Written Information Security Plan Template

Written Information Security Plan Template - Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Without the written information security plan template, accounting professionals can expect to spend over 20 hours developing an accountant data security plan from scratch. This written information security program (wisp). If you’re ready to get started, download the free wisp template to create your plan. Security plan is to ensure effective procedural, administrative, technological and physical safeguards for protecting the personal information of faculty, staff, students, alumni,. The following document is a template for your written information security plan (wisp), a legal requirement for all businesses that prepare taxes. Our comprehensive wisp template covers all essential aspects of cybersecurity and data protection, ensuring your. Every tax preparer must have a written information security plan that meet legal requirements in order to renew their ptin. Having a wisp protects businesses and. Houses user acknowledgement of your plan; This written information security program (wisp). Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Houses user acknowledgement of your plan; Find out how to create one for your firm. Having a wisp protects businesses and. The following document is a template for your written information security plan (wisp), a legal requirement for all businesses that prepare taxes. This document is intended to provide sample information and to help tax professionals, particularly smaller practices, develop a written information security plan or wisp. The objective in developing and implementing this comprehensive written information security program (wisp), is to create. For many startups, small businesses, and even established organizations, security strategies often lack depth, to put it bluntly. A sample template for businesses to comply with the massachusetts regulations for protecting personal information of residents. Find out how to create one for your firm. Tax pros need a written information security plan (wisp) for irs compliance and data protection. This written information security program (wisp). More information is available here. For many startups, small businesses, and even established organizations, security strategies often lack depth, to put it bluntly. Builds an editable irs wisp template using irs publication 5708; Without the written information security plan template, accounting professionals can expect to spend over 20 hours developing an accountant data security plan from scratch. If you’re ready to get started, download the free wisp template to create your plan. Tax pros need a written information security plan (wisp) for irs. Get a free template at erowisp.com. This document is intended to provide sample information and to help tax professionals, particularly smaller practices, develop a written information security plan or wisp. Builds an editable irs wisp template using irs publication 5708; If you’re ready to get started, download the free wisp template to create your plan. Security plan is to ensure. Having a wisp protects businesses and. The template includes the objective, purpose, scope, data. Find out how to create one for your firm. For many startups, small businesses, and even established organizations, security strategies often lack depth, to put it bluntly. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data. Without formal risk assessments, these. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. If you’re ready to get started, download the free wisp template to create your plan. Builds an editable irs wisp template using irs publication 5708; Use this template to document your firm's policies. Without formal risk assessments, these. Tax pros need a written information security plan (wisp) for irs compliance and data protection. More information is available here. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Discover a 2025 complete written information security plan (wisp) template tailored for sole practitioners. Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Having a wisp protects businesses and. Discover a 2025 complete written information security plan (wisp) template tailored for sole practitioners and ptin holders. For many startups, small businesses, and even established organizations, security strategies often lack depth, to put it bluntly. Without formal. For many startups, small businesses, and even established organizations, security strategies often lack depth, to put it bluntly. More information is available here. Get a free template at erowisp.com. Security plan is to ensure effective procedural, administrative, technological and physical safeguards for protecting the personal information of faculty, staff, students, alumni,. Allows auditable electronic signoffs as required; This document is intended to provide sample information and to help tax professionals, particularly smaller practices, develop a written information security plan or wisp. Discover a 2025 complete written information security plan (wisp) template tailored for sole practitioners and ptin holders. Or, rather than spend billable hours creating a wisp, our security experts can create one for you. Security plan. For many startups, small businesses, and even established organizations, security strategies often lack depth, to put it bluntly. Without formal risk assessments, these. Houses user acknowledgement of your plan; Fill out the wisp form and click “download free information plan”. This course provides essential guidance to individuals with information security implementation and operational responsibilities for developing and disseminating an. This written information security program (wisp). This document is intended to provide sample information and to help tax professionals, particularly smaller practices, develop a written information security plan or wisp. Security plan is to ensure effective procedural, administrative, technological and physical safeguards for protecting the personal information of faculty, staff, students, alumni,. It includes objectives, purposes, action plans, action steps, and. Discover a 2025 complete written information security plan (wisp) template tailored for sole practitioners and ptin holders. Builds an editable irs wisp template using irs publication 5708; The security summit partners recently unveiled a special new sample security plan designed to help tax professionals, especially those with smaller practices, protect their data. If you’re ready to get started, download the free wisp template to create your plan. Federal law, enforced by the federal trade commission, requires professional tax preparers to create and maintain a written data security plan. Fill out the wisp form and click “download free information plan”. Every tax preparer must have a written information security plan that meet legal requirements in order to renew their ptin. Tax pros need a written information security plan (wisp) for irs compliance and data protection. The objective in developing and implementing this comprehensive written information security program (wisp), is to create. How to create a written information security plan (wisp) for your tax & accounting practice (+ a free wisp template) secure your clients’ data with a well structured wisp and stay. Without the written information security plan template, accounting professionals can expect to spend over 20 hours developing an accountant data security plan from scratch. Without formal risk assessments, these.Information Security Plan Template

Why the IRS Requires WISP (written information security plan) for your

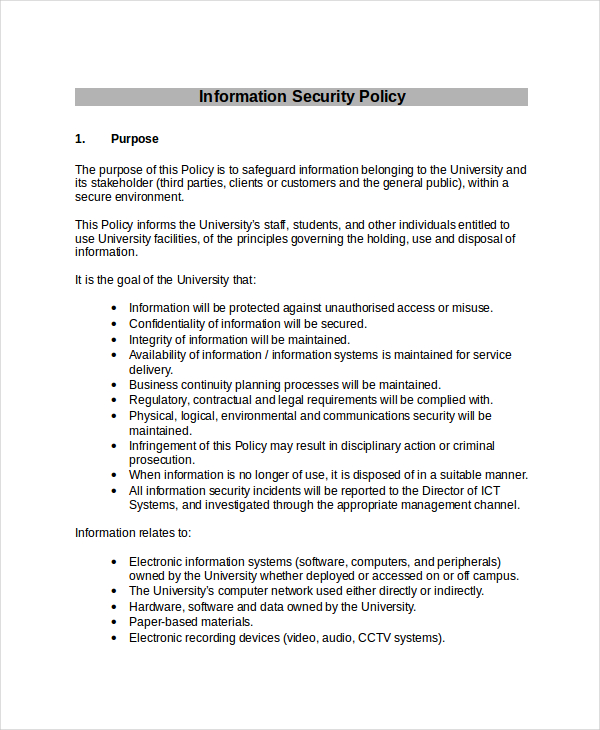

42 Information Security Policy Templates [Cyber Security] ᐅ TemplateLab

A Legal Guide To Privacy and Data Security 2024 ACC Tcm1045 606481

Ria Cybersecurity Policy Template

(PDF) UML Written Information Security Plan uml.edu DOKUMEN.TIPS

Written Security Plan Template

Written Security Plan Template

Wisp Template Download

42 Information Security Policy Templates [Cyber Security] ᐅ TemplateLab

Find Out How To Create One For Your Firm.

Houses User Acknowledgement Of Your Plan;

Or, Rather Than Spend Billable Hours Creating A Wisp, Our Security Experts Can Create One For You.

For Many Startups, Small Businesses, And Even Established Organizations, Security Strategies Often Lack Depth, To Put It Bluntly.

Related Post:

![42 Information Security Policy Templates [Cyber Security] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2018/05/Security-Policy-12.jpg)

![42 Information Security Policy Templates [Cyber Security] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2018/05/Security-Policy-10.jpg)