Receipt For Donation Template

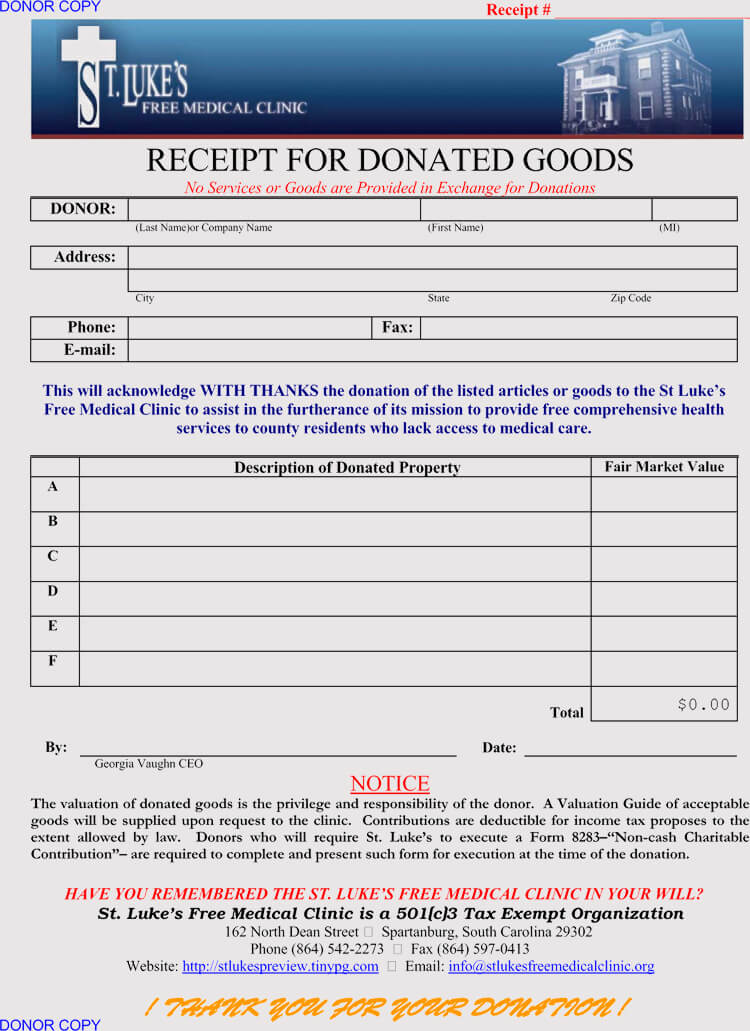

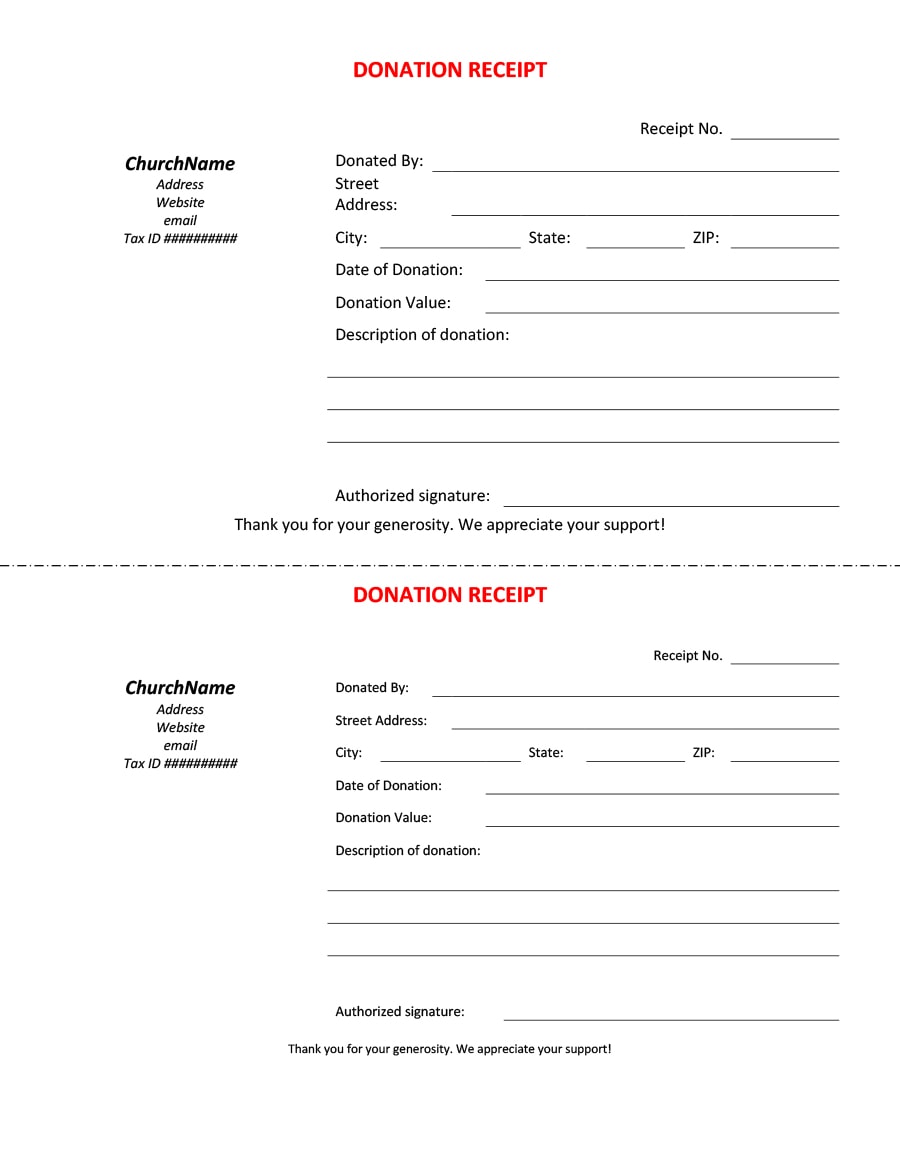

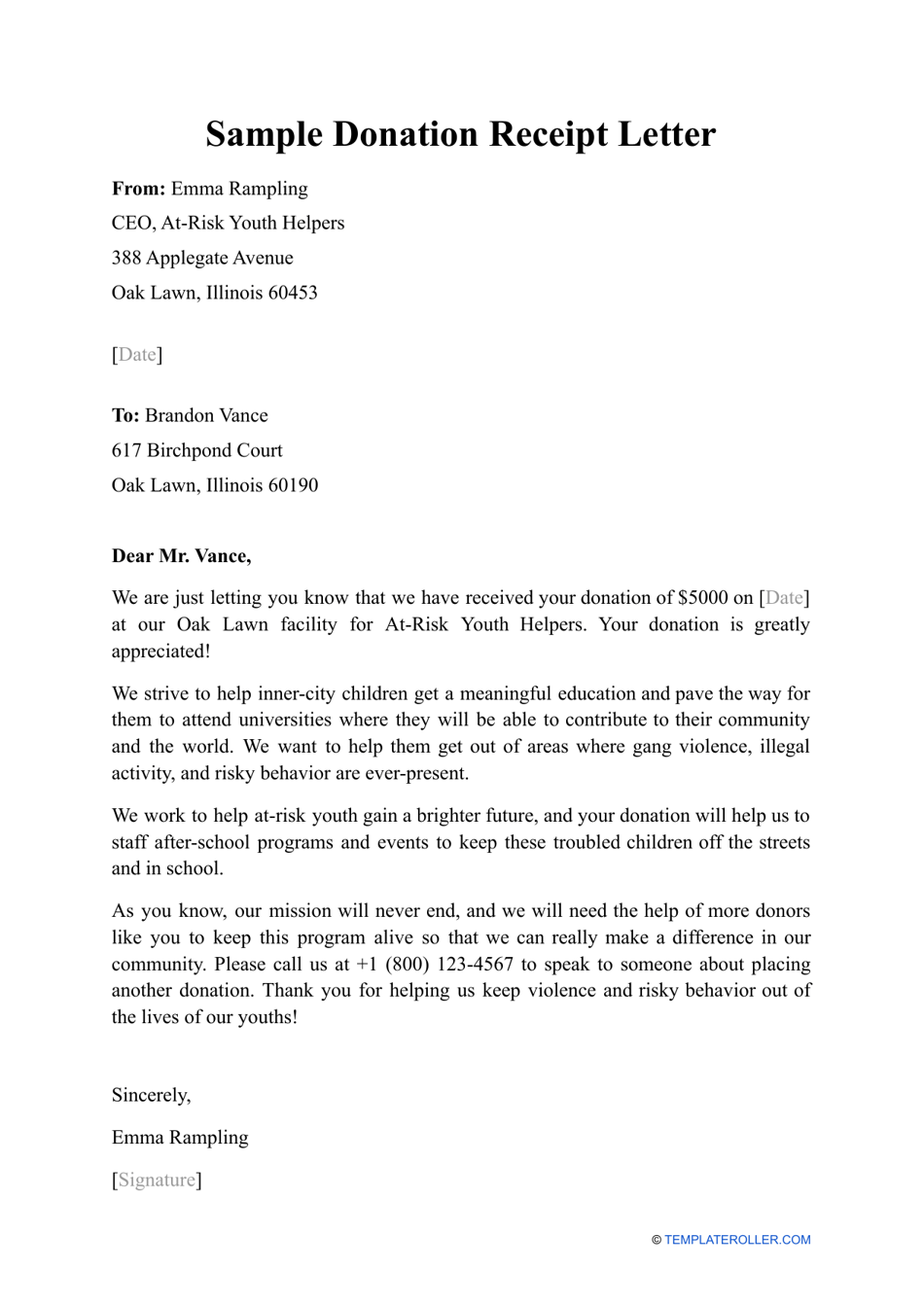

Receipt For Donation Template - The charity organization should provide a receipt and fill in their details and a. Made to meet us & canada requirements. Given below are donation receipt templates: These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Get simple, free templates that can be used for any donation or gift here. Donation receipt templates are a necessity when it comes to charitable donations. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. When donating in cash, individuals should endeavor to receive a receipt. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. A donation receipt is a document that acknowledges that an individual or organization has made a charitable contribution. The charity organization should provide a receipt and fill in their details and a. A receipt is required for all donation types in excess of $250. If an individual has made substantial contributions (in excess of $250) in cash and has not received. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. Given below are donation receipt templates: It is typically provided by. Get simple, free templates that can be used for any donation or gift here. Easily create a donation receipt for your charitable organization with our free donation receipt template. It is typically provided by. Get a free nonprofit donation receipt template for every giving scenario. A receipt is required for all donation types in excess of $250. Donation receipt template 39 types of receipts simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. When donating in cash, individuals should endeavor to. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Get a free nonprofit donation receipt template for every giving scenario. You can download one of our free templates or samples to get a better idea of what a donation receipt. Donation receipt templates are a necessity when it comes to charitable donations. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Donation receipt template 39 types of receipts simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Easily. If an individual has made substantial contributions (in excess of $250) in cash and has not received. It is typically provided by. When donating in cash, individuals should endeavor to receive a receipt. Donation receipt templates are a necessity when it comes to charitable donations. The charity organization should provide a receipt and fill in their details and a. Made to meet us & canada requirements. Get simple, free templates that can be used for any donation or gift here. Donation receipt template 39 types of receipts simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Printable and customizable in pdf and word formats. The charity organization should provide a receipt. Made to meet us & canada requirements. The charity organization should provide a receipt and fill in their details and a. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Get a free nonprofit donation receipt template for every giving scenario. It is typically provided by. The charity organization should provide a receipt and fill in their details and a. It is typically provided by. A receipt is required for all donation types in excess of $250. Donation receipt templates are a necessity when it comes to charitable donations. A donation receipt is a document that acknowledges that an individual or organization has made a charitable. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. It is typically provided by. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. Printable and customizable in pdf and word formats.. You can download one of our free templates or samples to get a better idea of what a donation receipt should look like. A receipt is required for all donation types in excess of $250. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Free. Printable and customizable in pdf and word formats. Given below are donation receipt templates: The charity organization should provide a receipt and fill in their details and a. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Donation receipt templates. Made to meet us & canada requirements. Get simple, free templates that can be used for any donation or gift here. The charity organization should provide a receipt and fill in their details and a. Get a free nonprofit donation receipt template for every giving scenario. These free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. When donating in cash, individuals should endeavor to receive a receipt. A receipt is required for all donation types in excess of $250. Free nonprofit (donation) receipt templates (forms) a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated a given value to a beneficiary. Printable and customizable in pdf and word formats. Easily create a donation receipt for your charitable organization with our free donation receipt template. It is typically provided by. Donation receipt template 39 types of receipts simplify your process and ensure transparency and gratitude towards your generous donors with our professionally designed templates. Nonprofit receipts are given to the donor when he donates to a nonprofit organization. Donation receipt templates are a necessity when it comes to charitable donations.501c3 Donation Receipt Template Printable in Pdf, Word

Donation Form Template 501c4 Printable Printable Forms Free Online

46 Free Donation Receipt Templates (501c3, NonProfit)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Printable Donation Receipt Template

Printable 501C3 Donation Receipt Template, Web nonprofit charity

Sample Acknowledgement Receipt For Donation

How To Make A Receipt In Excel Excel Templates

Charitable Contribution Receipt Template

501c3 Donation Receipt Template Printable [Pdf & Word]

If An Individual Has Made Substantial Contributions (In Excess Of $250) In Cash And Has Not Received.

Given Below Are Donation Receipt Templates:

You Can Download One Of Our Free Templates Or Samples To Get A Better Idea Of What A Donation Receipt Should Look Like.

A Donation Receipt Is A Document That Acknowledges That An Individual Or Organization Has Made A Charitable Contribution.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)

![501c3 Donation Receipt Template Printable [Pdf & Word]](https://templatediy.com/wp-content/uploads/2022/03/501c3-Donation-Receipt-PDF.jpg)