S Corp Accountable Plan Template

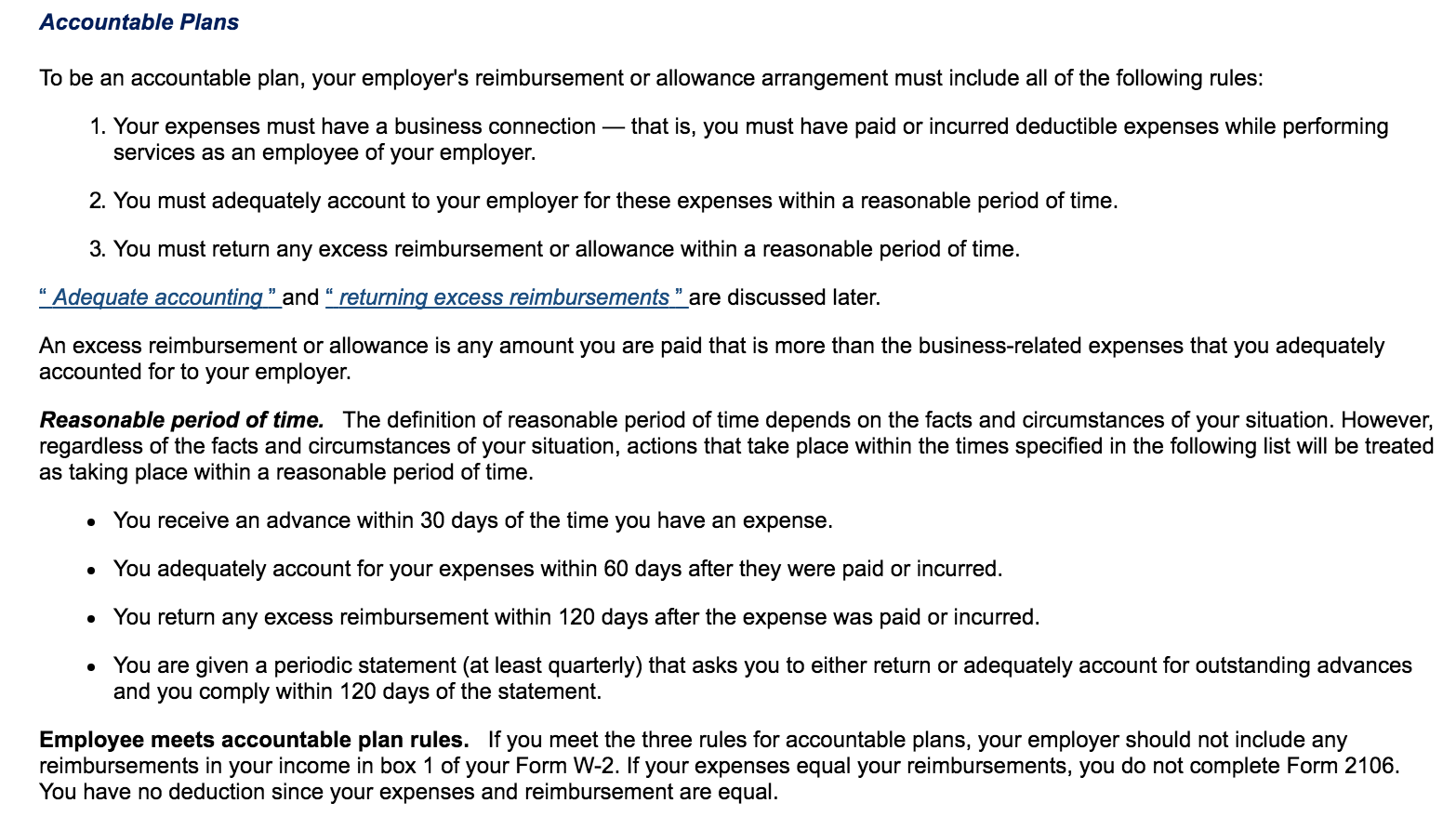

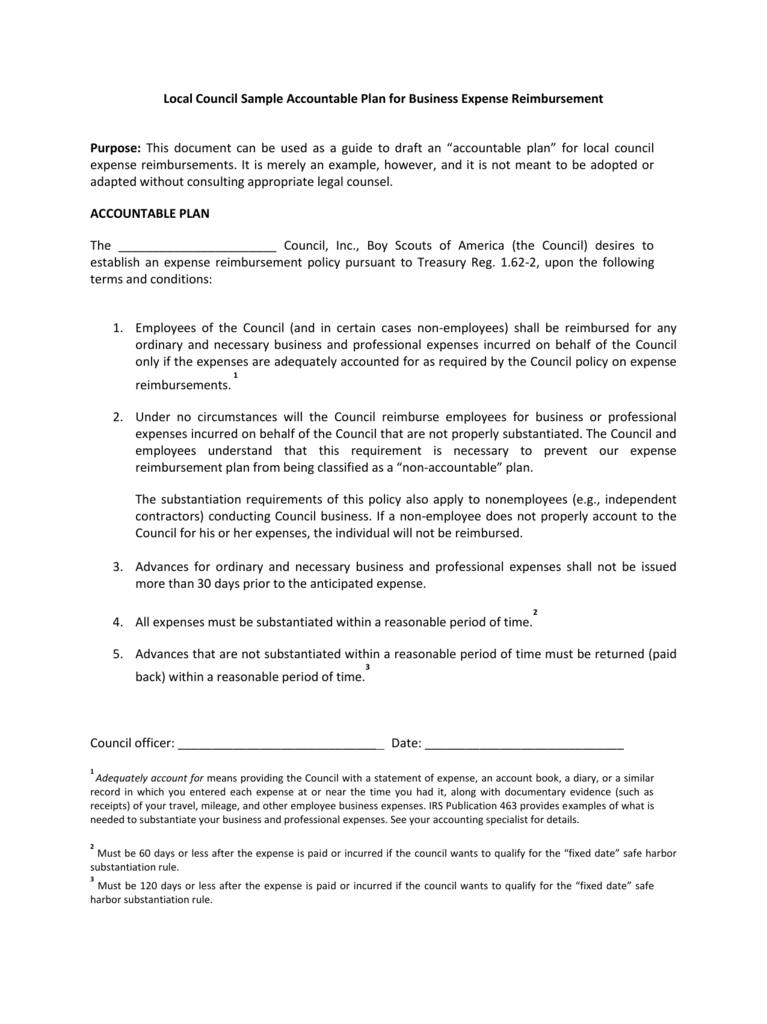

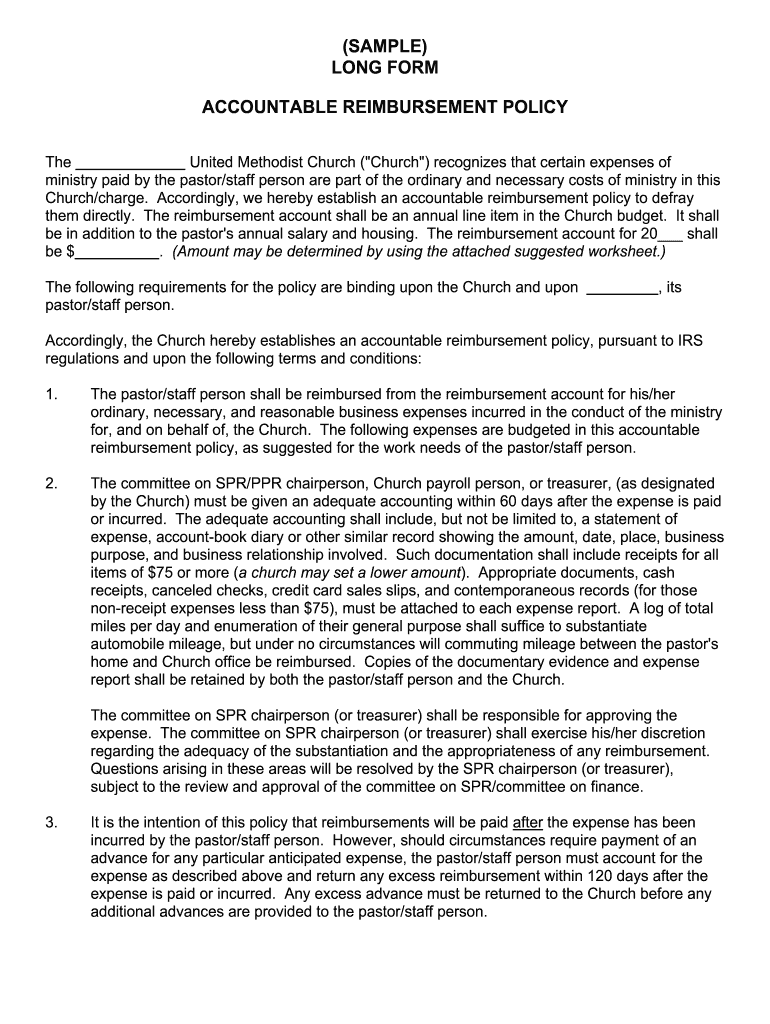

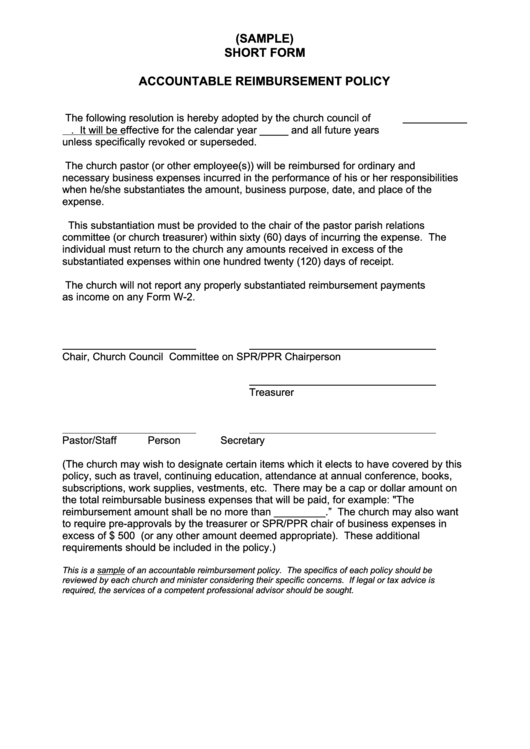

S Corp Accountable Plan Template - S corp accountable plan template the accountable plan template is an internal document that allows your business to reimburse its owners/employees (and deduct the expense) for. One of the most effective strategies to achieve this. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. Setting up an accountable plan is quite simple. Then, once a quarter or once a month, the. Sample accountable plan for business expense reimbursement purpose: This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Here’s a sample agreement you can adapt for your clients and have them sign. % of your deductions, take the square footage of the room(s) devoted to the business and divide that by the entire are of your home. Setting up an accountable plan is quite simple. S corp accountable plan template the accountable plan template is an internal document that allows your business to reimburse its owners/employees (and deduct the expense) for. Sample accountable plan for business expense reimbursement purpose: This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. Here’s a sample agreement you can adapt for your clients and have them sign. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. % of your deductions, take the square footage of the room(s) devoted to the business and divide that by the entire are of your home. Then, once a quarter or once a month, the. One of the most effective strategies to achieve this. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. Then, once a quarter or once a month, the. This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is. % of your deductions, take the square footage of the room(s). Sample accountable plan for business expense reimbursement purpose: S corp accountable plan template the accountable plan template is an internal document that allows your business to reimburse its owners/employees (and deduct the expense) for. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Here’s a sample agreement you can adapt for your clients and have them sign. S corp accountable plan template the accountable plan template is an internal document that allows. Here’s a sample agreement you can adapt for your clients and have them sign. Setting up an accountable plan is quite simple. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. S corp accountable plan template the accountable plan template is an internal document that allows your business. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. S corp accountable plan template the accountable plan template is an internal document that allows your business to reimburse its owners/employees (and deduct the expense) for. % of your deductions, take the square footage of the room(s) devoted to. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. Setting up an accountable plan is quite simple. Then, once a quarter or once a month, the. Sample accountable plan for business expense reimbursement purpose: One of the most effective strategies to achieve this. Then, once a quarter or once a month, the. Here’s a sample agreement you can adapt for your clients and have them sign. Sample accountable plan for business expense reimbursement purpose: This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to. Here’s a sample agreement you can adapt for your clients and have them sign. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the. Sample accountable plan for business expense reimbursement purpose: This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Then, once a quarter or once a month, the. One of the most effective strategies to achieve this. Here’s a sample. Sample accountable plan for business expense reimbursement purpose: As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. One of the most effective strategies to achieve this. Then, once a quarter or once a month, the. This document can be used as a guide to draft an accountable plan. One of the most effective strategies to achieve this. Setting up an accountable plan is quite simple. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. % of your deductions, take the square footage of the room(s) devoted to the business and divide that by the entire are of your home. Then, once a quarter or once a month, the. As an s corporation owner, you are always looking for ways to maximize tax savings while ensuring compliance with irs regulations. Sample accountable plan for business expense reimbursement purpose: This document can be used as a guide to draft an accountable plan for expense reimbursements however, it is.Irs Accountable Plan Template

S Corp Accountable Plan Template

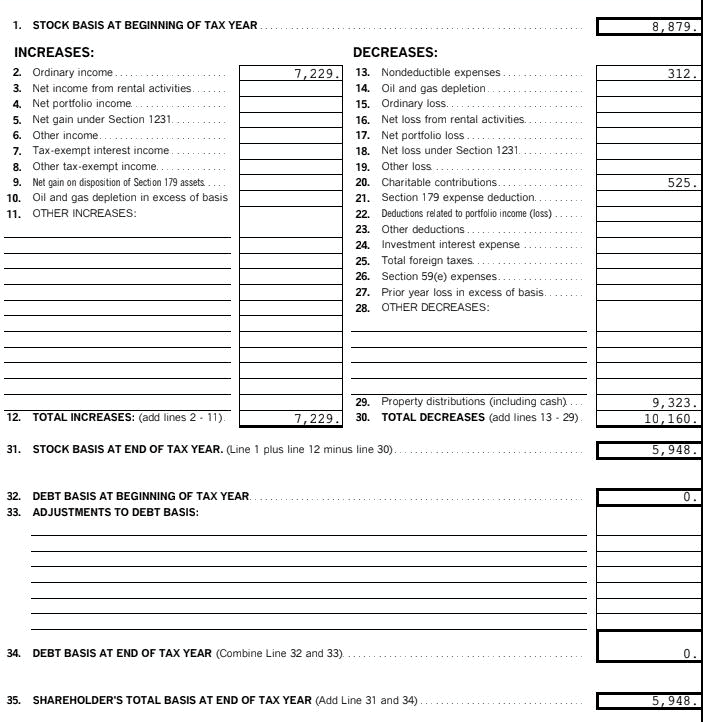

Scorp Accountable Plan Reimbursement Worksheet

S Corp Accountable Plan Template

SCorp Accountable Plan Reimbursement Worksheet Printable Word Searches

Accountable plan template Fill out & sign online DocHub

How to Use An Accountable Plan For An SCorp or CCorp Jones CPA

Try Our Accountable Plan Template and Simplify Reporting

S Corp Accountable Plan Template

S Corp Accountable Plan Template

S Corp Accountable Plan Template The Accountable Plan Template Is An Internal Document That Allows Your Business To Reimburse Its Owners/Employees (And Deduct The Expense) For.

Here’s A Sample Agreement You Can Adapt For Your Clients And Have Them Sign.

Related Post: