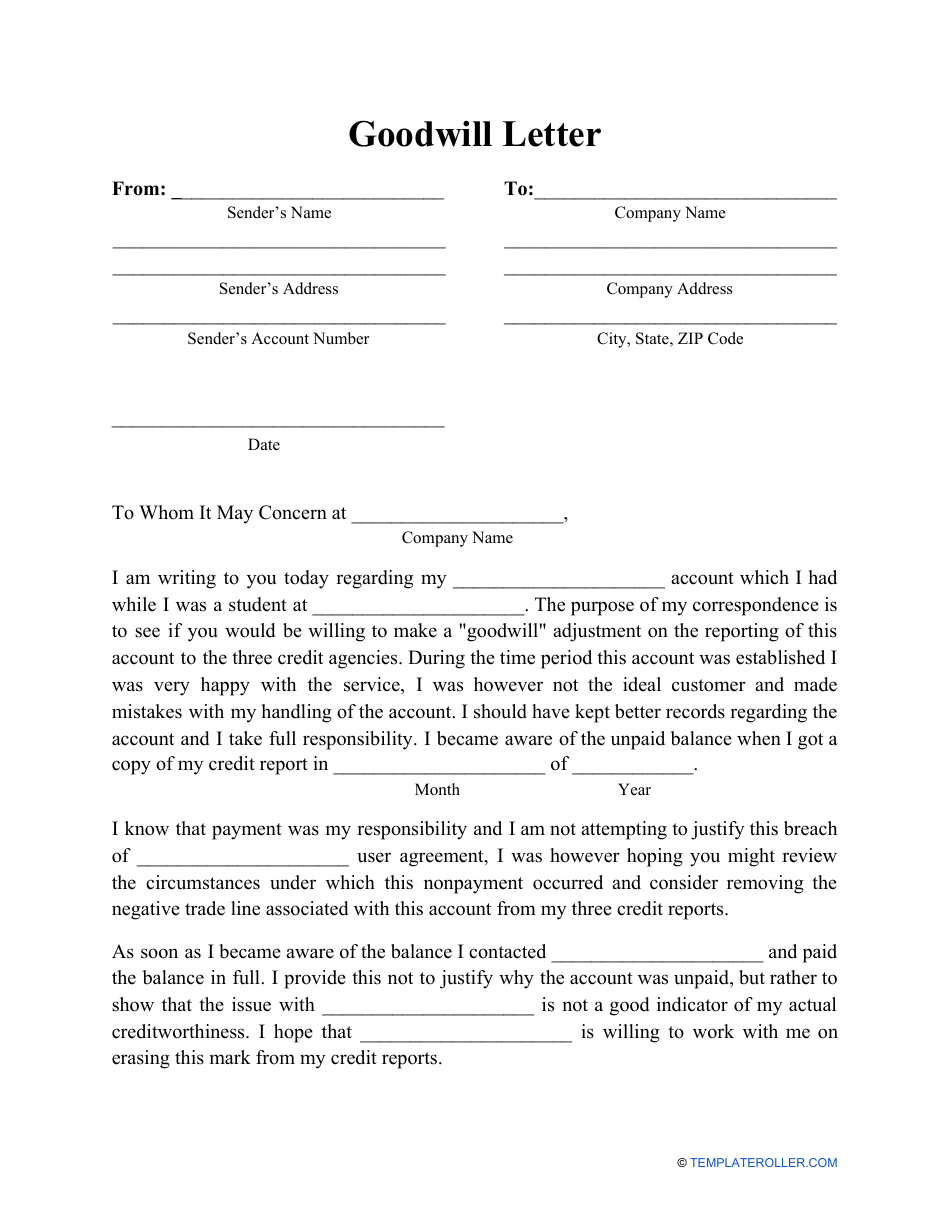

Goodwill Letter Template Download Printable PDF Templateroller

40 Free Goodwill Letter Templates (& Examples) ᐅ TemplateLab

When Writing A Goodwill Letter, Maintain A Polite, Professional, And Respectful Tone Throughout.

With The Right Approach, You Can Exit Your Role Gracefully While Maintaining Professional Relationships.

Request For Goodwill Consideration Dear [Company Name], I Hope This Letter Finds You Well.

Take Responsibility For Any Mistakes Or Past Actions That Led To The Negative Items On The Credit.

Related Post: