Private Letter Ruling Template

Private Letter Ruling Template - A private letter ruling (plr) is a written decision by the internal revenue service (irs) that is sent in response to a taxpayer’s request for guidance on unusual circumstances. A private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer’s represented set of facts. The irs ordinarily will not issue “comfort” letter rulings on matters that are already squarely addressed by statute, regulation, court. What is a private letter ruling (plr)? A plr is issued in. 8345003 (august 3, 1983) the service addressed a set of. A private letter ruling (plr) is a formal written statement issued by the internal revenue service (irs) in response to a taxpayer’s request for guidance on a specific tax. It explains the forms of advice and the manner in which advice is requested by taxpayers and provided by the service. Valero shall have received a private letter ruling from the u.s. To receive an irs private letter ruling, you must submit a letter ruling request before filing returns or reports. To receive an irs private letter ruling, you must submit a letter ruling request before filing returns or reports. Generally, private letter ruling explains how irs rules apply to. Private letter rulings a number of private letter rulings may also provide guidance on this matter. Thus, if you are unsure about whether proposed changes are consistent with your status as an exempt organization, you may want to request a private letter ruling. To assist you in preparing a letter ruling request, the department is providing this sample format, which is required to be used when preparing a ruling request. Unlike a public letter ruling, a private letter ruling is sent only to the taxpayer who has requested it. If your request is different from the sample format, a different format will not defer consideration of. A sample format for a letter ruling request is provided. 8345003 (august 3, 1983) the service addressed a set of. Valero shall have received a private letter ruling from the u.s. This template is a private letter ruling request (plr) that a taxpayer or the taxpayer's representative can customize to request guidance from the internal revenue service (irs or. This letter ruling request template will be helpful as an outline for anyone writing one. A private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and. What is a private letter ruling (plr)? Taxpayers can request a private letter ruling. Thus, if you are unsure about whether proposed changes are consistent with your status as an exempt organization, you may want to request a private letter ruling. Here's how to apply for a plr: Confirm there is a need. To receive an irs private letter ruling, you must submit a letter ruling request before filing returns or reports. A private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer’s represented set of facts. A private letter ruling request is a request to the irs by a taxpayer. 8345003 (august 3, 1983) the service addressed a set of. Valero shall have received a private letter ruling from the u.s. It explains the forms of advice and the manner in which advice is requested by taxpayers and provided by the service. A private letter ruling (plr) (also known as letter ruling) is a written statement issued to a taxpayer. A plr is issued in. A private letter ruling (plr) (also known as letter ruling) is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Thus, if you are unsure about whether proposed changes are consistent with your status as an exempt organization, you may want to request a. Private letter rulings a number of private letter rulings may also provide guidance on this matter. Unlike a public letter ruling, a private letter ruling is sent only to the taxpayer who has requested it. The irs ordinarily will not issue “comfort” letter rulings on matters that are already squarely addressed by statute,. Thus, if you are unsure about whether. Private letter rulings a number of private letter rulings may also provide guidance on this matter. A private letter ruling (plr) is a formal written statement issued by the internal revenue service (irs) in response to a taxpayer’s request for guidance on a specific tax. To assist you in preparing a letter ruling request, the department is providing this sample. A private letter ruling request is a request to the irs by a taxpayer (an individual, business, or other entity) requesting the irs to address, in writing, a specific tax situation that. A sample format for a letter ruling request is provided. 8345003 (august 3, 1983) the service addressed a set of. It explains the forms of advice and the. This letter ruling request template will be helpful as an outline for anyone writing one. To assist you in preparing a letter ruling request, the department is providing this sample format, which is required to be used when preparing a ruling request. Confirm there is a need. 8345003 (august 3, 1983) the service addressed a set of. It explains the. A private letter ruling (plr) is a written decision by the internal revenue service (irs) that is sent in response to a taxpayer’s request for guidance on unusual circumstances. The irs ordinarily will not issue “comfort” letter rulings on matters that are already squarely addressed by statute,. Valero shall have received a private letter ruling from the u.s. Here's how. Confirm there is a need. Here’s how to apply for a plr: This template is a private letter ruling request (plr) that a taxpayer or the taxpayer's representative can customize to request guidance from the internal revenue service (irs or. A private letter ruling request is a request to the irs by a taxpayer (an individual, business, or other entity) requesting the irs to address, in writing, a specific tax situation that. A private letter ruling, or plr, is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer’s represented set of facts. It explains the forms of advice and the manner in which advice is requested by taxpayers and provided by the service. A private letter ruling (plr) is a written decision by the internal revenue service (irs) that is sent in response to a taxpayer’s request. Here's how to apply for a plr: Unlike a public letter ruling, a private letter ruling is sent only to the taxpayer who has requested it. A private letter ruling (plr) is a written decision by the internal revenue service (irs) that is sent in response to a taxpayer’s request for guidance on unusual circumstances. A private letter ruling (plr) (also known as letter ruling) is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayer's specific set of facts. Valero shall have received a private letter ruling from the u.s. Internal revenue service substantially to the effect that, among other things, the contribution and the. A plr is issued in. If your request is different from the sample format, a different format will not defer consideration of. Generally, private letter ruling explains how irs rules apply to.RossWhitaker Ruling Letter Signed PDF Courts Federal Government

Private ruling application Australian Taxation OfficeTEB Private Letter

Private Letter Format

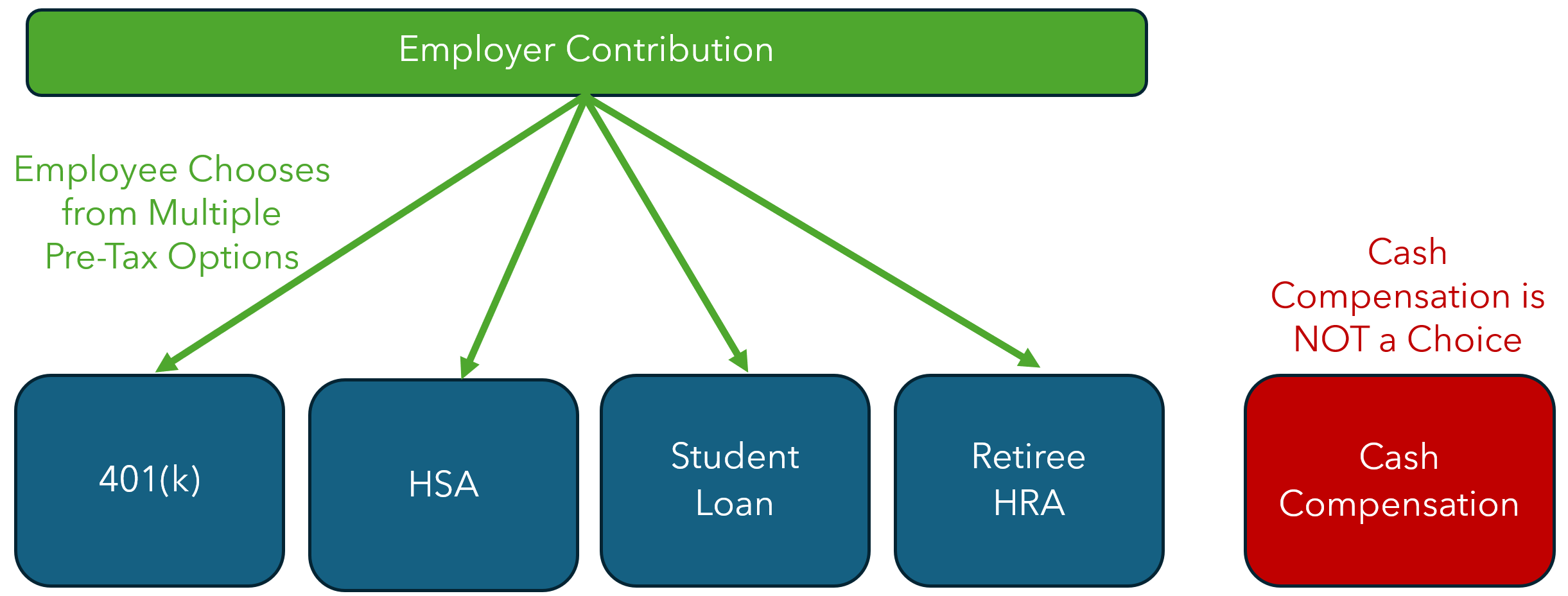

IRS Private Letter Ruling Allows Flexible Choice Plan Vita Companies

PPT PRIVATE LETTER RULING 200703024 (“PLR”) PowerPoint Presentation

New IRS Private Letter Ruling and Inclusion of Offsite Infrastructure

Private Letter Format

Appendix A Sample Format for a Letter Ruling Request Complete Legal

PPT PRIVATE LETTER RULING 200703024 (“PLR”) PowerPoint Presentation

PPT Administrative Regulations and Rulings PowerPoint Presentation

Private Letter Rulings A Number Of Private Letter Rulings May Also Provide Guidance On This Matter.

A Private Letter Ruling (Plr) Is A Formal Written Statement Issued By The Internal Revenue Service (Irs) In Response To A Taxpayer’s Request For Guidance On A Specific Tax.

Thus, If You Are Unsure About Whether Proposed Changes Are Consistent With Your Status As An Exempt Organization, You May Want To Request A Private Letter Ruling.

A Sample Format For A Letter Ruling Request Is Provided.

Related Post: