Validation Letter To Debt Collector Template

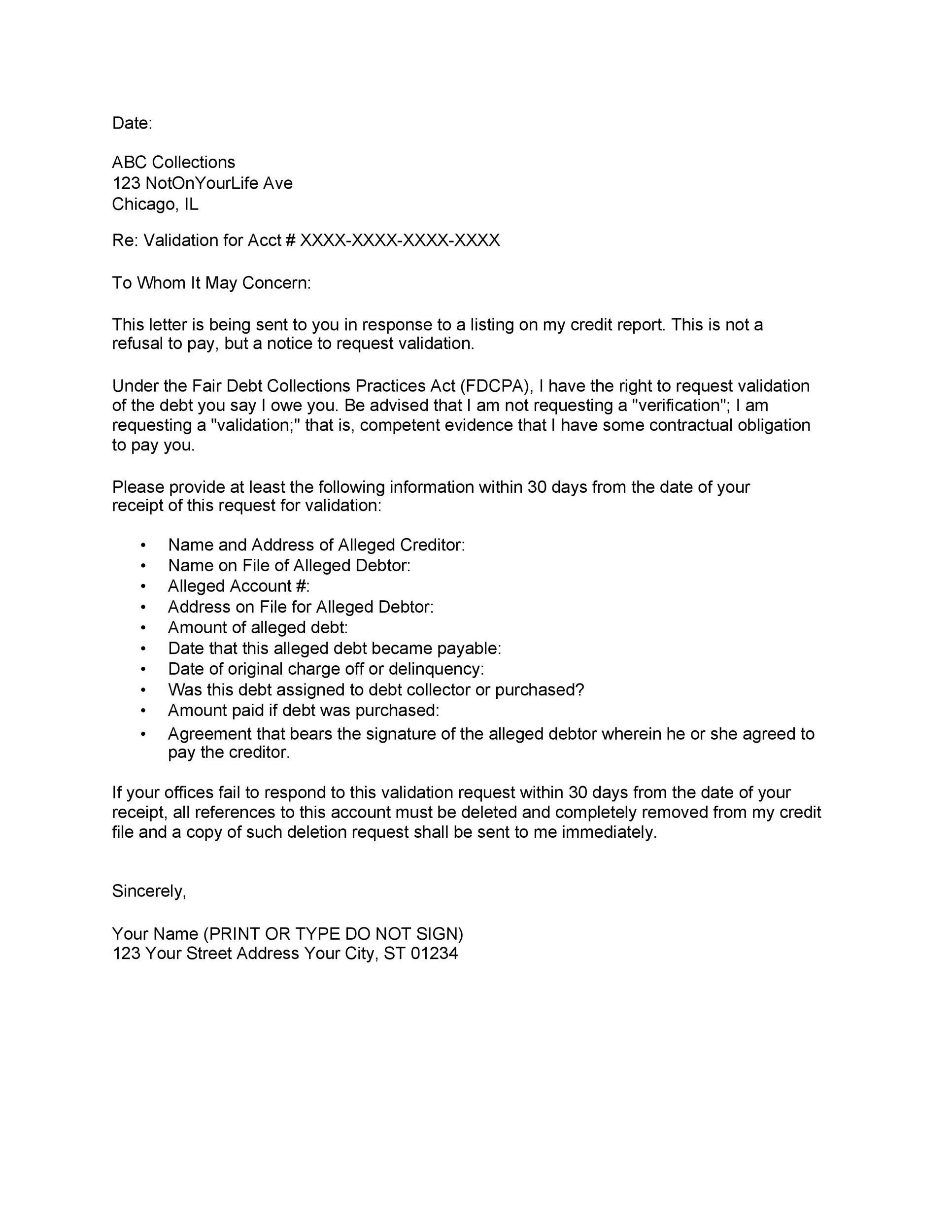

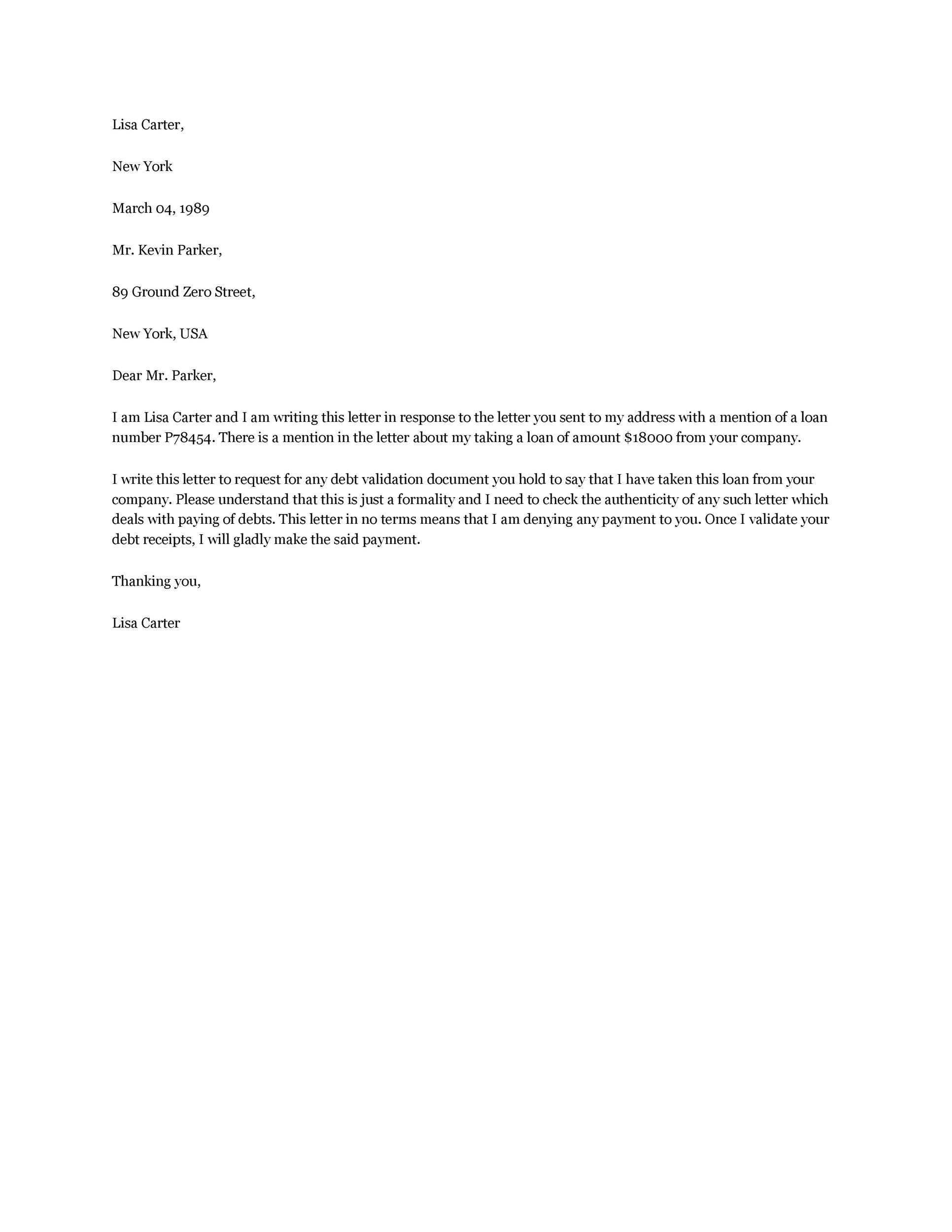

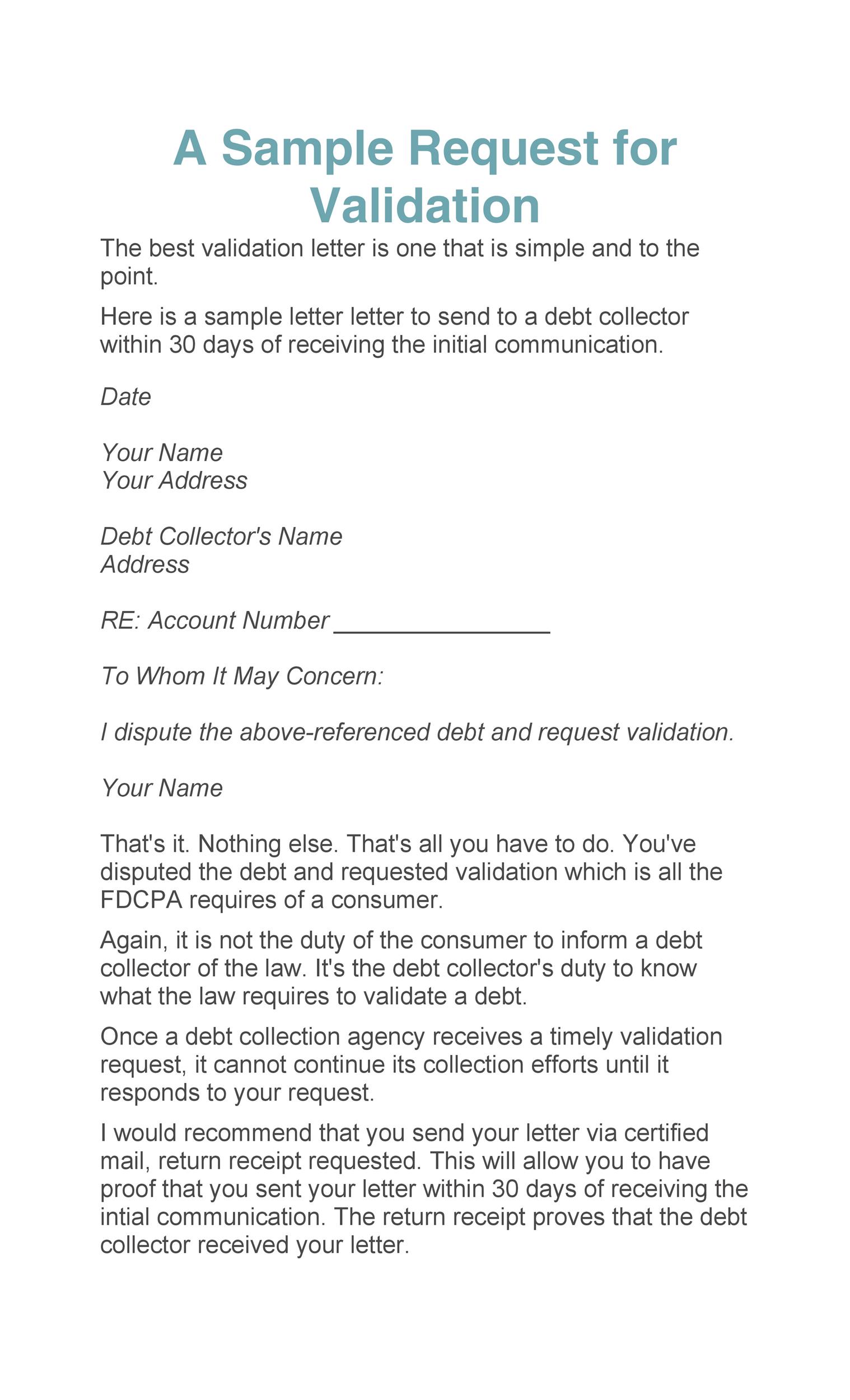

Validation Letter To Debt Collector Template - Under federal law, you have a right to get information about any debt you supposedly owe. Debt verification letter templates are used by debt collection companies to provide evidence of a claim for a debt. • commission for debt collector if collection efforts are successful. Collectors must provide a debt validation notice within five days of initial contact. Easily dispute and validate your debts with our free debt validation letter template. Use our debt validation letter to request the validity of a debt. • verification that this debt was assigned or sold to collector. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their information, and any facts supporting their claim that this is your debt. Here's how to compose a debt validation letter pdf, whether you are the debtor or the creditor: The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. If you notify a debt collector in writing that you are judgment proof and request they cease communication, they. Easily dispute and validate your debts with our free debt validation letter template. Personal information, debt details, request for validation, and legal references. • the amount of the debt and how old it is. To fill out this form, start by entering today's date and the collector's information. Perfect for individuals facing undue pressure from debt collectors. Begin writing the letter by adding the contact information for you and for the debt collector. Debt validation letters are created to protect customers from unfair debt collection practices. Requesting a debt validation letter is a legal and quick way to establish legitimacy before paying or negotiating with the debt collector. The sample letter below will help you to get details on the following: If you notify a debt collector in writing that you are judgment proof and request they cease communication, they. Get debt validation letter form Under this law, debt collectors cannot contact you at inconvenient times, use threatening language, or misrepresent the amount owed. Requesting a debt validation letter is a legal and quick way to establish legitimacy before paying or. Under the fair debt collection practices act (fdcpa), a debt collector must provide a written debt validation letter within five days. If you have been contacted regarding outstanding debts, collectors are legally required to provide proof of those debts. When a debt collector is asking you to pay money, you’re entitled to ask for details. • verification that this debt. • complete accounting of alleged debt. Specify the nature of the debt, including its origin and any accompanying documentation. To fill out this form, start by entering today's date and the collector's information. Access our free debt validation letter template, downloadable in ms word and google docs formats. Personal information, debt details, request for validation, and legal references. Regardless of what a debt collector may say by phone, sending a debt validation letter can help to ensure that you do not pay a debt that you do not owe, fall victim to a debt collection scam, or revive an old debt that could potentially be past the statute of limitations. Easily dispute and validate your debts with our. Simplify debt dispute resolution with this template designed to request debt validation from creditors or collection agencies. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their information, and any facts supporting their claim that this is your debt. Under this law, debt collectors cannot contact you at inconvenient times,. Failing to do so is a direct violation. A copy of the last billing statement sent to me by the original creditor. Collectors must provide a debt validation notice within five days of initial contact. • why a debt collector thinks you owe this debt. To fill out this form, start by entering today's date and the collector's information. If you notify a debt collector in writing that you are judgment proof and request they cease communication, they. Writing a letter requesting debt validation is fairly straightforward. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Simplify debt dispute resolution with this template designed. Use this document to assert your rights and request debt verification. Access our free debt validation letter template, downloadable in ms word and google docs formats. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Here's a sample template you can use to request debt. Under federal law, you have a right to get information about any debt you supposedly owe. Here's a sample template you can use to request debt validation. Download, customize, and send the letter in minutes. Use this document to assert your rights and request debt verification. Specify the nature of the debt, including its origin and any accompanying documentation. A copy of the last billing statement sent to me by the original creditor. Here's a sample template you can use to request debt validation. Perfect for individuals facing undue pressure from debt collectors. Begin writing the letter by adding the contact information for you and for the debt collector. Requesting a debt validation letter is a legal and quick. Finish by clearly stating your dispute and the requests you have for the collector. Provide detailed information on all parties involved, including your legal name and contact information. It can be reported to the federal trade commission (ftc), the consumer financial protection bureau (cfpb), or your state’s attorney general. How do i fill this out? Use this free debt validation letter template to send to debt collectors to validate alleged debts. Next, provide your details and the account number associated with the debt. Provide verification and documentation about why this is a debt that i am required to pay. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Under this law, debt collectors cannot contact you at inconvenient times, use threatening language, or misrepresent the amount owed. To fill out this form, start by entering today's date and the collector's information. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Failing to do so is a direct violation. The fdcpa offers additional protections against abusive or harassing behavior by debt collectors. Ensures the debt is legitimate and verifies the collector’s authority to collect. State the amount of the debt when you obtained it, and when that was. Personal information, debt details, request for validation, and legal references.50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

5 Compliant Debt Validation Letter Templates and Samples — Etactics

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Free Printable Debt Validation Letter Templates [PDF, Word] Medical

Debt Validation Letter for Debt Collectors (Template and Sample)

Debt Validation Letter 2025 (guide & Free Samples) Sheria Na Jamii

Second Debt Validation Letter Sample

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Under The Fair Debt Collection Practices Act (Fdcpa), A Debt Collector Must Provide A Written Debt Validation Letter Within Five Days.

Clarify The Original Debt Amount And Payment Schedule.

Collectors Must Provide A Debt Validation Notice Within Five Days Of Initial Contact.

• Verification That This Debt Was Assigned Or Sold To Collector.

Related Post:

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-05-790x1022.jpg)

![Free Printable Debt Validation Letter Templates [PDF, Word] Medical](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-validation-letter-template-2024.jpg)