Pay And Delete Letter Template

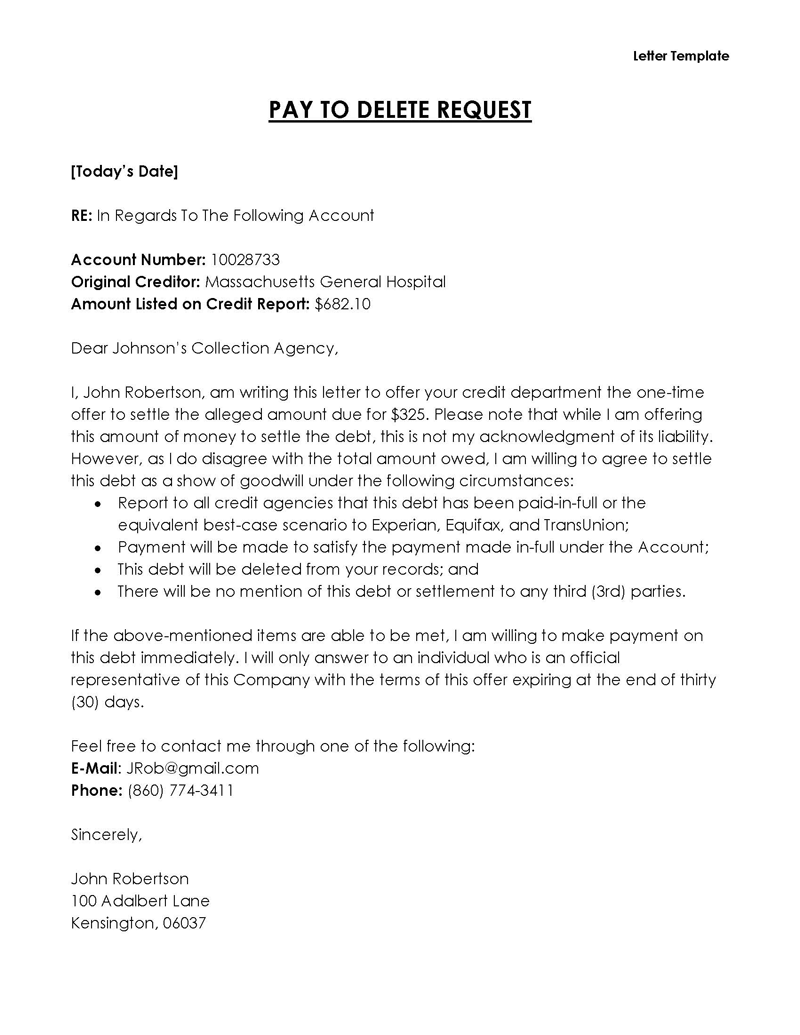

Pay And Delete Letter Template - A pay for delete letter lets a collector know you are open to paying off a debt that the collection agency says you owe. A pay for delete letter is an approach that debtors can use to attempt to improve their credit report by paying some or the total amount owed on debt in. A pay to remove a debt letter is an offer to pay a specific amount to remove an outstanding debt listed with credit reporting agencies. Craft your email in a polite yet firm tone, possibly. Download, fill in and print pay for delete letter pdf online here for free. A pay for delete is usually coupled with debt settlement, where a collection agency (not the original creditor) will agree to delete the negative item from your. In the letter, it is common for the debtor. When a client has an unverified debt, a pay for delete letter can serve to settle all debt without requiring a creditor to verify the debt claims. Keep reading to learn more about how these letters work and view a sample template to help you get started. When you discover a negative item on your credit report, contact the original creditor (or collection agency) and see. Pay for delete letters can remove the negative. A pay to remove a debt letter is an offer to pay a specific amount to remove an outstanding debt listed with credit reporting agencies. Generic pay for delete letter. It’s most commonly used when a person still owes a balance on a negative account. Fill it out online and save as a pdf. When you discover a negative item on your credit report, contact the original creditor (or collection agency) and see. Overdue payment reminder email template. In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score. What is a pay for delete? Keep reading to learn more about how these letters work and view a sample template to help you get started. In exchange, you’re asking for a signed contract indicating they will. A pay for delete letter is a. Sending a pay for delete letter is relatively straightforward: Pay for delete letters can remove the negative. In the letter, it is common for the debtor. You can leverage this sample to communicate with creditors and explore options. In the letter, it is common for the debtor. What is a pay for delete? In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score. To see our pay for delete letter templates you. A pay for delete letter is a negotiation tool intended to get negative information removed from your credit report. It’s most commonly used when a person still owes a balance on a negative account. In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score. Pay for. When a client has an unverified debt, a pay for delete letter can serve to settle all debt without requiring a creditor to verify the debt claims. A pay to remove a debt letter is an offer to pay a specific amount to remove an outstanding debt listed with credit reporting agencies. A pay for delete letter is an approach. This debt will be deleted from your records; You can leverage this sample to communicate with creditors and explore options. Pay for delete letter is often used in pay for delete letter template, debt payment, credit repair, debt. Essentially, it entails asking a creditor to remove the negative information in exchange for paying the balance. When a client has an. What is a pay for delete letter? When a client has an unverified debt, a pay for delete letter can serve to settle all debt without requiring a creditor to verify the debt claims. Pay for delete letters can remove the negative. You can leverage this sample to communicate with creditors and explore options. What is a pay for delete? Fill out this document to settle a portion of the original. In the letter, it is common for the debtor. Download, fill in and print pay for delete letter pdf online here for free. A termination letter template can help you maintain a standardized approach to all termination letters your organization issues. Essentially, it entails asking a creditor to remove. In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score. A termination letter template can help you maintain a standardized approach to all termination letters your organization issues. A pay for delete letter is a. It’s most commonly used when a person still owes a balance. In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score. You can leverage this sample to communicate with creditors and explore options. Craft your email in a polite yet firm tone, possibly. Overdue payment reminder email template. A termination letter template can help you maintain a. In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score. Download a free pay for delete letter template to negotiate the removal of negative items from your credit report. A pay to remove a debt letter is an offer to pay a specific amount to remove. A pay for delete letter is a. Pay for delete is a strategy of negotiation used to. Download, fill in and print pay for delete letter pdf online here for free. A pay for delete is usually coupled with debt settlement, where a collection agency (not the original creditor) will agree to delete the negative item from your. Generic pay for delete letter. Fill it out online and save as a pdf. To see our pay for delete letter templates you may check out our library and printable samples below. You can leverage this sample to communicate with creditors and explore options. Pay for delete letter is often used in pay for delete letter template, debt payment, credit repair, debt. In the letter, it is common for the debtor. Keep reading to learn more about how these letters work and view a sample template to help you get started. What is a pay for delete? It’s most commonly used when a person still owes a balance on a negative account. A pay for delete letter lets a collector know you are open to paying off a debt that the collection agency says you owe. Download a free pay for delete letter template to negotiate the removal of negative items from your credit report. In such a case, you need a pay to delete letter template to help you rectify your credit mistakes to improve your credit score.Free Printable Pay For Delete Letter Templates [PDF, Word]

Free Printable Pay For Delete Letter Templates [PDF, Word]

Free Pay for Delete Letter Template and Sample Word PDF eForms

Pay for Delete Letter How to Write (Free Templates)

Fillable Online payfordeletelettertemplate Fax Email Print pdfFiller

Free Printable Pay For Delete Letter Templates [PDF, Word]

Free Printable Pay For Delete Letter Templates [PDF, Word]

Free Printable Pay For Delete Letter Templates [PDF, Word]

Free Printable Pay For Delete Letter Templates [PDF, Word]

Free Printable Pay For Delete Letter Templates [PDF, Word]

Overdue Payment Reminder Email Template.

There Will Be No Mention Of This Debt Or Settlement To Any.

What Is A Pay For Delete Letter?

Essentially, It Entails Asking A Creditor To Remove The Negative Information In Exchange For Paying The Balance.

Related Post:

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Editable-Pay-for-Delete-Letter-Word.jpg)

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Blank-Pay-for-Delete-Letter.jpg?gid=697)

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Free-Pay-for-Delete-Letter-Download.jpg)

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Download-Pay-for-Delete-Letter-Sample.jpg?gid=697)

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Sample-Pay-for-Delete-Letter-Word.jpg?gid=697)

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Editable-Pay-for-Delete-Letter-PDF.jpg)

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/06/Pay-for-Delete-Letter-724x1024.jpg)