Sample Debt Validation Letter Template

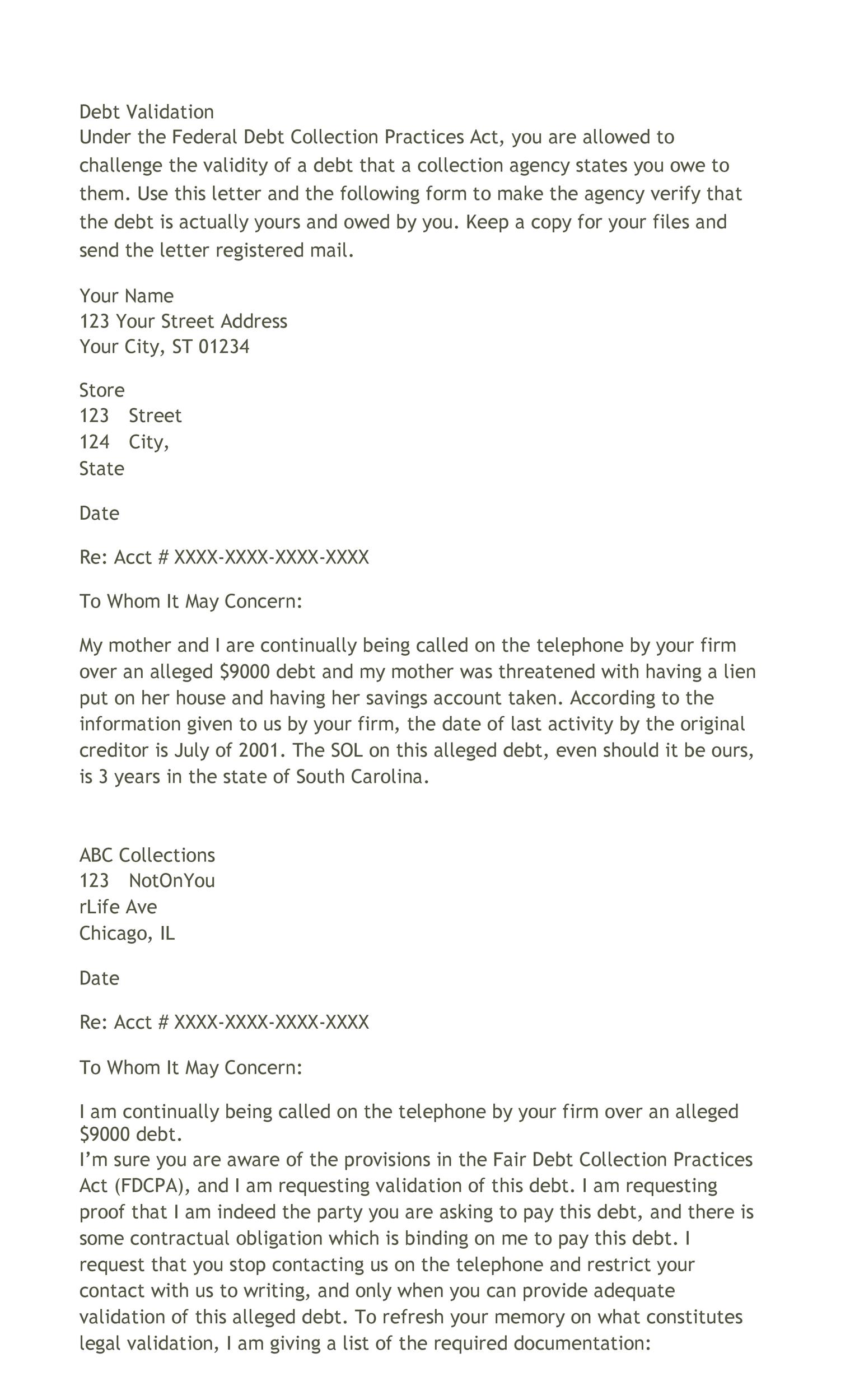

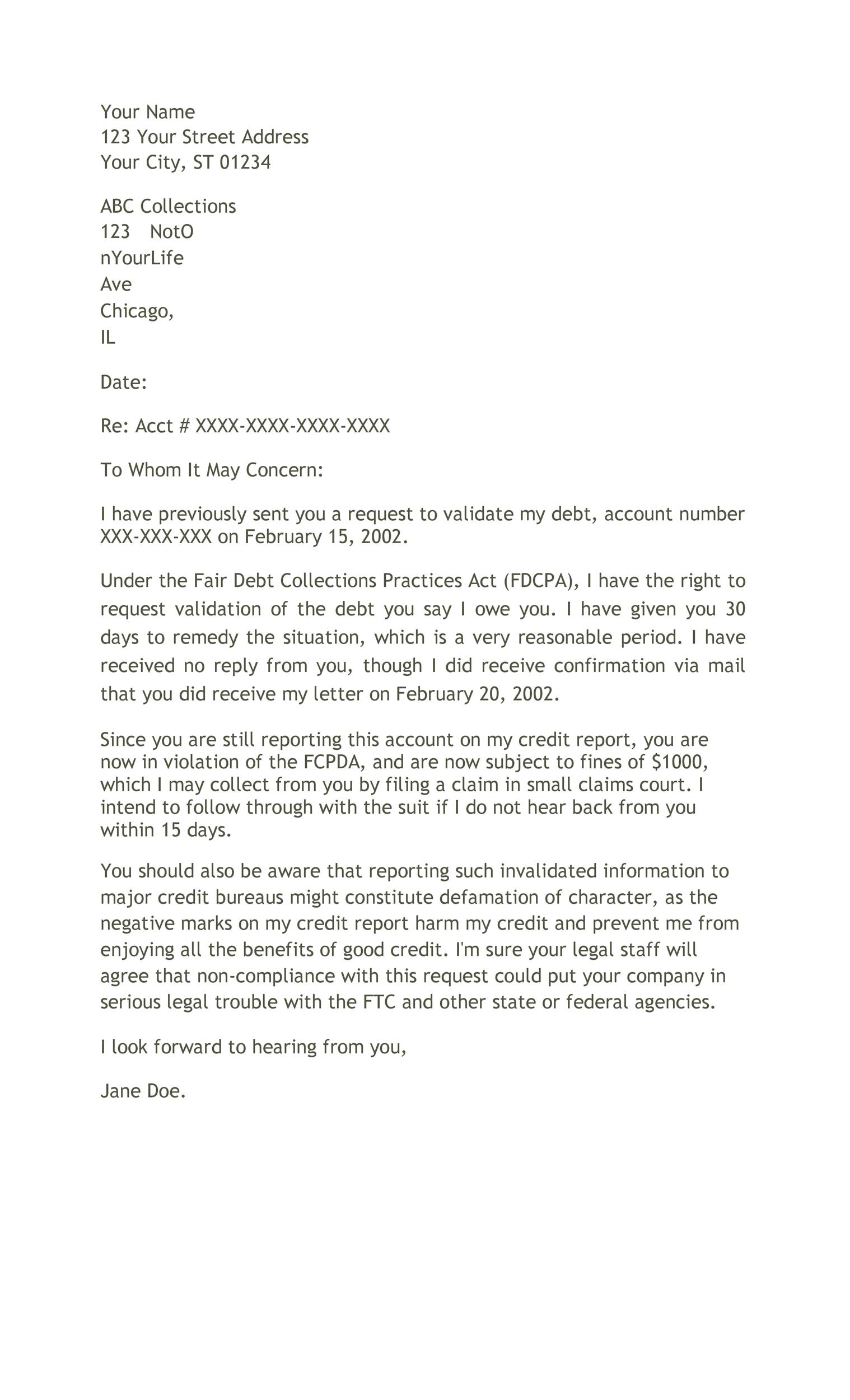

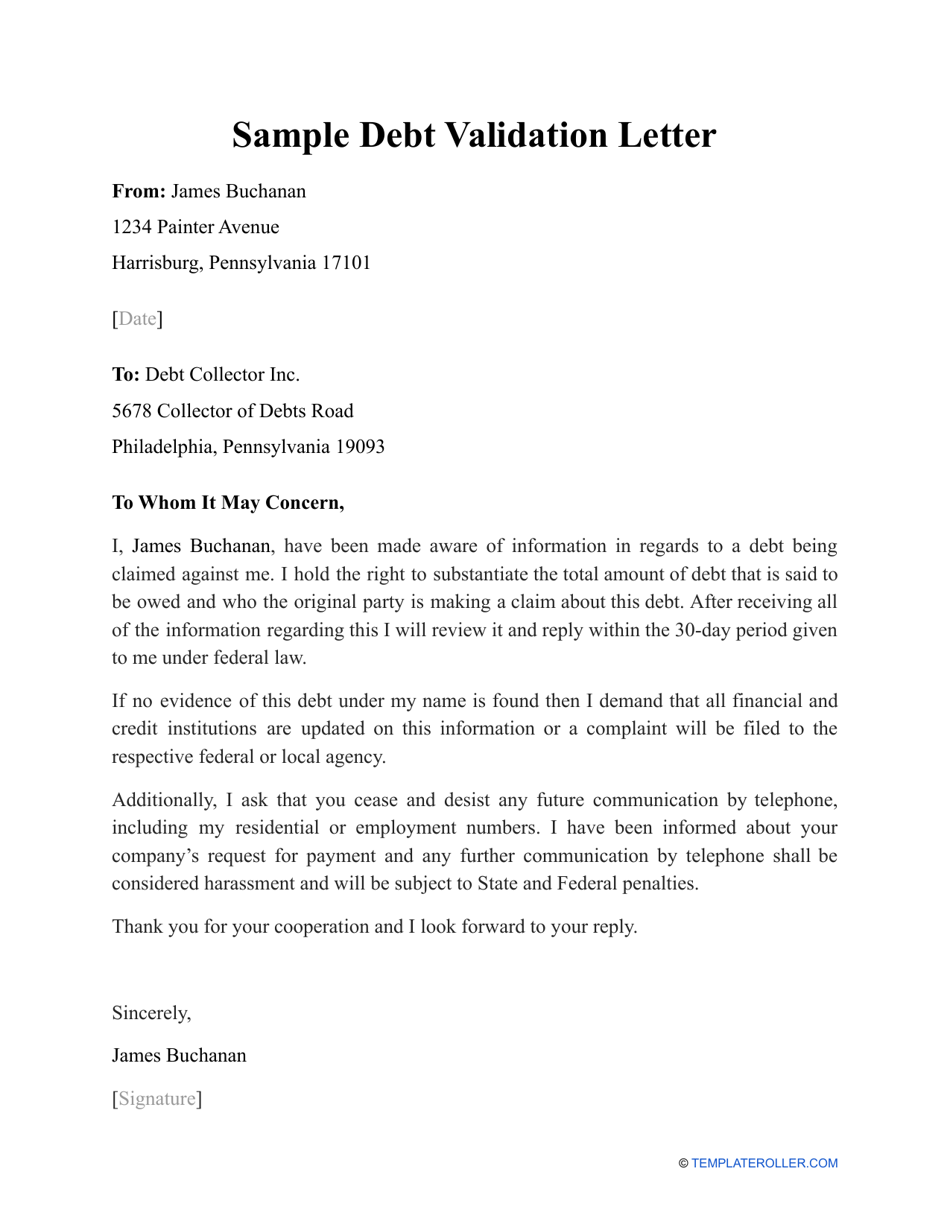

Sample Debt Validation Letter Template - Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their. If you believe that you do not owe the debt, a debt verification letter provides an opportunity to challenge its validity. • verification that this debt was assigned or sold to collector. Debt verification letter templates are used by debt collection companies to provide evidence of a claim for a debt. In this article, we’ll discuss the importance of debt validation letters and what information they should include. With a debt validation letter, you can. Download, customize, and send the letter in minutes. Debt collectors must provide evidence. A debt validation letter is a formal request sent to a debt collector to verify the legitimacy of the debt they claim you owe. A copy of the last billing statement sent to me by the original creditor. Requesting creditors to stop collection activities is a critical part of the letter. When a debt collector is asking you to pay money, you’re entitled to ask for details. Writing a letter requesting debt validation is fairly straightforward. Debt collectors must provide evidence. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Step up your financial communication game with our premium debt verification letter samples. A copy of the last billing statement sent to me by the original creditor. • verification that this debt was assigned or sold to collector. If you believe that you do not owe the debt, a debt verification letter provides an opportunity to challenge its validity. These templates can provide a clear and concise way to communicate with creditors, outlining the debt in question and requesting proof of its validity. Easily dispute and validate your debts with our free debt validation letter template. Under the fair debt collection practices act. We’ll also provide a debt verification letter sample and a free. Provide verification and documentation about why this is a debt that i am required to pay. State the amount of the debt. If you believe that you do not owe the debt, a debt verification letter provides an opportunity to challenge its validity. Writing a letter requesting debt validation is fairly straightforward. Provide verification and documentation about why this is a debt that i am required to pay. Requesting creditors to stop collection activities is a critical part of the letter. The. Debt verification letter templates are used by debt collection companies to provide evidence of a claim for a debt. Under the fair debt collection practices act. In this article, we’ll discuss the importance of debt validation letters and what information they should include. Writing a letter requesting debt validation is fairly straightforward. Reference the fair debt collection practices act (fdcpa),. With a debt validation letter, you can. Following is a sample debt validation letter that you can use to request the creditor/collection agency verify that the debt is actually yours and you are legally bound to. The sample letter below will help you to get details on the following: If you believe that you do not owe the debt, a. A debt validation letter is a written statement composed by an individual or entity and sent to a financial institution that notified them about the debt to find out whether this debt is legitimate. The sample letter below will help you to get details on the following: Writing a letter requesting debt validation is fairly straightforward. • verification that this. A copy of the last billing statement sent to me by the original creditor. We’ll also provide a debt verification letter sample and a free. Writing a letter requesting debt validation is fairly straightforward. A debt validation letter is a written statement composed by an individual or entity and sent to a financial institution that notified them about the debt. The sample letter below will help you to get details on the following: We’ll also provide a debt verification letter sample and a free. Debt verification letter templates are used by debt collection companies to provide evidence of a claim for a debt. With a debt validation letter, you can. You need to ask any debt collection company that claims. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. Writing a letter requesting debt validation is fairly straightforward. The purpose of the validation letter is to inform the collector that the debtor is 1) aware of their rights under the fair debt collection practices act (fdcpa) and 2) is requesting. • why a debt collector thinks you. • verification that this debt was assigned or sold to collector. A debt validation letter is a formal request sent to a debt collector to verify the legitimacy of the debt they claim you owe. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their. These templates can provide a. When a debt collector is asking you to pay money, you’re entitled to ask for details. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their. State the amount of the debt. In this article, we’ll discuss the importance of debt validation letters and what information they should include. You. Step up your financial communication game with our premium debt verification letter samples. Reference the fair debt collection practices act (fdcpa), which regulates debt collectors. A copy of the last billing statement sent to me by the original creditor. Designed for precision and legal compliance, these templates are invaluable tools for anyone. In this article, we’ll discuss the importance of debt validation letters and what information they should include. Download, customize, and send the letter in minutes. Provide verification and documentation about why this is a debt that i am required to pay. • complete accounting of alleged debt. A debt validation letter is a written statement composed by an individual or entity and sent to a financial institution that notified them about the debt to find out whether this debt is legitimate. Debt collectors must provide evidence. Easily dispute and validate your debts with our free debt validation letter template. When a debt collector is asking you to pay money, you’re entitled to ask for details. Under the fair debt collection practices act. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their. • why a debt collector thinks you owe. The purpose of the validation letter is to inform the collector that the debtor is 1) aware of their rights under the fair debt collection practices act (fdcpa) and 2) is requesting.50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

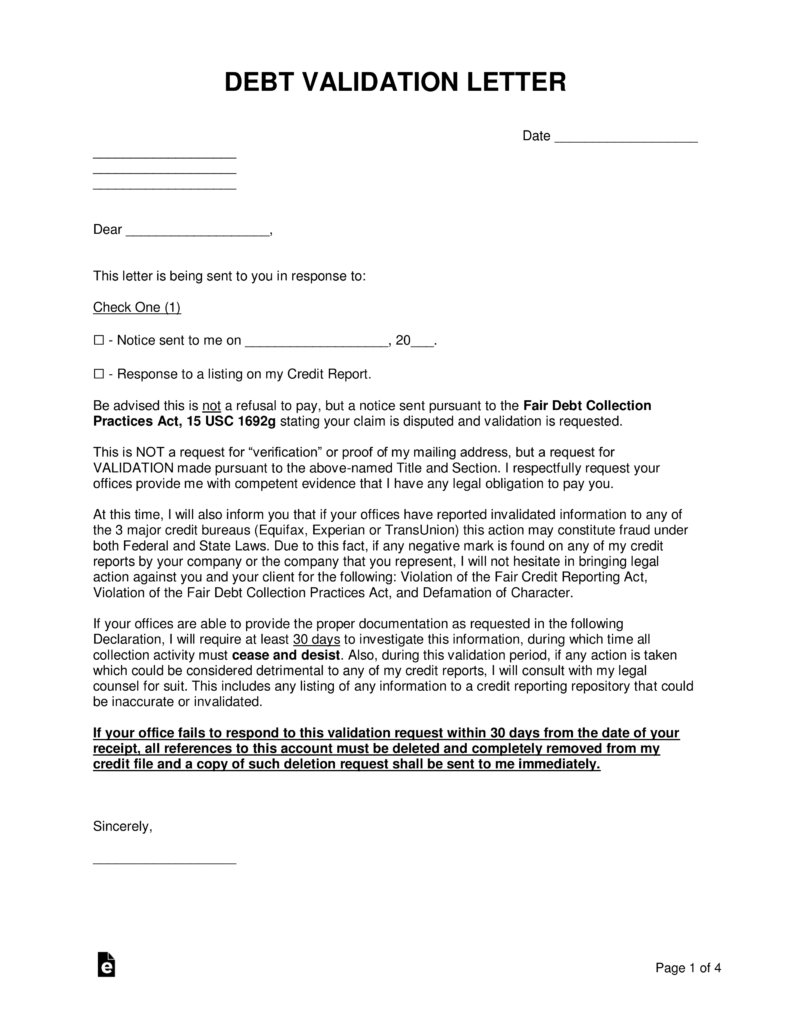

Free Debt Validation Letter Template Samples PDF Word eForms

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

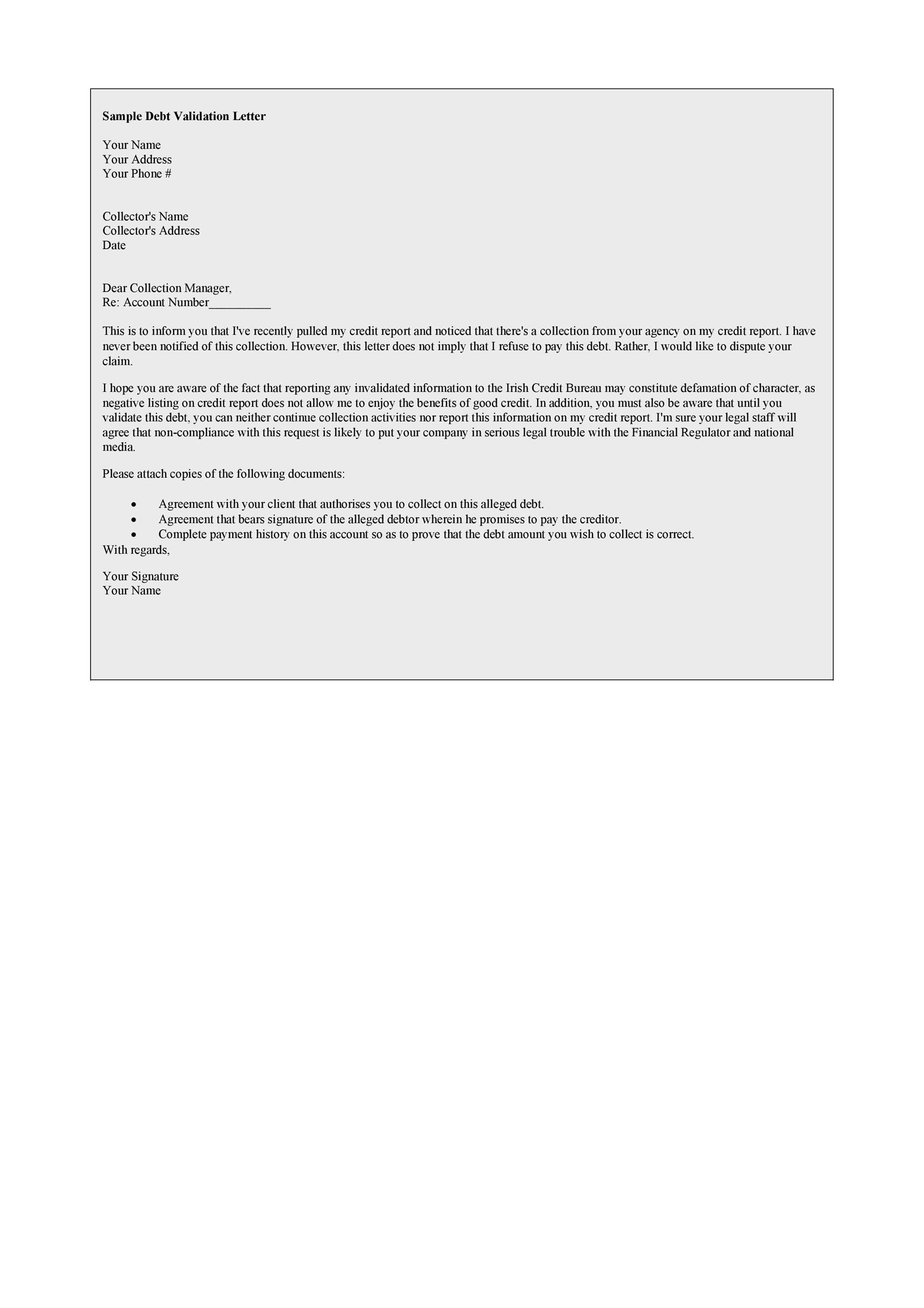

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Validation Of Debt Letter Template

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

Free Debt Validation Letter Template PDF & Word

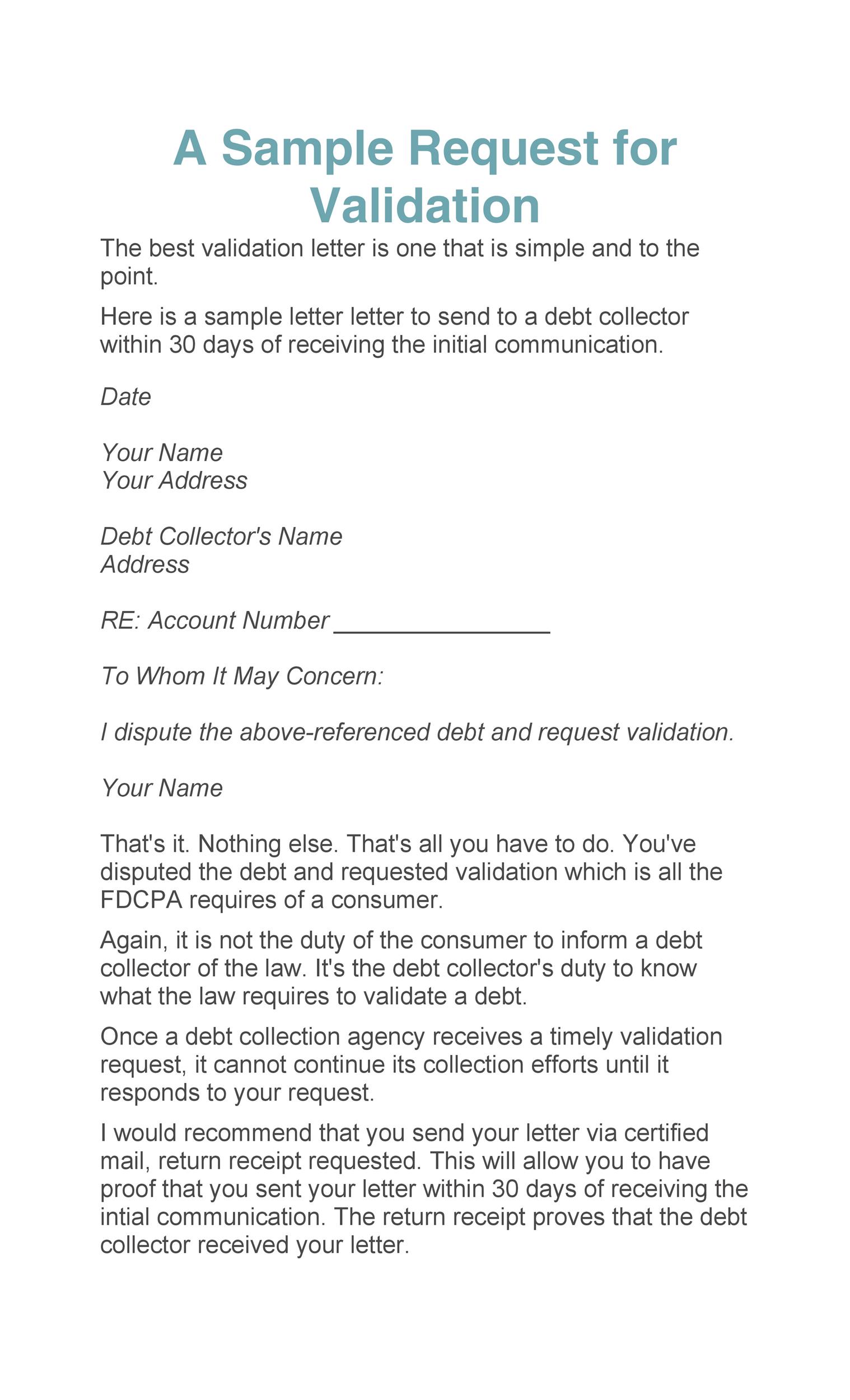

With A Debt Validation Letter, You Can.

Writing A Letter Requesting Debt Validation Is Fairly Straightforward.

The Sample Letter Below Will Help You To Get Details On The Following:

These Templates Can Provide A Clear And Concise Way To Communicate With Creditors, Outlining The Debt In Question And Requesting Proof Of Its Validity.

Related Post:

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-12-790x1022.jpg)

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-27-790x1022.jpg)