Safe Note Template

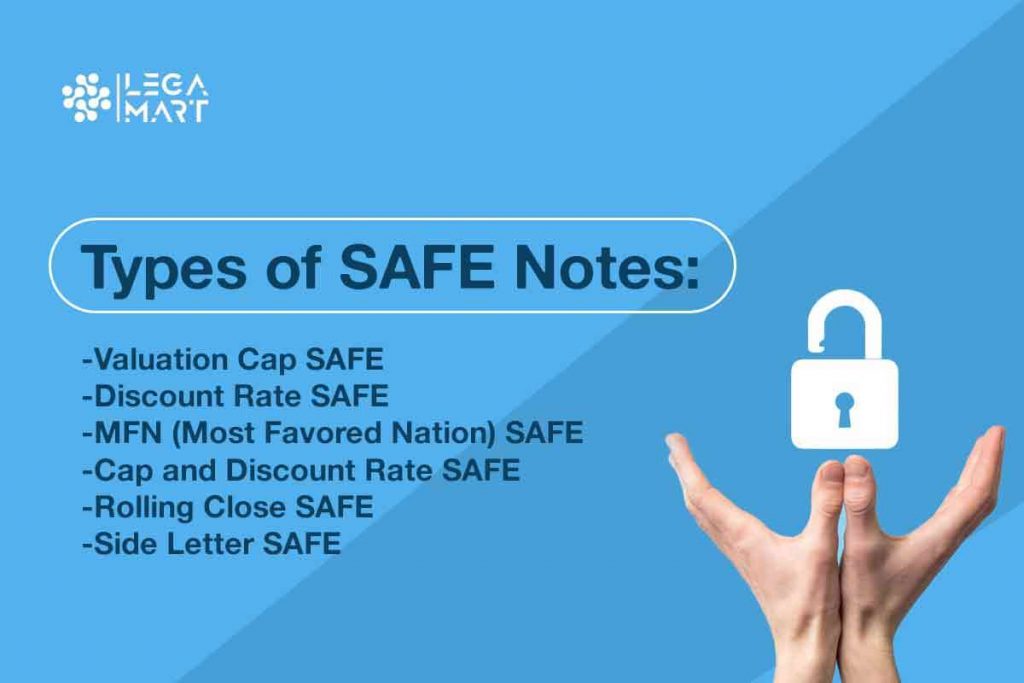

Safe Note Template - A detailed safe note template designed to facilitate investments in startups by outlining terms for future equity conversion. Essentially, a safe note acts as a legally binding promise to. The mandate to use sciencv only for the preparation of current and pending (other) support. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment into a company in return for the rights to subscribe for. In this tutorial, you’ll learn about “safe notes” for investing in startups, how they compare to traditional priced equity rounds, and whether they’re actually “unsafe” for startups. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. Utilizing a safe (simple agreement for future equity) note term sheet is a highly advantageous approach for startups and investors. A safe note is an innovative form of convertible security that enable small business like startups to raise capital while postponing valuation, which improves capital efficiency. Similarities between safe notes and convertible notes include that. Safe (or simple agreement for future equity ) notes are financial agreements that startups often use to help raise seed capital. In this tutorial, you’ll learn about “safe notes” for investing in startups, how they compare to traditional priced equity rounds, and whether they’re actually “unsafe” for startups. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. Similarities between safe notes and convertible notes include that. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment into a company in return for the rights to subscribe for. Utilizing a safe (simple agreement for future equity) note term sheet is a highly advantageous approach for startups and investors. The mandate to use sciencv only for the preparation of current and pending (other) support. This document includes provisions for valuation. A safe note is an innovative form of convertible security that enable small business like startups to raise capital while postponing valuation, which improves capital efficiency. Essentially, a safe note acts as a legally binding promise to. You just need to provide your raise goal, valuation cap, and discount. While the safe may not be suitable for all. Essentially, a safe note acts as a legally binding promise to. A detailed safe note template designed to facilitate investments in startups by outlining terms for future equity conversion. The mandate to use sciencv only for the preparation of current and pending (other) support. You just need to provide your raise. You just need to provide your raise goal, valuation cap, and discount. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. This document includes provisions for valuation. While the safe may not be suitable for all. Review multiple. Find safe note templates created and drafted by lawyers to buy. Essentially, a safe note acts as a legally binding promise to. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. Utilizing a safe (simple agreement for future. While the safe may not be suitable for all. The mandate to use sciencv only for the preparation of current and pending (other) support. Similarities between safe notes and convertible notes include that. Review multiple versions with different use cases depending on your needs. Utilizing a safe (simple agreement for future equity) note term sheet is a highly advantageous approach. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. You just need to provide your raise goal, valuation cap, and discount. In this tutorial, you’ll learn about “safe notes” for investing in startups, how they compare to traditional. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. Essentially, a safe note acts as a legally binding promise to. Safe (or simple agreement for future equity ) notes are financial agreements that startups often use to help. This document includes provisions for valuation. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. A simple agreement for future equity (safe) is a contract by which an investor makes a cash investment into a company in return. Find safe note templates created and drafted by lawyers to buy. In this tutorial, you’ll learn about “safe notes” for investing in startups, how they compare to traditional priced equity rounds, and whether they’re actually “unsafe” for startups. Safe (or simple agreement for future equity ) notes are financial agreements that startups often use to help raise seed capital. A. While the safe may not be suitable for all. You just need to provide your raise goal, valuation cap, and discount. Essentially, a safe note acts as a legally binding promise to. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right. The mandate to use sciencv only for the preparation of current and pending (other) support. The safe user guide explains how the safe converts, with sample calculations, an explanation of the pro rata side letter, and suggestions for best use. In this tutorial, you’ll learn about “safe notes” for investing in startups, how they compare to traditional priced equity rounds,. This document includes provisions for valuation. Utilizing a safe (simple agreement for future equity) note term sheet is a highly advantageous approach for startups and investors. Essentially, a safe note acts as a legally binding promise to. The safe user guide explains how the safe converts, with sample calculations, an explanation of the pro rata side letter, and suggestions for best use. Review multiple versions with different use cases depending on your needs. While the safe may not be suitable for all. A detailed safe note template designed to facilitate investments in startups by outlining terms for future equity conversion. A simple agreement for future equity (safe) is a straightforward, flexible financing agreement that allows an investor to make a cash investment in a company, with the right to convert that. Safe (or simple agreement for future equity ) notes are financial agreements that startups often use to help raise seed capital. Find safe note templates created and drafted by lawyers to buy. A safe note is an innovative form of convertible security that enable small business like startups to raise capital while postponing valuation, which improves capital efficiency. The mandate to use sciencv only for the preparation of current and pending (other) support.Safe Note Template

Free Safe Note Template for New Business Seed Investments

Safe Note Template

SAFE Notes A Quick Guide

Free Safe Note Template for New Business Seed Investments

Safe Agreement Template

SAFE Note or SAFE Agreement Template Customizable Legal Document

SAFE Note or SAFE Agreement Template Customizable Legal Document

Safe Note Template

SAFE Convertible Note Template Eqvista

You Just Need To Provide Your Raise Goal, Valuation Cap, And Discount.

A Simple Agreement For Future Equity (Safe) Is A Contract By Which An Investor Makes A Cash Investment Into A Company In Return For The Rights To Subscribe For.

Similarities Between Safe Notes And Convertible Notes Include That.

In This Tutorial, You’ll Learn About “Safe Notes” For Investing In Startups, How They Compare To Traditional Priced Equity Rounds, And Whether They’re Actually “Unsafe” For Startups.

Related Post: